Turning Less Into More

It’s a deeply ingrained investing maxim that risk and return go hand in hand: to get more return, you must accept more risk. So, for some investors, it may seem counterintuitive that the opposite is also true: you can take less risk and still beat the market over time. It’s a different way of defining investment success that leans on downside defenses in the pursuit of long-term goals.

Following the extended postcrisis bull runs in bonds and equities, the future returns of many traditional investing strategies are unlikely to pack the same punch. Investors are realizing that they’ll need to take more risk to meet their long-term goals, including adding equity exposure.

That’s a troubling proposition for a large and growing group of investors. Whether an individual saving for retirement, a pension plan facing funding gaps, or an insurance company dealing with stiffer capital requirements and asset/liability-matching challenges, investors are much more risk-sensitive today. They can’t tolerate wild market swings, let alone the prospect of losing money. They need their investments to go the distance.

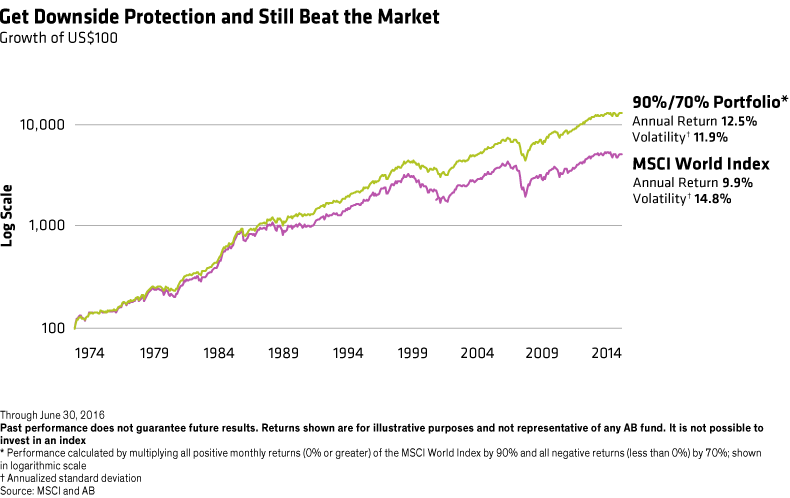

That’s where strategies that expressly target downside-risk protection come in. These solutions get their performance power from the simple mathematics of lower risk drag and compounding. Stocks that lose less in market downturns have less ground to regain when the market recovers, so they’re better positioned to compound off those higher returns in subsequent rallies (Display).  Over time, this gentler return pattern can end up ahead of the market.

Over time, this gentler return pattern can end up ahead of the market.