Now that 2017 is behind us, it’s time to start planning for 2018. Specifically, it’s important to think about charitable gifts. Why?

The implementation of the Tax Cuts and Jobs Act (TCJA) for 2018 means that last year’s advice for charitable giving may no longer be the right advice going forward. Understanding how to structure your gifts to meet your philanthropic goals and provide the highest benefit to you, starts today.

What’s Changed?

Under the new TCJA, itemized deductions are mostly limited1 to mortgage interest, state and local taxes (capped at $10,000), and charitable gifts. At the same time, the standard deduction was increased to $12,000 for individuals and $24,000 for married couples. For most people, the standard deduction is projected to be greater than their itemized deductions.

Despite the inability for some to write off charitable donations, many individuals will still give to philanthropic causes and charities. While the tax benefit may not be as obvious without the ability to itemize, there are ways to structure charitable gifts to provide the highest advantage to you, the donor. When making gifts, you need to consider the types of assets you own, your age, tax bracket, and whether or not you can itemize your deductions.

Cash Isn’t Always King

For investors who are younger than 70 ½, gifting is generally limited to two types of assets—cash and appreciated assets. Whether the investor can itemize or not, giving appreciated assets will likely be the optimal asset to give. Let’s use an example to illustrate this point.

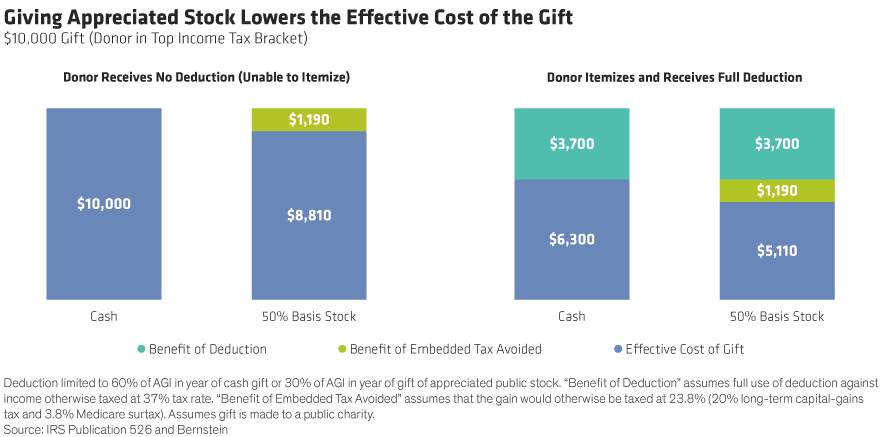

A donor is choosing between gifting $10,000 in cash or a highly appreciated stock with the same value (Display).

Regardless of whether the donor can itemize, the effective cost will always be lower when giving highly appreciated stock. The reason is simple: When you give appreciated stock, you avoid taxes on the gain in the stock. You can see this in our example. The effective cost of a $10,000 gift when the donor receives no deduction is $10,000 for a cash gift compared to $8,810 for a gift of stock with a cost basis equal to 50% of its value. The difference comes from avoiding the embedded tax liability on the stock.

Of course, if the donor can itemize and receive the full deduction, the effective cost will be lower for both types of gifts. In this case, the gift of stock still results in a lower effective cost of $5,110 compared to $6,300 for a cash gift.

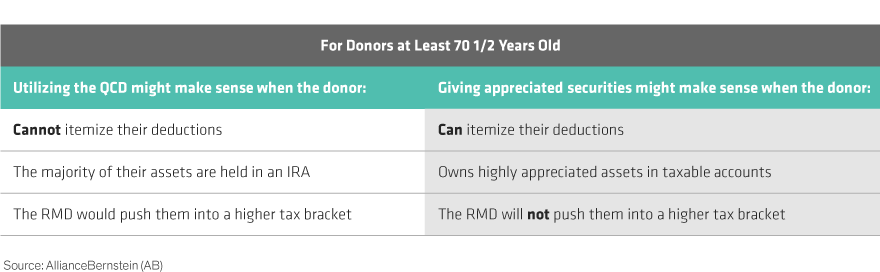

With Age Comes … the QCD

Investors over the age of 70 ½ with IRA assets have another option—making a Qualified Charitable Distribution (QCD). A QCD allows a donor to avoid paying taxes on the required minimum distribution (RMD), or the amount you must withdraw from your IRA each year, up to $100,000, if the distribution goes directly to a qualified public charity.* At first glance it may seem like making a QCD is the obvious choice because of this tax avoidance benefit, but it may not always deliver the most optimal outcome. In some cases, giving highly appreciated assets might be the right choice (Display).

Unfortunately, many donors may not fit neatly into these boxes, necessitating another solution: combining a QCD and a gift of appreciated assets.

The New Era

The changing tax landscape highlights the importance of stepping back and assessing old rules of thumb. Because what once worked may no longer make sense in this new tax era.

*The Protecting Americans from Tax Hikes (PATH) Act of 2015 allows IRA owners who are at least 70½ years old to donate up to $100,000 each year directly from their IRA to a qualified public charity, but not to donor-advised funds, supporting organizations or private foundations.

1Itemized deductions can also include for those who qualify, medical expenses (deduction limited to medical expenses in excess of 7.5% of Adjusted Gross Income (AGI) in 2018, then in excess of 10% of AGI thereafter) and student loan interest (deduction limited to $2,500 if Modified AGI is less than $80,000 for a single filer, and $160,000 for a joint filer).

For more tips on becoming financially engaged, explore Women & Wealth, a new Bernstein podcast series designed to educate, empower, and inspire female investors, and for additional thought leadership, check out the related blogs here.

Business owners deserve a partner who will support them right from the start. For more thought leadership for entrepreneurs and business owners, check out the related blogs here.

The views expressed herein do not constitute and should not be considered to be legal or tax advice. The tax rules are complicated, and their impact on a particular individual may differ depending on the individual’s specific circumstances. Please consult with your legal or tax advisor regarding your specific situation.

The views expressed herein do not constitute research, investment advice, or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.