US inflation has been running low for some time, and key members of the Federal Reserve Open Market Committee (FOMC) are pointing a finger at the traditional policy framework. So rate hikes are on hold for the time being—and monetary policy is under the microscope.

Since the beginning of this year, bond markets have dramatically adjusted their expectations for US Federal Reserve interest-rate hikes. The market is no longer pricing in further increases this year, or in 2020, for that matter. We don’t expect further rate hikes either, but our rationale is different from popular wisdom.

Inflation Has Gone Missing

As we see it, the Fed didn’t stop hiking interest rates because there’s a growth problem—it stopped because there’s an inflation problem. Simply put, inflation has gone missing, and the Fed is worried about it. That concern led to a freeze on rate hikes—even though the US economic growth outlook remains solid.

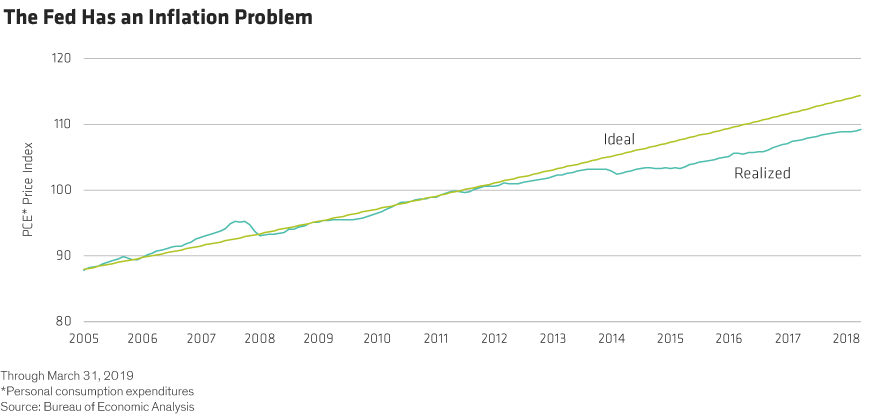

The Fed’s inflation target is 2.0% year over year, as measured by the personal consumption expenditure deflator index. Based on that data series, inflation has averaged less than 1.5% per year over the course of this economic cycle. As a result, current price levels are almost 6% lower than they would have been if the Fed had achieved its inflation target (Display).

That’s a lot of missing inflation!

Because of this inflation shortfall, inflation expectations are about 50 basis points lower than they were in earlier economic cycles. Inflation expectations can be self-fulfilling: businesses tend to set prices based on where they think inflation is headed. So lower inflation expectations today could mean lower actual inflation tomorrow.

That’s a problem for the Fed. It may seem counterintuitive to some, but low inflation could end up being a bigger headache than high inflation. If deflation sets in, it can be hard to break free of—as the Japanese have discovered over the past couple of decades.

Setting Sights on a New Inflation Target

With inflation running persistently below target, some FOMC members are worried that inflation could get stuck at too low a level. A newly formed FOMC group is looking at changing the framework for monetary policy, and this has already started to shape the way the committee discusses policy.

In our view, the Fed is likely to shift to an “average” inflation target of 2.0% over the course of a business cycle. Since we know inflation will be under 2.0% when times are bad, the Fed will need to keep inflation above 2.0% in good times. Otherwise, the math doesn’t work.

Right now, times are good, which has implications for where inflation is headed. We think the FOMC would be comfortable with inflation hovering above 2.0% for a sustained period of time.

There are limits to this approach, however. The Fed won’t let inflation run wild. But investors should get used to the idea of inflation staying around 2.5% for a while. After all, there’s plenty of room for today’s below-target inflation to run hotter. This is why we don’t expect the Fed to hike rates this year or next, despite our favorable US economic growth outlook.

Leaning Toward Change in the Policy Reaction Function

Not all FOMC members are on board with changing the policy framework. But the internal debate seems to be tilting in the direction of change when it comes to dealing with inflation. We think the intellectual debate within the Fed can be characterized by three different groups.

Group one consists of a minority of FOMC members who still want to raise rates later this year. But this group is too small to have much influence on policy or on the views of the two larger factions within the FOMC, neither of which is pushing for more rate hikes at the moment.

Group two, which likely includes Chairman Powell, isn’t necessarily committed to average inflation targeting yet. But its members think past rate hikes have done what they were supposed to do in the current cycle, and don’t see the need to hike rates further.

It’s the third group, led by John Williams, President of the Federal Reserve Bank of New York, and Richard Clarida, Vice Chair of the Federal Reserve Board, that appears most committed to average inflation targeting. So, this group is the most resistant to more rate hikes. We believe that Williams and Clarida are the most influential FOMC thinkers. With Clarida chairing the ongoing study group, we expect group three’s view to prevail over time.

The takeaway: rate hikes are off the table for now, and policy is likely to evolve in a way that encourages inflation to run hotter than it has so far in the cycle. So even if price pressures mount, we don’t think the FOMC will act any time soon.

Eric Winograd is a Senior Economist in Fixed Income at AB.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.