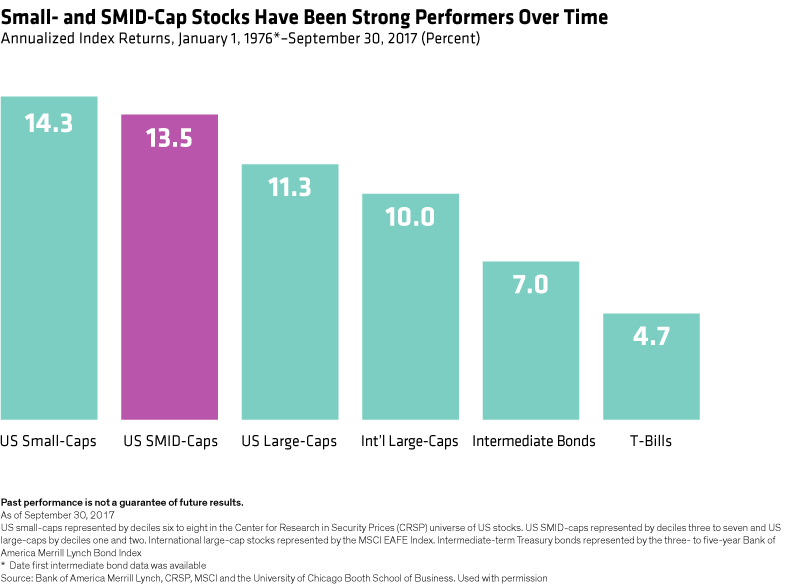

Smaller companies have outperformed large-cap stocks for decades (Display). But small-cap stocks are usually more volatile, suffer from thin trading liquidity and are often more vulnerable to business downturns or macroeconomic slowdowns.

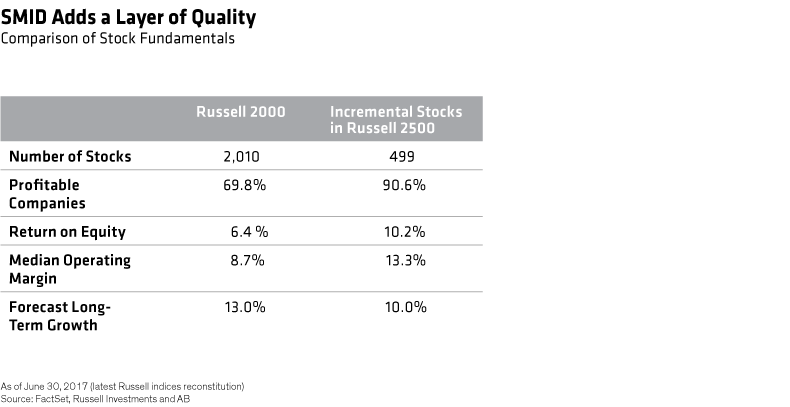

In this paper, we demonstrate the benefits of adding a layer of medium-sized companies like Panera to a portfolio of smaller stocks. With better business plans and stronger balance sheets, smaller mid-caps are generally much more profitable than small-caps (Display).

Powerful Potential In SMID Stories

Through stories of individual companies, we illustrate the opportunities and risks, and highlight the importance of applying a bottom-up, active approach, to SMID-cap investing. In our view, this approach can help investors identify SMID companies that are better equipped to weather unforeseen shocks to the economy or markets, while providing added maturity, tested business models and higher financial resiliency.

In a world of lower expected returns and heightened uncertainty, we believe that SMID-cap stocks are an important component of an equity allocation that can help investors enjoy the high-return potential of small-cap investing while taking the edge off the accompanying risk.