Investors in many risk-managed strategies may be wondering why performance has trailed the benchmark over the past 12 months. Our question would be: is the approach broad enough?

While it’s true that risk-management strategies have struggled to keep pace, we don’t think the performance gap is a broad indictment of risk management. Instead, we believe that broadening the approach to risk management can help improve performance.

There’s a lot of variety available in risk-management strategies: they range from completely quantitative approaches to the purely fundamental. A quantitative strategy typically takes its cues from a volatility signal, usually derived from implied or realized equity volatility; such a strategy increases equity exposure when volatility falls and reduces equity exposure when volatility rises.

The problem with many of these strategies isn’t that they look at a volatility signal; it’s that they look only at a volatility signal—and often a narrow one. By keeping the blinders on, these strategies leave themselves vulnerable to chaotic market environments.

Risk Management Has Been Effective over the Long Run…

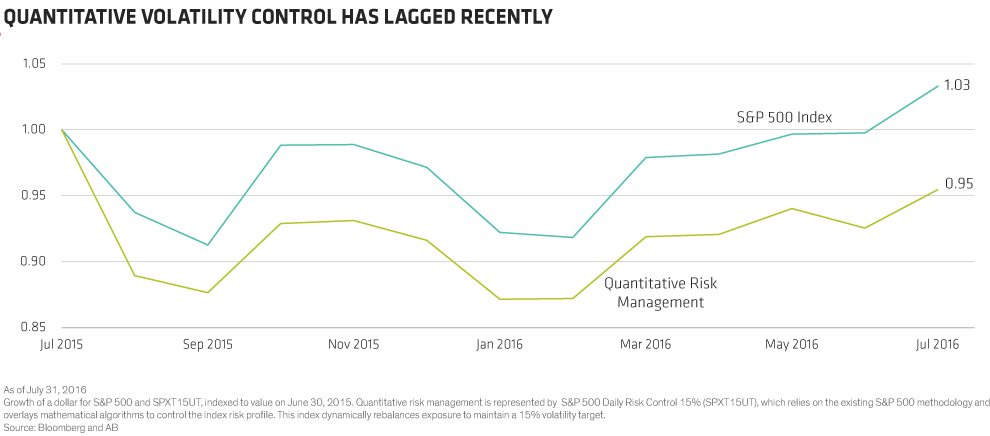

The gap in the armor for such singularly focused strategies is highlighted by looking at the performance patterns of a proxy. The S&P 500 Daily Risk Control 15% Index uses the same methodology as the S&P 500 Index, adding mathematical algorithms to allocate between cash and the stocks in the S&P 500 in order to target a constant volatility of 15%.

This quantitative approach has done a good job over the long run. From the index’s inception in 1999 through July 2016, it delivered an annualized return of 5% with 12% volatility. That track record stacks up well against the S&P 500 itself, which returned 3% with 15% volatility. So, it’s clear that risk management—even using narrowly focused strategies—can be effective over long market cycles.

…but Risk-On, Risk-Off Presents a Major Stress Test

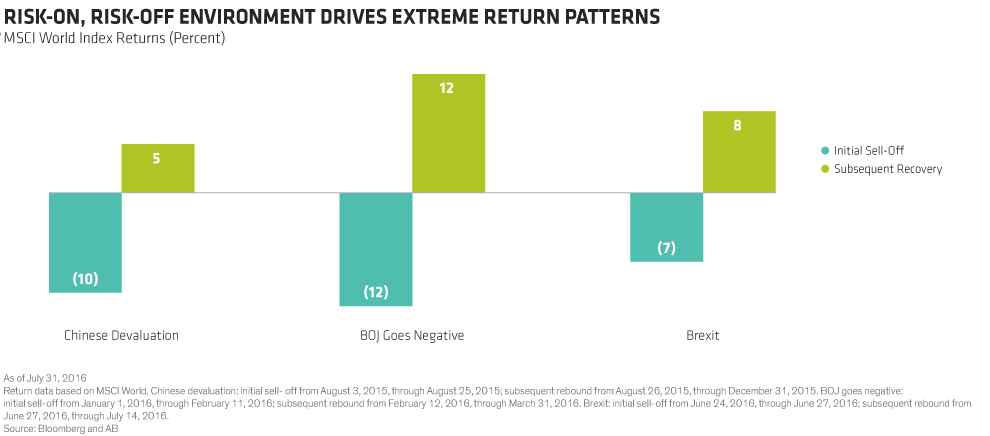

But an environment susceptible to large market shifts in either direction—what we call a risk-on, risk-off market—has posed a major test. During this time, we’ve seen periods of extended and persistent below-average volatility punctuated by three extreme volatility spikes:

1. China unexpectedly devalued the yuan renminbi in August 2015.

2. The Bank of Japan (BOJ) moved one of its policy rates below zero in January 2016.

3. A UK referendum unexpectedly favored an exit from the European Union in June 2016.

In each of the episodes, we observed a huge spike in volatility followed immediately by a decline in volatility almost as rapid as the initial spike. Returns during these periods were extreme, too, with initial sell-offs followed by similarly strong rallies (Display 1).

Quantitative Approaches Suffer a 2015–16 Performance Reversal

This challenging period led to a performance reversal that exposed the limitations of quantitative risk-management strategies. For the 12 months ended July 2016, the proxy index for this approach underperformed the S&P 500 by about 8% (Display 2).

This performance shortfall is typical when there are big swings in volatility. Why? When volatility spikes, the reduction of equity exposure in quantitative risk-management strategies causes them to miss the subsequent rally. Even the slightest overweight or underweight can lead to sizable underperformance when big market swings are taking place.

Holistic Risk Management: More Tools and a Very Different Response

The struggles of volatility-management strategies over the last year highlight a key point: simple approaches that rely on a central volatility signal are prone to stumble in extreme markets. Risk management should take a broader perspective on risk when making investment decisions—and it should factor in asset-class return potential as well as fundamental judgment.

These enhancements might change risk-management decisions—including those made during the Brexit-induced volatility in mid-2016. Given that our return outlook for most major asset classes was positive, we think it made sense to only modestly reduce risk even as volatility spiked. Our fundamental assessment of the potential Brexit impact supported this stance—even though the market was tumbling. That’s a very different path than many systematic volatility-management approaches would likely have taken.

Market environments like the one we’ve seen over the last 12 months would put any volatility-management approach to the test. But a holistic process can apply more tools to the challenge. We’ve already mentioned designing a better risk measure and including return assessments as well as fundamental judgment. Other tools include exposure to diversifying asset classes like high yield and real estate. Options can create incremental equity exposure that goes out of the money if markets sell off, creating a built-in circuit-breaker effect.

Managing volatility is a complex challenge, and it takes a thoughtful, multifaceted solution to address it. In our view, expanding your perspective beyond risk alone can pay dividends when a risk-on, risk-off environment comes calling.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams