With equity markets likely headed into a period of lower returns, fees of all kinds are coming under increasing scrutiny. Active management is under this spotlight, too—but it also offers a potential solution.

It’s only natural that fees don’t stand out as much when equity markets are churning out big returns year after year. A beta wave featuring double-digit annual returns can keep the spotlight off advisory and active-management fees—even if active managers are underperforming.

But the story often changes when market returns come back down to Earth. Suppose equity returns are running at 5% to 6% per year; that means a classic 60/40 stock/bond portfolio might deliver something like 4% or 5%.

Warming Up the Hot Seat

In these environments, fees stand out a lot more—and the “fee” seat can get quite a bit hotter. A passive—or mostly passive—design can’t boost market returns, and in many cases locks in underperformance. Active management can help, but many advisors still wrestle with a big issue: fees. How can you be sure an active manager can deliver alpha that justifies what it is charging?

Essentially, fees are like the 80-basis-point gorilla of active management. That number roughly equals the average management fee across active equity funds over the past few years. If an active manager can’t beat the benchmark by at least that much, it doesn’t help anyone.

Change Is Under Way on the Fee Front

The explosive growth of passive investing and greater scrutiny have been making a dent in active fees, with more funds launching lower-fee share classes and strong market returns boosting fund assets. Today, the average active equity fund charges a management fee of 71 basis points.* So, the gorilla has already lost some weight. And all things being equal, lower fees are better for investors.

Performance fees are increasingly entering the discussion, too, as investors and advisors look for more innovative and flexible structures in the fees they pay for active managers and alpha generation. There are different ways to design performance fees, but the underlying principle is the same: fees are scaled to the fund’s relative performance.

Performance-Fee Innovation Could Change the Game

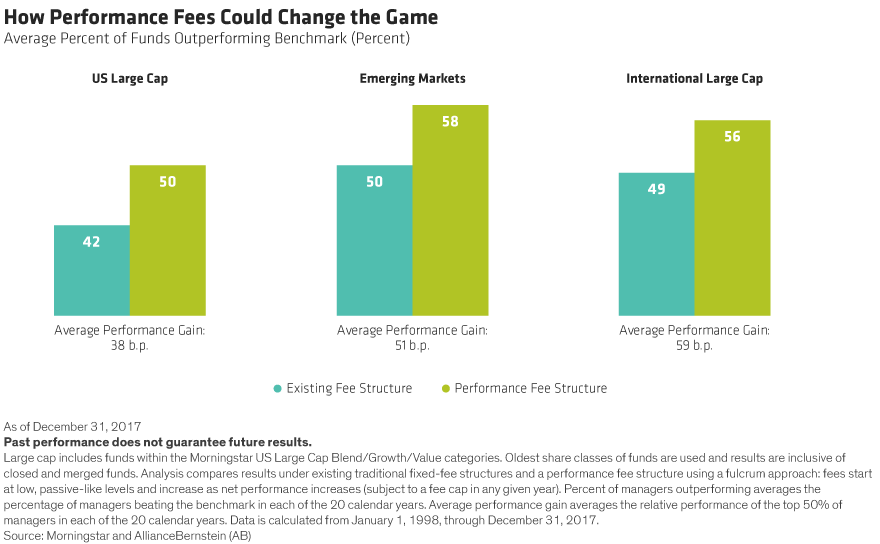

How much could performance fees improve outcomes? Let’s look at universes of active equity managers (Display). Under existing fee structures, 42% of active US large-cap managers beat their benchmarks between 1998 and 2017. But under a performance-fee structure (starting at low ETF-like fees that go up only with outperformance), 50% of managers would have outperformed, with an average performance gain of 27 basis points.

In segments where information and research advantages can be greater, performance fees would have had an even bigger impact. For example, the percentage of emerging-market equity managers beating the benchmark would have risen from 50% to 58% under performance fees, with an average gain of 61 basis points. Because performance fees scale to relative performance, they create an alignment between fees and outcomes.

The Active-Passive Pendulum Seems to Be Swinging

Of course, fees aren’t the only reason many advisors have balked at adding more active exposure to their clients’ portfolios. There’s also the lingering memory of the post-financial-crisis years, when active managers as a group struggled with structural challenges. On the other hand, truly active managers fared much better.

The environment was a factor, too. The years-long beta wave featuring very low volatility and low return dispersion among individual stocks left a lot less room for active managers to add value. But the playing field seems to be changing. Market volatility is back in 2018, which is helping create a friendlier landscape for active.

And just as active management faced structural risks that contributed to a decade-long slump, passive management faces growing structural challenges today. With over a million indices and more and more passive vehicles chasing a limited number of stocks, no one knows for sure how much damage could result if a major crowded trade were to break.

The Death of “Active vs. Passive”

So, where does all of this leave the active-passive debate? As we’ve said, the debate is dead: each approach can be valuable in an investor’s portfolio.

But as we see it, the pendulum has swung too far toward passive, and leaving active out in the cold could mean leaving money on the table. That’s a particular concern if we are indeed entering a lower-return environment—a time when that added alpha will be even more meaningful in enhancing investors’ outcomes.

Of course, as the fine print says, you can’t invest in an average or a category—it takes extensive due diligence to get it right. Everything should be in play: How active a manager actually is. The fee level and fee structure. How an active strategy fits in a client’s portfolio. An advisor’s own take on the environment ahead and how portfolio choices could impact client outcomes.

It may take considerable effort to find high-conviction active equity managers who can deliver consistently, but given today’s investing landscape and what we see coming down the road, we think it’s worth the effort.

*Equal-weighted management fee for primary share class of US-domiciled active equity funds with greater than $100 million in assets as of May 31, 2018.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.