Rising interest rates. Stretched valuations. Populist politics. These are some of the challenges bond investors face today. They’re also reminders of why it’s so important to manage interest-rate and credit risk in an integrated way.

Too often, investors separate rate-sensitive securities (global government bonds, inflation-linked bonds) and growth-sensitive credit ones (high-yield corporate bonds, emerging-market debt) into distinct groupings—and then look to different managers to oversee each one.

In theory, the divide-and-conquer approach works like this: if the assets in the credit-oriented portfolio get too expensive to justify the risk, a manager might sell some of them and shift those assets into the rate-sensitive portfolio. But managing these pools of assets separately can cause investors to miss income-generating opportunities and take on too much exposure to a single risk.

RATES AND CREDIT: BETTER TOGETHER

In our view, a “combine-and-conquer” approach is better. Pairing the two groups of assets in a single strategy known as a credit barbell can minimize large drawdowns while still providing a strong and steady stream of income.

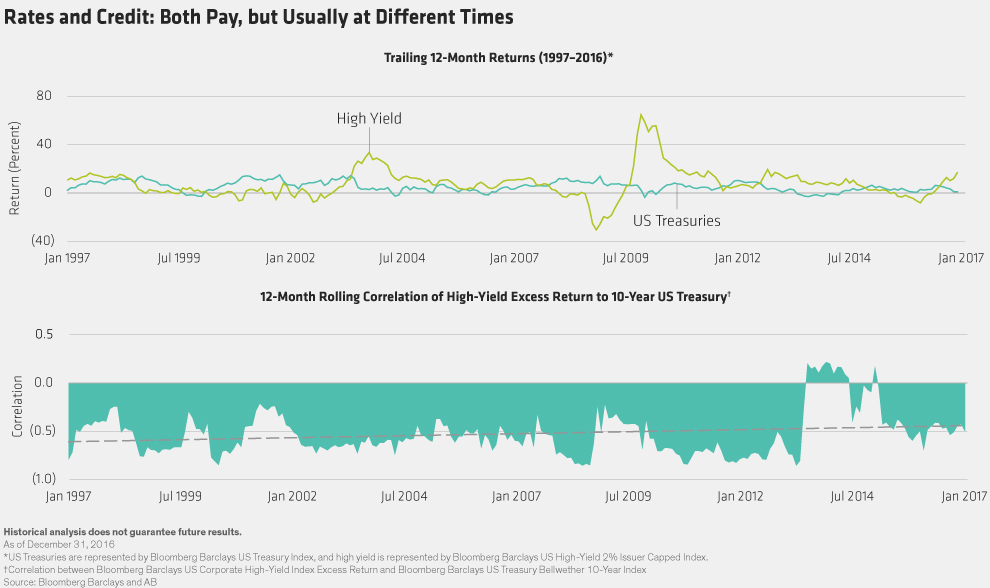

Credit barbells blend asset classes whose returns are usually negatively correlated (Display); rate-sensitive government bonds—known as risk-mitigating assets—tend to do well when growth slows, while return-seeking credit assets such as high-yield corporates shine when growth accelerates and interest rates rise.

Managing these assets holistically lets investors capitalize on the critically important interplay between prevailing interest-rate and credit cycles by rebalancing the portfolio as conditions and valuations change.

HOW MARKET CYCLES INTERACT

The interplay between rate-sensitive and credit assets has always existed. But over the last nine years or so, investors could get by without paying too much attention to it.

We can chalk that up to the global financial crisis and the unusual conditions it created. Interest rates plunged, inflation dried up, and central bank policy—not the real economy—became the most important variable for global bond markets. For years, investors could virtually ignore interest-rate risk.

At the same time, central banks’ easy money policies made companies less likely to default, leaving investors free to load up on credit risk to boost returns.

As markets and the global economy emerge from nearly a decade of postcrisis conditions, that’s all starting to change. Interest rates have started to rise, and major central banks are likely to tighten conditions even more in the years ahead by slowly shrinking their swollen balance sheets. That could put more upward pressure on interest rates and make it harder for some corporate borrowers to service their debt.

Political risk is rising, too, as economic and social insecurity fuels populist movements around the world.

In this environment, investors must pay constant attention to interest-rate and credit risk. That means having a manager who understands how the two interact and has the flexibility to tilt toward one or the other, depending on rapidly changing conditions.

It’s possible, of course, for investors who segregate rate and credit risk in separate portfolios to do this on their own. But it isn’t easy.

For instance, rebalancing by shifting money from one portfolio to another can be challenging. Timing an interest-rate change or credit event is tough even for veteran professionals, let alone rank-and-file investors saving for college or retirement.

Also, the manager of a purely interest rate–oriented portfolio will necessarily be focused on interest-rate risk. That means he or she may miss attractive opportunities in global credit markets.

Times are changing, and a brave new world is taking shape for fixed-income investors. We think a balanced approach gives investors the best chance of success.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.