Today’s risks are clear: stock valuations are high, credit spreads are tight and interest rates remain low. A modest tilt toward return-seeking assets still makes sense. But investors should also be willing to look beyond traditional stocks and bonds.

Making investment decisions is rarely easy. But it can be a major challenge to know which way to lean when stocks and bonds both look expensive and interest rates seem as low as they can go—and in some cases are already heading up. Even central bankers, who rarely comment on broad market levels, are taking note: Fed Chair Janet Yellen recently remarked that asset valuations appear somewhat rich.

On top of this, politics and policy have become hard to predict, yet markets have been largely positive and volatility seems to have disappeared. Investors, meanwhile, are left to wonder how long all this good news can last.

The Case for Optimism

When we widen the lens, the picture seems brighter. The global economy continues to grow, with China and the euro area showing improvement. Labor markets are healthy. Years of central bank easing seem to have ended the threat of deflation. Politicians are speaking about more fiscal spending to spur growth. In other words, the world isn’t such a bad place, and recent market strength makes sense.

The risks, of course, haven’t disappeared. Interest rates could rise more quickly than expected, and the eventual withdrawal of global monetary stimulus could prove more disruptive than many anticipate. Politicians may not keep their fiscal promises. Elevated earnings expectations in the US may disappoint.

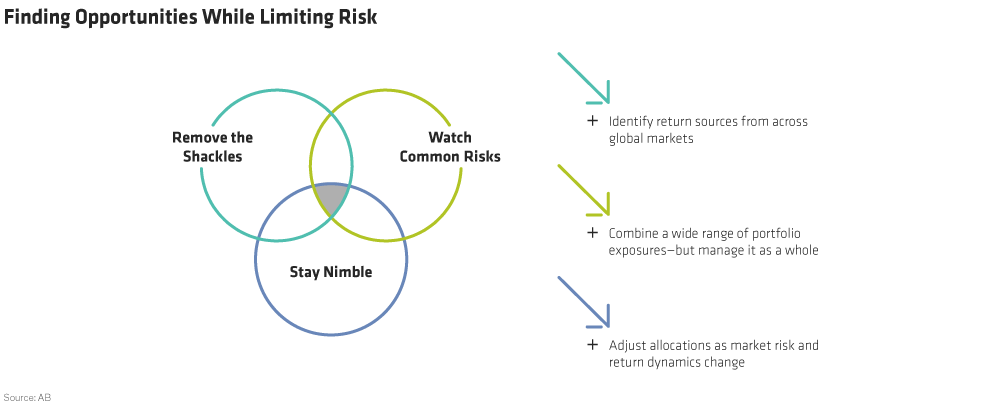

How can investors identify opportunities without exposing their portfolios to unwanted risk? The trick is to have a disciplined investment process that’s broad enough to pursue opportunities wherever they arise and dynamic enough to react quickly when conditions change.

Here are three things that we think investors can do (Display):

1) Remove the shackles to source portfolio returns. While a simple passive mix of stocks and bonds may have treated investors well so far this decade, the forward-looking opportunity isn’t nearly as bright. The expected return for a traditional 60/40 stock/bond portfolio over the next decade is a historically low 4.5%—well below most investors’ expectations.

Investors who hope to improve on that outcome will need to think creatively. That may involve incorporating long/short strategies that can exploit mis-pricings within markets and take advantage of the many behavioral biases that create persistent return opportunities.

It’s important that these alternative strategies include a wide range of exposures that diversify an investor’s broad market exposure. The ideal strategy would have low beta—or market exposure—to both equities and bonds.

It can also help to blend passive strategies with high-conviction active ones. The return streams of each tend to be uncorrelated, which can make a portfolio better suited to weather all kinds of market environments.

Finally, tilt the portfolio toward strategies that stand to benefit from higher inflation. Reflation-sensitive strategies (e.g., real assets, deep value) are attractively valued and can add incremental returns.

2) Keep an eye on common risks. This is especially important in multi-asset strategies that mix tactical allocations with a strategic allocation across asset classes. Why? Because even a diversified portfolio may contain common risks. Avoiding common risks should help to determine which opportunities investors take and where they take them.

In recent years, investors have been more worried about deflation than runaway inflation—and with good reason. Demographic headwinds, low productivity and the impact of technology in holding down inflation have all crimped nominal economic growth and kept price gains in check.

The problem: these fears have prompted investors to position themselves the same way. Many have gravitated to certain high-quality bond segments, real estate investment trusts, low-volatility equities and high-dividend-yielding stocks and away from commodities, cyclical stocks, inflation-protected securities and deep-value strategies.

The result: many investors have undiversified portfolios that could struggle if growth accelerates and interest rates rise. All the assets in this conservative allocation are negatively correlated with interest rates and would likely deliver poor returns in a reflationary environment. An integrated multi-asset approach can help to identify and diversify these types of common risks.

3) Take the long view—but stay nimble. It’s important to have the flexibility to move quickly if a changing market environment brings new opportunities or risks. These days, politics are an important factor influencing asset prices. But politics are unpredictable. So it pays to have a process that helps your multi-asset portfolio evolve along with market conditions.

But first, you’ll need a robust risk-management framework that draws on multiple perspectives to forecast the market’s long-term direction. That’s because while it may be relatively easy to identify potential risks, knowing when and how to respond is critical. After all, many of today’s risks—high stock and bond valuations, rising interest rates, political uncertainty—were risks six months ago and have been widely discussed. But pulling out of the market then would have been costly.

Market analysts spend a lot of time talking about expectations. But over the short- to medium-term, it’s the surprises that drive market pricing. Expectations for corporate earnings and growth are historically high today. That makes positive surprises unlikely.

What’s more, today’s conditions are unlike any we’ve seen in the postwar era. Nobody knows how the gradual withdrawal of today’s unprecedented monetary policy accommodation will play out. How will markets react when central banks finally start to sell the assets they acquired during the crisis? There’s simply no road map for investors to follow.

That uncharted territory means today’s risk management requires thinking beyond simple historical relationships and stress-testing your portfolio for the unexpected. What if earnings disappoint? What if companies don’t recover their pricing power? What about rising labor costs and slowing trade flows?

To know when to act, investors need to identify the catalysts likely to make lingering risks a reality. That’s hard to do. Diversification is one time-tested approach. But it takes more than that.

In our view, an active approach is critical to guarding against potential risks. And it takes one that employs a combination of fundamental and quantitative analysis—man and machine, working together.

There are always risks to monitor. But investors who have built flexibility and balance into their portfolios and can dig deep to exploit opportunities should be able to adapt to whatever comes next.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.