Equity investors in emerging markets (EM) typically focus on large-cap companies. But allocating to smaller companies can help broaden an EM allocation by providing a different mix of exposures to opportunities across countries and sectors—and can bring potential for higher added value.

Investors in EM equities are facing a rapidly changing market landscape. Some countries are coping with the impact of COVID-19 better than others. Companies are reconfiguring supply chains amid the pandemic and deglobalization trends. And efforts to upgrade economies are providing new growth prospects for many businesses. These trends are creating fertile ground for lesser known smaller-cap EM stocks, which offer investors different performance and risk dynamics relative to their large-cap EM investments.

Small-Caps Provide Different EM Exposures than Large-Caps

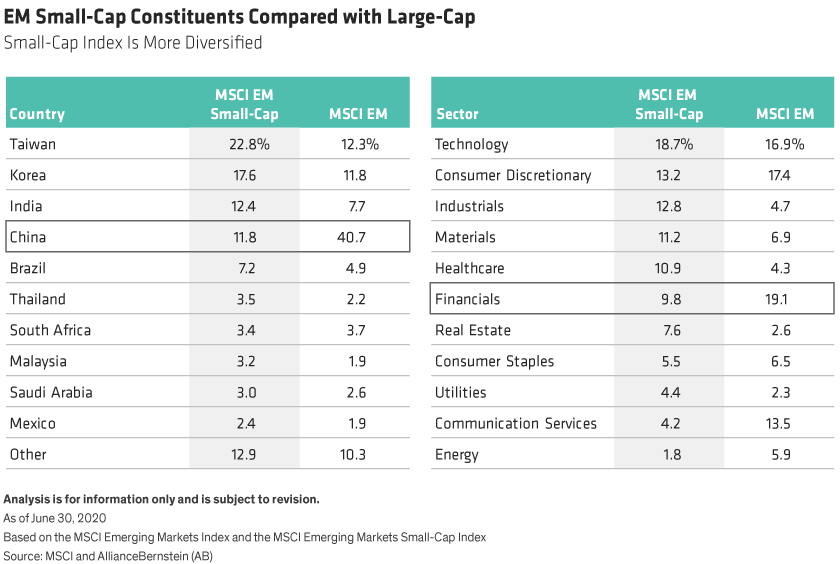

The EM small-cap universe looks very different from the large-cap benchmark (Display, below). In particular, the small-cap country allocation is not dominated by China, and the sector allocation has less exposure to industries driven by macroeconomic factors such as financials, consumer discretionary and energy. The EM large-cap benchmark is dominated by mega-cap stocks, with Alibaba, Tencent and TSMC accounting for 20% of the index, and the top five names (also including Samsung and Meituan) making up 25%. EM small-cap’s wider spread of more companies with unique business drivers provides opportunities both for improved diversification, and for finding compelling value-adding ideas through lesser-known stocks with strong potential.

The Outperformance Advantage

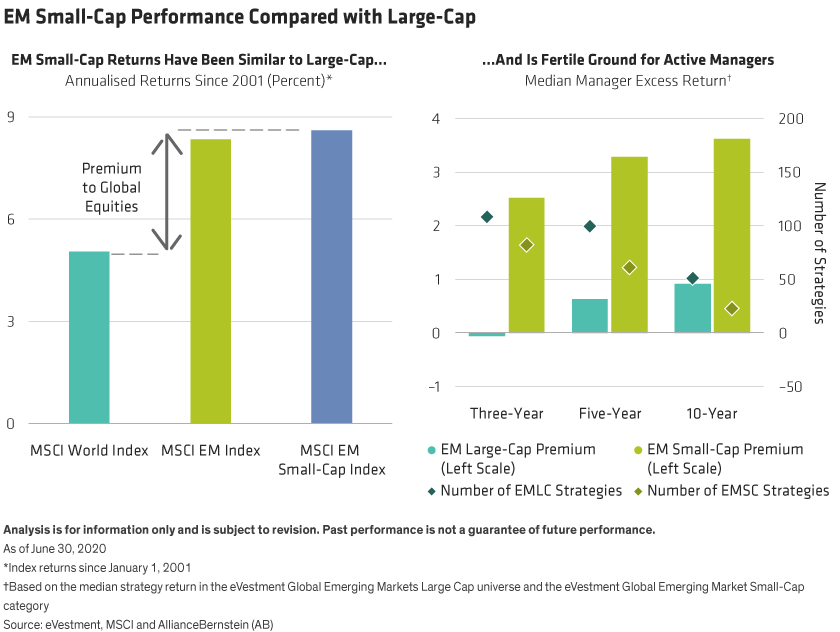

On a 20-year timescale, EM small- and large-caps have both outperformed large-cap developed markets (DM) by a wide margin (Display below, left). But over the last 10 years, as the large-cap median manager’s outperformance has dwindled, EM small-cap managers have still delivered significant excess returns (Display below, right).

