Philanthropic giving is inherently personal because it is rooted in your values and in how you choose to fulfill your sense of responsibility to your family, the community, and the world. But how you make your gifts can affect the nature and scope of their impact to both the cause and for you. Here are a few tips to ensure your gift qualifies for a charitable income tax deduction.

Three Guidelines for Maximizing Your Gift

#1: Complete Your Gift Before Year-End

Charitable donations must be completed within a given tax year, by December 31, for the contribution to be deductible in that same year. Donors need to be careful with gifts made close to or on the last day of the year. Failure to ensure the donation is complete by the end of the year will result in the deduction being deferred into the next tax year.

Generally, a donation is considered complete when delivery to the charitable organization takes place and the donor has surrendered control of the asset. In practice, determining when delivery has taken place and control has been transferred depends on the type of asset and the method in which it is transferred.

- Donations made by check: Considered to be complete on either the date the check is delivered to the charitable organization, or when using the US postal service, the date the check is mailed to the charitable organization. If the check is not ultimately paid in due course or restrictions are placed on the time or manner, then the deduction will be deferred into the next tax year.

- Donations of stock: Generally complete when the donor has surrendered control of the stock to the charitable organization. The most common form of stock donation today involves an electronic transfer between brokerage firms or custodians. Generally, the donation is not considered complete until the stock is transferred into the charitable organization’s account regardless of when the transfer instructions are provided. Thus, a donor providing transfer instructions and authorization to his/her broker prior to the end of the year is not sufficient. Instead, the donor should ensure that the broker can and will complete the actual transfer prior to the end of the year.

- If giving physical stock certificates, then the donation is complete when the donor delivers properly endorsed stock certificates to the charitable organization, an agent of the organization, or on the date of mailing. The mailing date only applies for properly endorsed stock certificates delivered using the US postal service.

- If the donation of physical stock certificates is being made through the donor’s broker, the donation is not considered complete until the stock is transferred on the books of the actual corporation.

#2: Give Assets Where the Deduction Is Based on Fair Market Value

Charitable deductions vary depending on the asset you give (Display). In general, donations made to public charities of appreciated capital assets—private or public securities or real estate, for example—which have been held for more than one year, are deductible based on the property’s fair market value (FMV). If held less than one year, the deduction will generally be limited to the donor’s tax basis in the property.

One exception to the fair market value deduction rule is for donations of publicly traded partnerships (PTP) such as master limited partnerships (MLPs). For PTPs, the charitable deduction is reduced by the amount of ordinary income that would have been realized if the security was sold at FMV on the date donated. In addition, if the partnership carries debt—as many do—the donor could incur a tax liability. Further, donations of PTPs worth at least $5,000 may require the donor to obtain a qualified appraisal because PTPs are not considered securities.

#3: Maintain Appropriate Documentation

There are strict rules for the verification and reporting of charitable contributions. Failure to comply will often result in complete disallowance of an income-tax charitable deduction. It doesn’t matter how large or small a donation is; unless there’s a record of the contribution, no deduction will be allowed. Necessary records may include a written acknowledgement and an appraisal.

