With the global economy facing stronger headwinds, we’ve reduced our global growth and interest-rate expectations. But the US Federal Reserve has a variety of policy tools it could use—some unconventional—that we think will help the US economy hold up better than some of its peers.

We forecast slower—but still positive—economic growth in the US, so we don’t think the Fed needs to roll out new tools in the next few quarters. We expect the economy to avoid recession, but there are downside risks to acknowledge, so it’s worth taking a look at what tools the Fed has left. After all, expected Fed support is a big reason why we expect US growth to remain positive.

Limited Options for the Fed?

As we enter the later stages of the economic cycle, it may look like the Fed’s options are limited. Policy rates, at the 2.0%–2.25% range—are very low by historical standards, and we expect a 25-basis-point cut at this week’s Federal Open Market Committee meeting to take them still lower.

Still, from a global perspective, the Fed’s policy rate is quite high: rates for both the European Central Bank and the Bank of Japan are negative. Because the Fed’s target rate is still positive, the first thing we’d expect if the economy started to slip into recession would be a cut to zero. Our current forecast doesn’t quite get there—we expect rates between 0.5% and 1.0% over the next year. But if the economy underperforms our expectations, zero is a likely destination.

What if that isn’t enough? Will the Fed cut rates into negative territory?

It’s possible, of course, but not likely in our view. Other central banks that have taken that route have seen mixed results. Negative rates don’t seem to have caused systemic dislocations within the financial sector as some had feared, but they haven’t been particularly effective in boosting growth, either. Given the Fed’s publicly stated skepticism about negative rates—and the range of other tools at its disposal—we think a negative policy rate is unlikely.

What Else Do Policymakers Have in the Tool Kit?

The first tool the Fed might reach for is forward guidance—a commitment to hold off on interest-rate hikes, either for a certain time period or until certain macroeconomic benchmarks are reached. As we see it, forward guidance was the most effective policy tool during the recovery from the last recession, and it could be effective again.

A related idea would be to raise the inflation target. A higher target would clearly signal to the market that rates won’t go up for a very long time. There are obvious credibility concerns about changing the inflation target, however, so we’d expect the Fed to try a variety of other policies before resorting to a revised inflation target.

A Restart of QE? Or “Operation Twist” Again?

If the combination of a zero policy rate and forward guidance aren’t enough, the obvious action for the Fed would be to restart quantitative easing (QE). The Fed’s balance sheet now stands at about $3.75 trillion; that’s $750 billion below its peak size from a couple years ago. And there’s no mechanical upper limit on how large the balance sheet could get.

So, there’s clearly scope for the Fed to roll out more asset purchases, particularly with Treasury issuance increasing along with budget deficits. QE may have been considered an unconventional policy the last time around, but it’s now a conventional part of the Fed’s toolkit.

The Fed might also try to reduce longer-term bond yields. If the policy rate were already at zero, the committee could revive “Operation Twist.” This involved concentrating security purchases at the longer end of the yield curve. Or, it could borrow from the Japanese example and turn to yield-curve control—committing to buy as many bonds as needed to keep longer-term yields below a certain threshold.

Thinking Outside the Toolbox

The Fed could take other, more aggressive steps if the economy weakens and conventional monetary policy isn’t enough.

For instance, it could provide lending facilities that offer very cheap credit to banks, subject to the condition that the funds be lent out into the economy. The Fed doesn’t have the legal authority to provide credit directly to nondepository institutions, but pushing credit through the financial sector might lower its cost and increase its availability to the private sector.

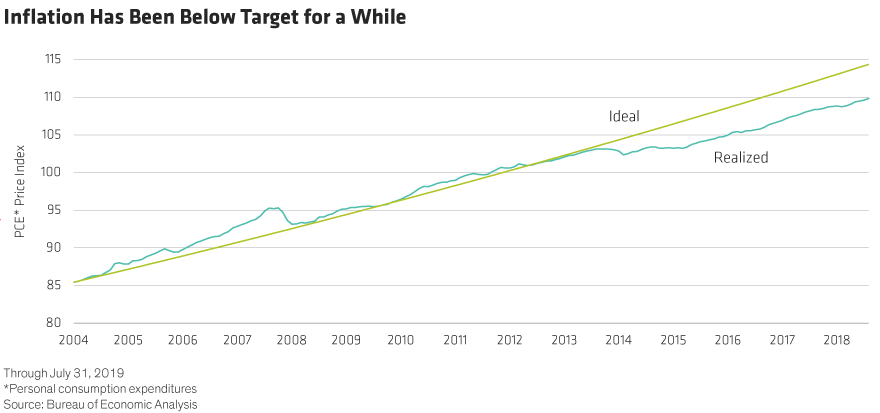

As we noted above, the Fed could change its inflation target. While that doesn’t seem likely, policymakers have flexibility around how they pursue that target. With inflation staying below the Fed’s target rate for most of the last decade (Display), the Fed could pledge to “make up” for the inflation shortfall by not raising rates until that shortfall has been corrected.

To sum things up, the existence of these policy tools is a major reason why we expect the US economy to stay on better footing than most other major economies. The Fed clearly has the ability to support economic growth—now, it’s a matter of discovering just how much support will be needed.

Eric Winograd is a Senior Economist at AB.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.