Target-date funds have seen tremendous asset growth in recent years, but their investment design hasn’t kept pace with available innovations. We think it’s time that changed.

Most retirement plans still use traditional, single-manager target-date fund designs that were adopted some 10 years ago or more. But fiduciary standards have changed dramatically since then due to the Pension Protection Act of 2006 and subsequent regulatory clarifications and guidance tips from the Department of Labor (DOL).

The investment environment has changed, too. A broad range of time-tested strategies are now available that can be incorporated into target-date glide path design. They provide greater diversification beyond traditional stocks and bonds and have been used successfully for years by pensions, endowments and foundations. Already, many of the largest defined contribution (DC) plan sponsors are taking advantage of these strategies—shedding proprietary, single-manager offerings in favor of custom funds that can deliver greater manager and asset-class diversification.

We believe target-date glide paths should generally be including more of these innovative strategies. They can help reduce sensitivity to the four common risks that plague the retirement saving and spending goals of DC plan participants: subpar market growth, insufficient risk reduction, rising inflation and increasing longevity.

Of course, these risks have always been around, but they’re likely to be more challenging in the next decade than they were in the recent past. And our research indicates that traditional, single-manager stock/bond glide paths will be hard pressed to combat today’s heightened retirement risks.

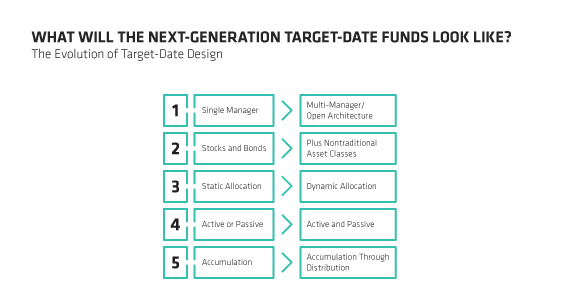

That’s why we believe it’s time to revisit target-date fund designs and single-manager structures. In our latest research, we focus on five key areas where target-date funds should evolve (Display):

- Moving from a single investment manager format to a multi-manager or open-architecture format to access best-of-breed managers and reduce concentration risk

- Diversifying the underlying investment mix from a traditional stock/bond glide path to also incorporate nontraditional asset classes

- Providing more flexibility to respond to short-term market fluctuations by using a dynamic, rather than static, approach

- Mixing active and passive investing strategies to enhance risk-adjusted returns and manage costs

- Calibrating the glide path to deliver better results in the distribution phase of a retirement plan—a critical, but often overlooked, component of any retirement solution

In upcoming blogs, we’ll look at the heightened risks as well as the investment and design solutions that we see as contributing to better retirement outcomes.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

"Target date" in a fund's name refers to the approximate year when a plan participant expects to retire and begin withdrawing from his or her account. Target-date funds gradually adjust their asset allocation, lowering risk as a participant nears retirement. Investments in target-date funds are not guaranteed against loss of principal at any time, and account values can be more or less than the original amount invested—including at the time of the fund's target date. Also, investing in target-date funds does not guarantee sufficient income in retirement.