Our recent post showed that it’s possible to get equity downside protection and still outperform. The hard part is building a portfolio that reliably delivers that outcome. Our guiding principle: Target profitable, resilient businesses at attractive prices.

To illustrate this “gaining more by losing less” concept, we used a hypothetical portfolio with a 90%/70% upside/downside performance record—meaning that it captured 90% of market upturns and fell only 70% as much in market downturns. At the end of a 30-year period, this portfolio had amassed a capital balance more than 2.5 times larger than the market’s.

As we wrote in that earlier post, this performance comes as close to investing nirvana as one can find. To our thinking, it’s a strategy that should hold particular appeal for investors with long-term needs who can’t stomach big downdrafts.

But one big caveat: We made our case with a hypothetical scenario. In the real life, striking the right 90%/70% upside/downside balance is incredibly difficult. Simple definitions and checklists won’t do. Finding these companies takes skill, research and a broad, flexible view of risk and return, one that can pivot when opportunities arise (sometimes in unexpected places) or when the world throws curve balls.

Quality Businesses Are Everywhere

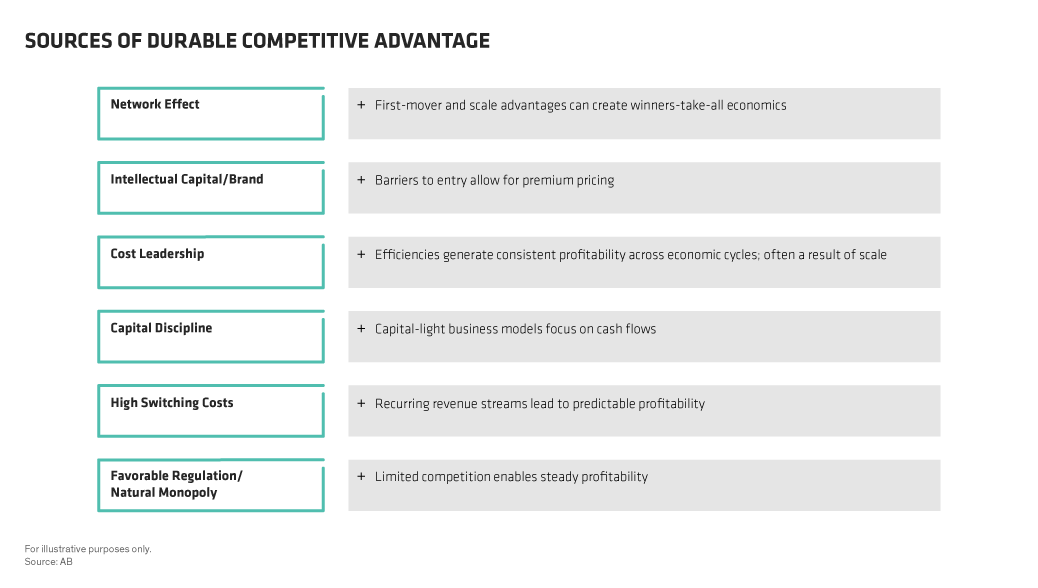

So, what are some examples of well-armored business models? Overall, we look for companies enjoying hardened competitive advantages that enable them to maintain high and predictable profitability for longer than the market is giving them credit for. The sources of this sustainability can vary—from a well-defended network effect, a difficult-to-replicate service or beloved brand to a low-cost production process (Display). These companies are also strong cash generators and good stewards of capital, which gives them control over their own fate.

You may think that only companies in traditional safe-haven or defensive sectors—consumer staples, healthcare and utilities—make the grade. In reality, however, standout business models are everywhere.

They can be found among tech-savvy disruptors such as Google and online travel-information provider Amadeus IT Group, both of which are profiting from powerful network effects built on their formidable leads in the collection of data and on their exceptional ability to analyze and monetize it. But durable business models can also be found in industries suffering massive technological disruption. Advertising powerhouse WPP, information services provider Equifax and insurance broker Marsh & McLennan are reaping the benefits of recent large investments in data analytics and other services, which have revitalized their value as intermediaries in their respective market niches.

Meanwhile, as ecommerce continues to upend traditional retailing, dollar stores and off-price apparel chains are thriving. They’ve crafted business strategies focused on encouraging strong customer loyalty and frequent store visits—dollar stores through their convenient neighborhood locations and low, everyday prices on small-pack basic items, and off-price apparel retailers through their ever-changing designer-brand assortments and “treasure hunt” appeal. Both gain from the efficiencies of superfast inventory turnover.

Resiliency Adds a Safety Net

Some of the stickiest business models in technology are concentrated in software, particularly in the enterprise arena, where it is often used for mission-critical operations. Once installed, the costs of switching become prohibitive, erecting a strong barrier to entry. For example, Fiserv, a provider of online banking, payments, data analytics and core account processing, is winning IT-outsourcing business by partnering with small and midsize companies looking for ways to lower the cost of regulatory compliance.

But Valuation Seals the Deal

But identifying those high-quality, shock-resistant companies is not enough. To tip the scale even higher to the upside, the next step is to determine whether those fundamental characteristics are being fully appreciated by the market. Staying alert to valuation is another way to boost return potential and to avoid pricey, vulnerable pockets of the market.

It’s not easy building a portfolio that can capture more upside during market rallies than it loses during downturns over time. In our view, the secret to delivering on this nirvana potential lies in the intersection of quality, stability and attractive valuation—and nimbly adjusting exposures as insights into fundamental attractiveness and risks change.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.