-

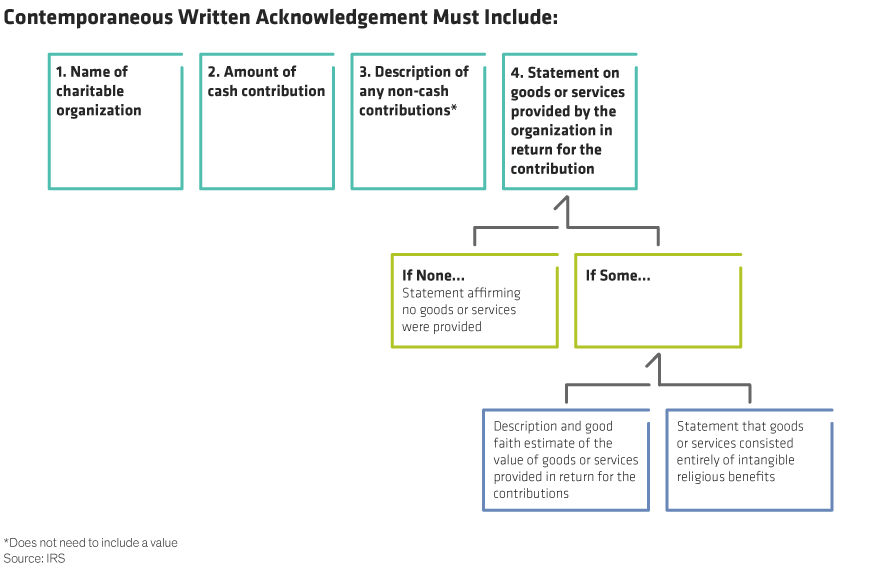

Contemporaneous written acknowledgement: Gifts of cash or property with a value of $250 or more require the donor to have “contemporaneous written acknowledgement” from the charitable organization prior to when the donor’s tax return is filed or the due date, including extensions, if earlier. Acknowledgements need to include specific criteria and even minor omissions can result in the complete loss of an income tax deduction (Display).

These rules also apply to private foundations, even when the donor is the sole officer or trustee of the foundation. In this case, the donor would, as the foundation’s trustee or officer, give contemporaneous written acknowledgement to him or herself. Charitable remainder trusts, however, are not required to follow these rules.

-

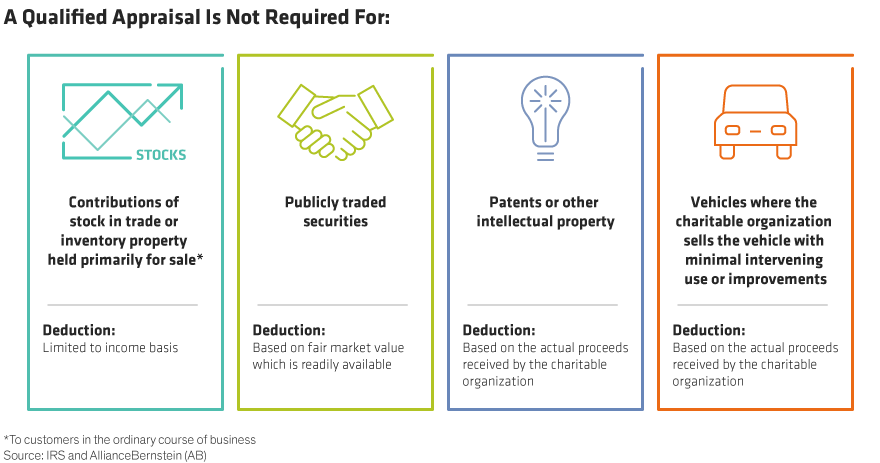

Appraisal requirements: Some gifts require appraisals, while others do not (Display). Property valued in excess of $5,000, for instance, must have a qualified appraisal.* In determining the $5,000 threshold, all “similar items of property” for which an income tax charitable deduction is claimed within the same taxable year—whether or not the property is donated to the same charity—must be aggregated.

The appraisal must be for no earlier than 60 days before the date of the contribution and no later than the due date including extensions of the return on which the charitable deduction is claimed.**

Benefit Today to Give More Tomorrow

Donations provide the fuel for charitable organizations around the world. But while you’re doing your part to help these organizations reach their vision and fulfill their mission, you should also make sure that you’re getting the most out of your philanthropic gifts. Because the more you benefit today, the more you’ll have to give in the future.

*Contributions of property in excess of $500,000 that also require a qualified appraisal require the donor to attach the qualified appraisal to the tax return.

**The requirements for a qualified appraisal are extensive. A donor who is interested in making a charitable gift should consult with tax and legal counsel to make sure appropriate appraisals are obtained, if necessary. Bernstein does not provide tax or legal advice.

The views expressed herein do not constitute, and should not be considered to be, legal or tax advice. The tax rules are complicated, and their impact on a particular individual may differ depending on the individual’s specific circumstances. Please consult with your legal or tax advisor regarding your specific situation.