Both the Federal Reserve and the European Central Bank (ECB) met this week to set policy interest rates, each hiking their targets by 25 basis points. That’s where the similarities end: the Fed signaled it probably won’t hike rates again this cycle, while the ECB sent a message that more hikes are all but certain.

What explains the diverging paths—and how long will they stay that way?

The Fed Takes a Pause to Survey the Landscape

The Fed’s decision to pause was based on the cumulative weight from 500 basis points (5.0%) of rate hikes over the past year. Because monetary policy works with a lag, the US economy is only starting to feel the impact of the rate hikes, so the full effect won’t be seen until further down the road.

It makes sense to pause and assess the extent to which tighter policy could restrain economic growth—especially given mounting evidence that it’s already working. Home prices have fallen over the past year as mortgage rates have surged. Inflation seems to have peaked and is poised to cool. Labor demand is starting to wane as well, with both hiring rates and job openings slowing.

The recent banking turmoil is another reason for caution from the Fed. We don’t expect the turbulence to halt the US economy, but small and regional banks will clearly need to pull back on lending, which will tighten financial conditions. That effect will put another restraint on the economy, which could help the rebalancing process but also risks a worse outcome that will become more likely if rates keep rising.

The Fed’s statement acknowledged the many inputs to its policy decisions by stating that it will “take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments.”

All in all, there’s a strong case for the Fed to pause rate hikes, starting with its next meeting in mid-June, and that’s what we expect.

Europe: Policymakers Still Waiting for the Core to Cool

While the Fed believes its policy setting is restrictive enough to bring the economy back into equilibrium, the ECB clearly doesn’t share the same view about its own policy path.

President Christine Lagarde repeatedly indicated that policymakers have “more ground to cover” in their inflation battle—a very clear signal that more rate hikes are looming. We expect hikes of 25 basis points in both June and July, which would eventually bring Europe’s deposit rate to 3.75%.

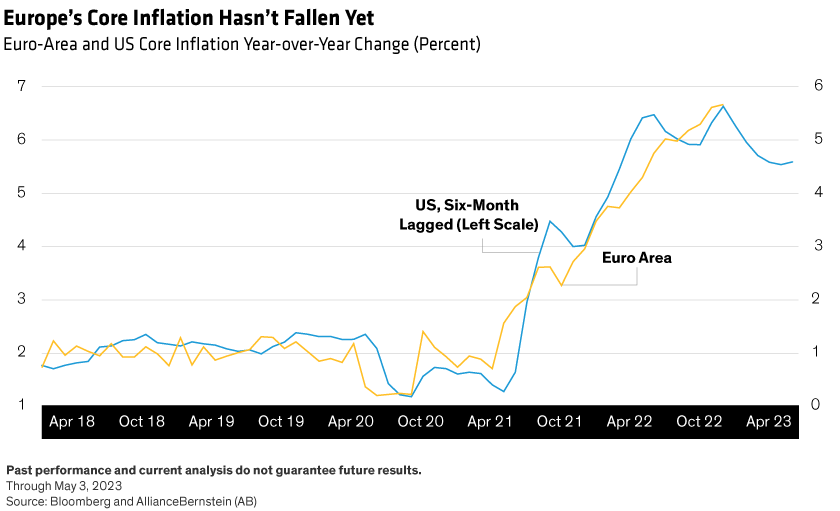

Throughout this cycle, European inflation has tracked the behavior of US inflation, but with a lag between three and six months. As a result, headline inflation in Europe has now peaked and is following US data lower, but the policy-relevant core inflation measure hasn’t yet turned down (Display). We expect this to happen in the coming months—but until it does, the ECB will likely stay on high alert.

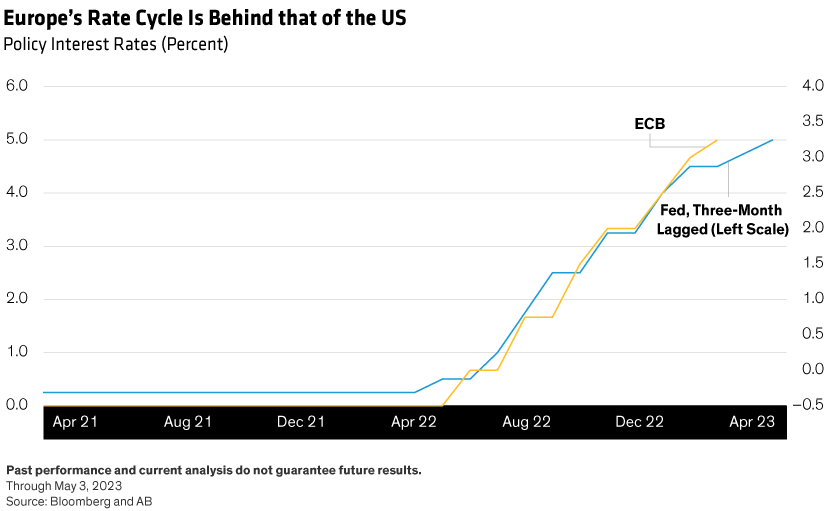

Given these relative inflation patterns, it’s not surprising that the ECB’s monetary policy has also followed that of the Fed—again with a three-to-six-month lag (Display). This week’s policy decisions reinforce that point: the ECB’s decision to slow the scale of interest-rate hikes to 25 basis points comes three months after the Fed made a similar move. Markets expect this policy lag to continue.

Economic data also suggest that the euro area’s trajectory is a few months behind. The US has already seen tighter monetary policy start to pass through to the real economy. In Europe, more restrictive policy has tightened lending standards but hasn’t yet pulled down economic activity. We have little doubt that this will happen, but it will take a few months.

Diverging Policy Rates…but Not for Long

The big picture is that this week’s adjacent decisions by two major central banks point to a near-term divergence in policy paths between the US and Europe: the Fed is on hold and the ECB is still raising rates. But investors shouldn’t expect those paths to be different for very long. In our view, by the end of the summer both central banks will be on hold. Then the focus will likely turn to when rate cuts will start.

The views expressed herein do not constitute research, investment advice or trade recommendations, do not necessarily represent the views of all AB portfolio-management teams, and are subject to revision over time.