The era of ultralow interest rates may be over. This could burst the safety bubble in equities—and create new opportunities in stocks that have been out of favor for a long time.

Donald Trump always intended to shake things up by running for president. But even he may not have realized how his victory would make a profound impact on one of the most stubborn market trends in recent years.

Trump’s promises of a big fiscal boost for the US economy have provoked an accelerated rebound in US Treasury yields. By November 21, the 10-year US Treasury was yielding 2.3%, after having fallen as low as 1.4% in July. And the prospect of rising inflation is widely expected to prompt an interest-rate hike by the US Federal Reserve before year-end, with more to come next year. Yet the recent sell-off in global bonds is just the most visible effect of the post-election shift.

Tide Turning in Equities

For equity investors, a turn in deeper market undercurrents is accelerating. A sustained increase in interest rates would mark a sea change from the market environment of recent years, when a combination of ultralow rates and bursts of volatility fueled a flight to “safer” equities, which might be far less secure than widely believed.

With government bond yields so low, investors flocked to high-yielding equities that are considered bond proxies in sectors such as utilities, real estate and consumer staples. Valuations of such stocks were inflated dramatically, as the explosive growth of passive vehicles pumped money into them indiscriminately.

Even before the US election, there were already clear signs that the safety trade had gone too far and was starting to reverse. Since the election, this trend has accelerated, as the 20% of global stocks with the lowest beta characteristics underperformed the market by 3.9%, amid weak performance in sectors such as utilities and consumer staples.

Two Scenarios as Rates Rise

There are two broad scenarios that can be expected in a rising-rate environment, in our view. First, the sell-off of bonds could lead to a shift toward equities, which could push the markets up broadly and fuel a beta rally. But we believe that this is only a small part of what is likely to unfold.

The second scenario would be a sustained rotation from “safety stocks” toward more cyclical equities. In other words, recent signs of a reversal in returns of safety stocks could turn into a full-blown stampede away from the crowded trades in these sectors.

There are good reasons to think that the safety bubble has burst. As safety stocks advanced broadly, fueled by flows into ETFs, investors weren’t really paying attention to their underlying business fundamentals. Now, a rotation toward more cyclical sectors could lead to a wholesale retreat from stocks that are highly correlated with bond yields.

What Should Investors Do?

If this trend accelerates, what should investors do? The first thing is to take a wider view of equity markets as the safety sell-off unfolds. When market bubbles rupture, it may feel as though equities as a whole are risky. But in fact, the effects can be complex. For example, when dot-com stocks crashed in 2000, “old economy” sectors such as industrials and energy did well, while value stocks in particular outperformed the broad market by a wide margin. In our view, it is more important than ever to use in-depth company research to identify the winners and the losers from changes in taxes and regulation. And, more broadly, three approaches to the market look particularly appealing and could deliver results in a broad shift away from safety:

-

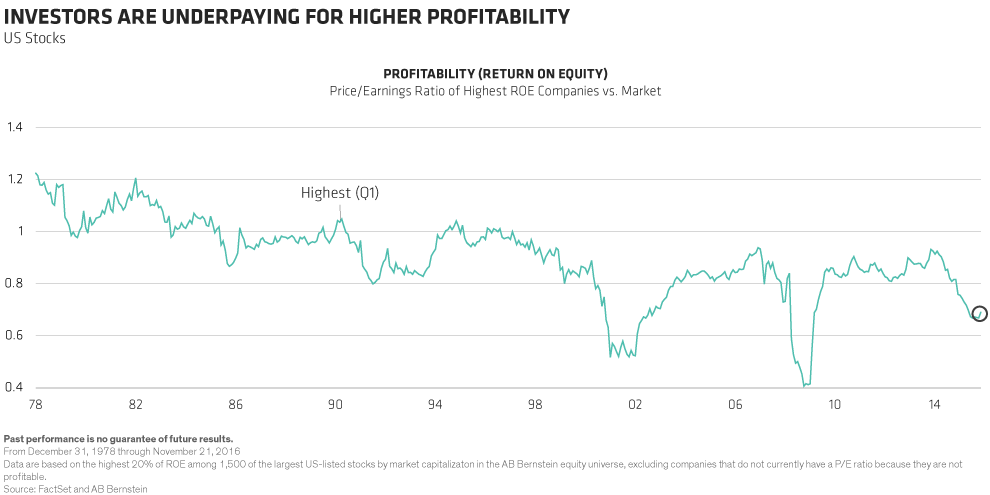

Focus on superior growth—Stocks of companies that are capable of growing their businesses thanks to competitive advantages, favorable industry trends and excellent management capabilities should do well, in our view. Signs that a Trump administration will promote a repatriation of earnings from overseas are an added bonus for some US growth companies (for example in the healthcare sector) which may also benefit from a less aggressive approach to price regulation. And companies with high profitability continue to trade at unusually attractive valuations relative to the market (Display).

-

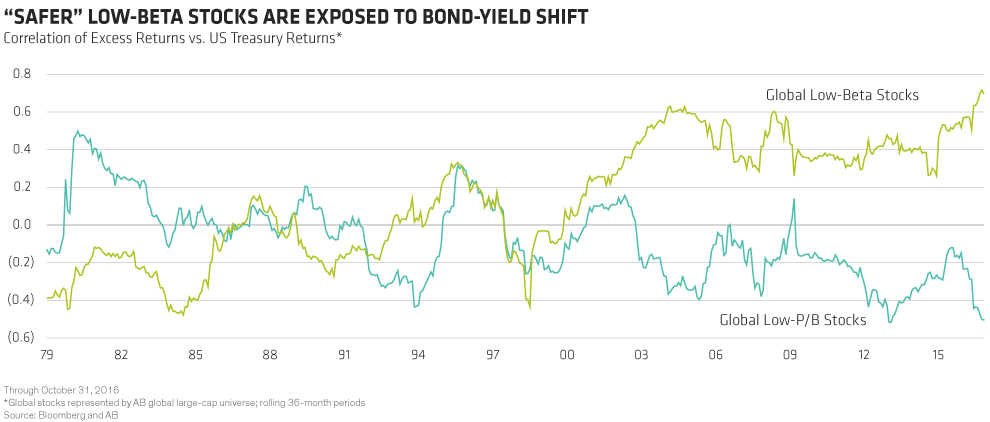

Capturing deep value—In recent years, the preference for safety has led investors to shun the cheapest stocks on the market, including those which offer promising recovery potential. And returns of the cheapest stocks by price to book value (P/B) show little correlation to bond yields, while “safer” low-beta stocks are vulnerable to a change in direction of rates (Display). Value stocks had already started to rebound in the third quarter, and could continue to recover, not least because many cheaper areas of the market—notably bank stocks—should benefit from rising interest rates.

-

Thoughtful downside protection—Even as safety sells off, it’s still important to think about downside protection. Given the uncertainties about the direction of the new US administration and how its economic policies will affect different industries and companies, there’s likely to be plenty of volatility ahead. Equity strategies that target downside protection, but use an active approach to focus on quality businesses and avoid expensive parts of the market, can be effective at mitigating risk and smoothing long-term return patterns.

Many investors may be rattled if the safety trade continues to unwind. And the rising uncertainty about how the policies of a Trump administration will affect the US and global economies, as well as interest rates and markets, will be unsettling for some time to come.

In this type of environment, we think active equity strategies are vital for equity investors. Selective and high-conviction approaches can steer around segments of the market that may underperform as crowded trades reverse, while focusing on the most promising opportunities as they unfold in a dynamic environment of heightened political risk, macroeconomic changes and a tectonic shift in the interest-rate landscape.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.