By 2050, one in five Americans will be older than 65. The US is far from ready to address the challenges of an aging workforce, but defined contribution (DC) plans have started incorporating innovative tools to help the workforce—and the workplace.

Currently, the average retirement age in the US is 63. But retirement savings for most workers are low, more defined benefit plans are being frozen or eliminated, and full Social Security benefits aren’t kicking in until age 66 (and going up to 67 for those born after 1960). The result: employees are increasingly working longer.

In our latest survey of DC plan sponsors, more than half our respondents (56%) say the average retirement age at their company has risen over the past five years. They also expect that nearly one-fourth of employees (23%) will hold off on retiring until after age 67. That’s putting more pressure on DC plan sponsors and employers concerning how involved they should be in their participants’ DC account decisions when they retire.

Financial Wellness Programs: Surprising Payoff for an Innovative Exercise

Retirement unreadiness is such an acute issue for American workers that it needs to be attacked from any and every angle possible. So it’s heartening to see the positive early results for financial wellness programs, often broadly defined by such topics as budgeting and paying for college. As with many innovations for employee benefits that complement their DC plans, the early adopters of financial wellness programs are more concentrated among larger companies, with half of institutional-size plan sponsors already noting their companies’ participation. Only one-fourth of companies with micro and small plans are taking part.

Companies offer these formalized, needs-driven programs to employees as additional resources, separate from the 401(k) education program. According to our survey respondents, the most common services are investment planning (53%), targeted education programs (51%) and seminars (48%).

While financial wellness programs have only begun to gain popularity as formal programs, almost four in 10 companies (38%) offer them already. And the median participation rate of roughly 30% is surprisingly robust, considering the programs are entirely optional and not directly related to employee benefits, such as the DC plan.

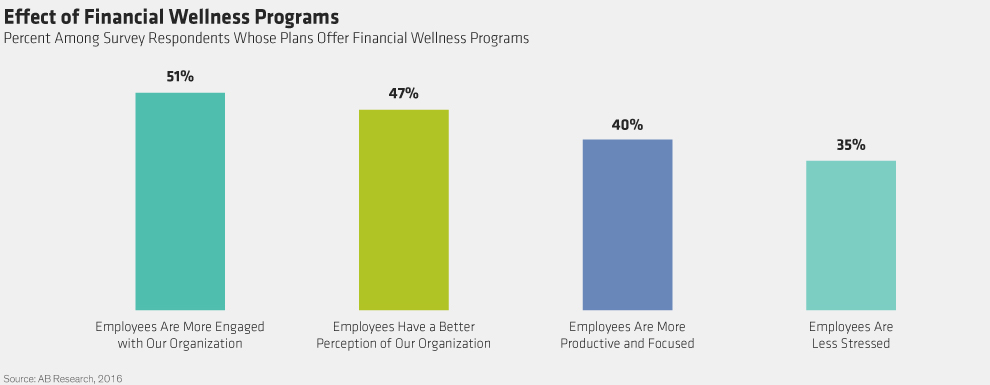

Plan sponsors whose companies offer these programs frequently cite several important benefits (Display). More than half (51%) say employees are more engaged, and nearly as many (47%) say employees have a better perception of the organization. But two other metrics are even more noteworthy: four in 10 plan sponsors report that employees are more productive and focused, and one-third say employees are less stressed.

These responses certainly indicate a win-win for financial wellness programs. Companies have more engaged, productive employees who’ve improved their financial knowledge and confidence—and those employees will more likely be able to retire when they want.

Of course, it’s still a bit early to know if workers’ retirement readiness and savings have actually improved, but these financial wellness programs seem to help steer them to better savings decisions.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.