Large-caps tend to receive more intensive analyst coverage, which may explain the shrinking outperformance. Beyond the advantage of more limited analyst coverage for small-caps, we believe that there are good reasons why carefully selected smaller EM companies should continue to deliver on their strong historical performance track record in the future.

Why Do Small EM Stocks Offer Big Potential?

Smaller companies provide an enormous range of opportunities in some of the world’s most dynamic emerging economies. Three areas deserve special attention:

-

Modernization of emerging economies: As emerging markets modernize and formalize how they operate, companies that help catalyze this transition stand to benefit. For example, Sunny Friend Environmental Technology Ltd focuses on the collection and disposal of biomedical and hazardous waste. By bringing developed-market waste management standards to Taiwan and China, the company helps these countries better protect the environment while continuing to industrialize.

Privatization is another area where EM countries are quickly catching up. In China’s death care industry, Fu Shou Yuan is emerging as the largest private operator. With 90% of funeral parlors still owned by local governments, Fu Shou Yuan has a long runway of growth potential ahead.

-

Building blocks of global tech innovation: Though US technology firms are better known than their EM counterparts, many EM small-caps play a key role in driving global technology trends. Servers, for instance, are the backbone of the modern internet and are enjoying strong demand as the world embraces cloud computing and video conferencing in the fight against COVID-19. Aspeed Technology, based in Taiwan, is the market leader in server management chips through a product it pioneered called the baseboard management controller (BMC). The low cost of a BMC chip relative to its benefits gives the company strong pricing power and return on capital.

Another EM business benefiting from digital business transformation is a little-known Argentinian IT outsourcing company called Globant. With software talent at a huge premium in the US, Globant builds mobile apps, analytics tools and more for Fortune 500 companies such as Disney, which recently chose the firm to reinvent the mobile experience at its parks and resorts.

-

Addressing local needs: EM small-caps are often best placed to identify and capitalize on local needs in emerging markets. We often see Western companies fail to replicate their success in countries like India, China or Brazil. Meanwhile, smaller domestic companies in these markets have the local networks and cultural understanding required to thrive. For example, Bank BTPN Syariah provides microfinance to small businesses in Indonesia. The bank also offers locally relevant products such as Sharia banking and is better able to assess credit risk among lower income borrowers than a larger institution can.

On the other side of the world in Brazil, Notre Dame Intermedica operates healthcare and dental plans alongside well-being and preventative medicine. With Brazil facing rapid healthcare cost inflation, Intermedica has vertically integrated by acquiring hospitals, building outpatient ERs and adding lab services. Through these efforts, the company is lowering costs and premiums, improving quality of service and capturing market share even amid a recession in Brazil.

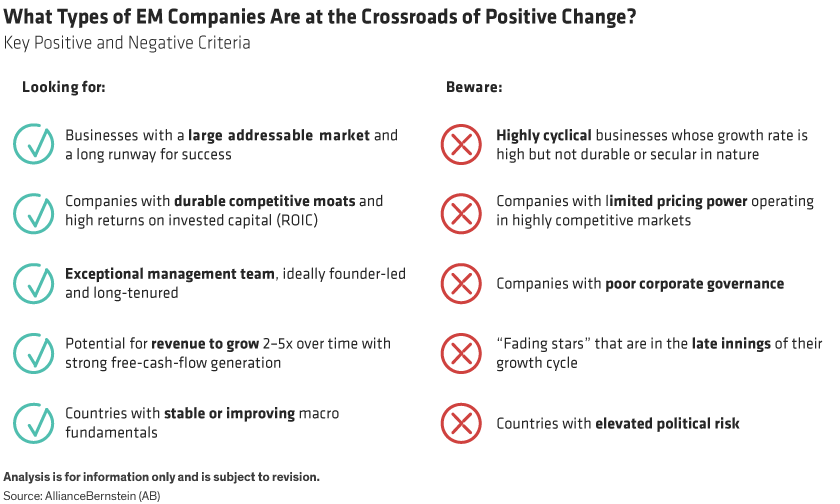

When searching for smaller EM companies with big potential, we believe investors should look for companies that are at the crossroads of positive change. These are companies that have a competitive edge and a large addressable market in front of them, enabling strong sales growth and margin expansion for years to come (Display).

Are smaller EM companies riskier? Not necessarily. By paying careful attention to the quality of management, we think investors can reduce the risks. And by considering environmental, social and governance factors as an integral part of a research process, investors can identify companies with responsible behavior and sustainable growth. Following a clear investment process can create a more diversified EM allocation, drawing on new sources of long-term potential in smaller companies that are agents for big change in the developing world and beyond.

Sergey Davalchenko is Portfolio Manager—Emerging Markets Small Cap Equity and Emerging Markets Growth at AB

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.

Past performance does not guarantee future results. The value of an investment can go down as well as up and investors may not get back the full amount they invested. Before making an investment, investors should consult their financial advisor.

MSCI makes no express or implied warranties or representations and shall have no liability whatsoever with respect to any MSCI data contained herein.