Investing in healthcare companies amid “repeal and replace” feels a bit like mystery diagnosis to some investors; many would prefer to wait for a clearer prognosis. But we’re not ready to quarantine every company in the sector.

Regardless of the fate of healthcare reform, we don’t expect legislative efforts to result in major upheaval. Instead, we believe that companies can, for the most part, be carefully evaluated for their attractiveness without knowing the details of the eventual changes to the Affordable Care Act. In other words, politics becomes less and less important as you focus on the health of individual companies. With that said, our bottom-up research does point to potential headwinds and tailwinds—though they’re not always blowing in the direction you might think.

Some Insurers May Gain Market Share

Take health insurers, for example. Many investors are studiously avoiding those with heavy exposure to Medicaid, a state and federal program that provides health coverage to people with low income. That’s because proposed reforms might transform Medicaid from a reimbursement formula to a fixed-grant system, where states—not the federal government—would be on the hook for cost overruns.

Some worry that if such a shift occurs, insurers’ profits may be jeopardized by slower Medicaid growth or by states reallocating block funds to other budget priorities. Our analysis suggests otherwise: A formula switch may actually benefit insurers with a Medicaid focus. Why?

Most states today spend roughly 40% of their healthcare budget through managed-care companies, while the remainder is directly spent. As cost control comes into focus, we foresee states swiftly moving the direct portion to managed-care companies. In other words, while the total Medicaid pie is likely to grow more slowly, managed-care companies stand a better chance of coming away with a bigger slice. While changes to Medicaid funding may pose a near-term challenge, we believe health insurers will continue to be a stable part of investors’ portfolios.

Headwinds for Hospitals

In contrast, the outlook for hospitals appears less favorable. A number of repeal and replace proposals have been projected to increase the total number of uninsured individuals in the population. Because hospitals are legally obligated to treat patients seeking emergency room treatment, they are at increased risk of failing to recoup the costs of a rising number of uninsured patients.

Our research indicates that hospital profitability is particularly vulnerable because most operate with a high degree of leverage. Their heavy debt burden means that small changes in enterprise value can translate into big changes in equity value. This sensitivity makes hospital stocks particularly volatile; it is one of the key reasons we are not as optimistic about the sector.

Drag from Drug Pricing?

Some investors fear cost controls will put downward pressure on drug prices. We believe these concerns may be overblown. Large drug companies—so-called “Big Pharma”—might struggle, but not for the reasons you might expect.

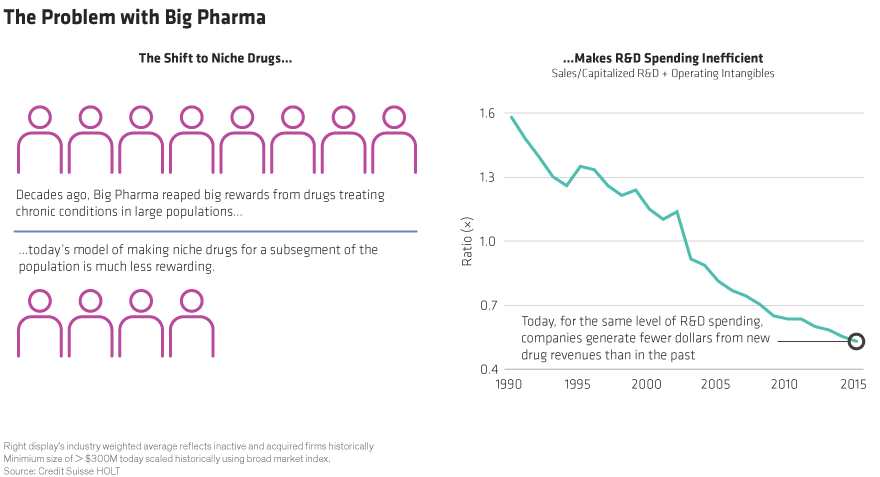

We see gradual pressure on drug pricing continuing to mount in the commercial sector, not the public sector. Other fundamentals weigh more heavily on the industry, which is long past its profitable heydays. Twenty to thirty years ago, Big Pharma was introducing drugs to treat chronic conditions in large segments of the population, such as medications for control high blood pressure. Today, it is launching drugs with limited applications that are more expensive to bring to market (Display).

Companies have also been hit by the law of diminishing returns when it comes to research and development. Today, they bring fewer drugs to market, resulting in less revenue from new drugs than an equivalent level of R&D spending delivered in the past. As a result, Big Pharma offers low returns on invested capital, and contrary to popular belief, its earnings growth is slower than the market’s. While some Big Pharma stocks represent attractive investments, we see more opportunity in biotech stocks, which we think generally offer greater potential for profitable innovation than the market appreciates.

Assess Healthcare Stocks from the Bottom Up

Uncertainty surrounding healthcare policymaking has fueled speculation about the sector’s prospects. Not surprisingly, our research suggests that the picture may be more complicated than it seems. Conventional wisdom isn’t always correct when it comes to companies that stand to benefit—and those likely to shoulder a heavier burden. That makes research a vital bedside companion.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.