The Tax Cuts and Jobs Act (TCJA) went into effect this year. Many of the changes are obvious, but some of them are less apparent and require some forethought and planning. Charitable giving is a good example. Even though the new law did not make material changes to the ability to give charitable donations, it does require individuals to think differently about the way they give. Here’s why.

What’s Changed?

Before we discuss ways to structure donations, let’s talk about what’s changed.

Under the new TCJA, itemized deductions are mostly limited to mortgage interest, state and local taxes (capped at $10,000), and charitable gifts. i At the same time, the standard deduction was increased to $12,000 for individuals and $24,000 for married couples. For most people, the standard deduction is projected to be greater than their itemized deductions. In fact, the Tax Policy Center estimates the number of tax returns claiming deductions for charitable contributions may drop by more than half. And that’s why the way you structure your gifts going forward may have a greater impact than in the past.

Bunch Together or Spread Out?

Even though some donors will no longer receive a deduction for their charitable gifts, they will continue to give to charitable organizations and causes that are important to them. To help donors achieve their philanthropic goals and allow them to receive a tax benefit, a “bunching” strategy may be effective. “Bunching” is a strategy that may help push donors’ itemized deductions above the new higher standard deduction.

Here is how the strategy works: Instead of making charitable gifts each year, a donor can aggregate two or potentially several years’ worth of gifts into a single tax year to push their total deductions above the standard deduction. Given the deduction limits,ii the donor must have sufficient taxable income to fully deduct several years of charitable contributions in a single year for this “bunching” strategy to work. In the year individuals “bunch” their charitable donations, they will itemize deductions on their tax returns; in the subsequent year or years that follow, if they do not make charitable gifts or do not have enough other deductions, they will claim the standard deduction.

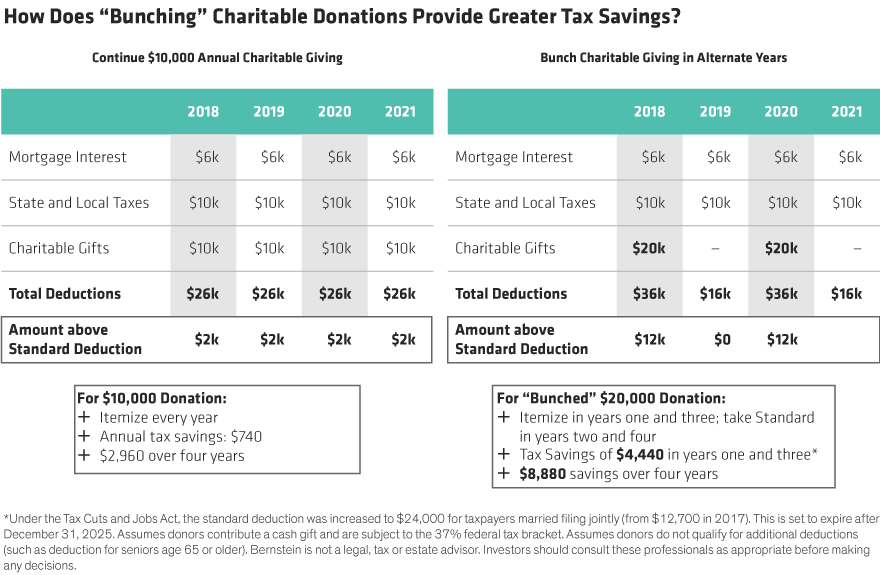

The following hypothetical example illustrates this:

We show two examples of structuring charitable gifts (Display). In the first structure (Display, left side), we assumed the donor makes $10,000 gifts annually, which results in their total deductions being $2,000 higher than the standard deduction each year. This amount above the standard deduction will allow them to recognize $2,960 in total tax savings over four years. In the second structure, (Display, right side) the donor bunches two years’ worth of charitable gifts, or $20,000, in 2018 and again in 2020, which allows them to deduct a higher amount—$12,000—above the standard deduction recognizing a total tax savings of $8,880 over the four-year period, nearly $6,000 more than if they made a $10,000 gift each year.

Everyone Wins

A “bunching” strategy can create significant tax savings over time. One potential obstacle to this structure is that the donor needs to budget for higher donation amounts during the “bunching” years. Another drawback is that some donors may not want to give a larger amount of money to a charity all at once. A way around this drawback is to utilize a Donor-Advised Fund (DAF). By making a “bunched” gift to a DAF first, the donor can then make grants to a qualified charity at any time from the DAF, thus controlling the disbursement of their donations over time.

____________________________________________________________________________________

i Itemized deductions can also include for those who qualify, medical expenses (deduction limited to qualified medical expenses in excess of 7.5% of adjusted gross income (AGI) in 2018, then in excess of 10% of AGI thereafter) and student loan interest (deduction limited to $2,500 if Modified AGI is less than $65,000 for a single filer, and $135,000 for a joint filer. The deduction will be gradually reduced to zero for single filers with Modified AGI between $65,000 and $80,000 and for joint filers with Modified AGI between $135,000 and $165,000).

ii Charitable deductions are limited to 60% of adjusted gross income (AGI) for cash gifts and 30% of AGI for a gift of an appreciated asset.

For more tips on becoming financially engaged, explore Women & Wealth, a new Bernstein podcast series designed to educate, empower, and inspire female investors, and for additional thought leadership, check out the related blogs here.

The views expressed herein do not constitute and should not be considered to be legal or tax advice. The tax rules are complicated, and their impact on a particular individual may differ depending on the individual’s specific circumstances. Please consult with your legal or tax advisor regarding your specific situation.

The views expressed herein do not constitute research, investment advice, or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.