American workers might do better at investing for retirement if they could see good role models in action. What are the top habits and attitudes that unlock confidence? Our latest survey has some answers.

Capable Investors “Get It”

Our new survey of defined contribution (DC) plan participants uncovered three distinct personas defined by their attitudes toward investing:

-

Capable: confident investors

-

Eager: young, unaware participants

-

Conservative: cautious savers

From their answers to a series of 14 questions, we found that each group holds relatively distinct financial attitudes, perspectives and levels of knowledge. Only one group—Capable—appears headed in the right retirement direction.

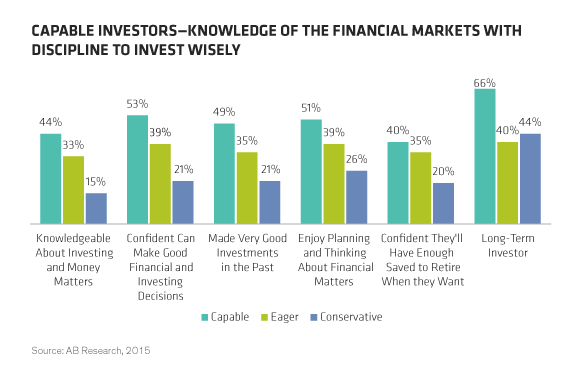

That direction includes the realization that you need to invest for retirement, not just save. Capables get that. More than the other two personas, Capables feel more knowledgeable and confident at being long-term investors (Display 1). When we asked Capables about selecting investments for their contributions, 70% said they’d be comfortable doing it themselves; less than half of the other two groups felt that way. Only Capables have a strong majority who feel confident about selecting a strategy that can generate lifetime income once they retire (60% versus roughly 40% for Eagers and Conservatives).

Higher Financial Literacy, Higher Contribution Rates

As a group, Capables did the best on our financial literacy quiz: Nearly 60% got six or more correct answers (out of eight). They typically have more household and DC plan assets than the other personas, and they have about three times as much savings outside the plan.

What’s the most notable difference with Capables? On average, their contribution rate to their DC plan is two full percentage points higher than that of the other groups (8% vs. 6%). Over time, that makes a huge difference.

A Curious Relationship with Target-Date Funds

Nearly one-third of Capables invest in target-date funds—in line with our overall survey results. But nearly one-fourth of those Capables invest 100% of their assets in target-date funds. That’s far more than in the other two groups and much more aligned with the strategic concept of target-date funds.

Capables are also more aware of their target-date usage: only 16% said they don’t know whether or not they use one. That’s much lower than the 27% of Eagers and 25% of Conservatives that were unaware.

Capables are the most independent and savvy group. Those who invest in a target-date fund most frequently stated that it keeps them appropriately invested as they save for retirement—and in retirement. Capables who don’t invest in target-date funds cited two big reasons. First, they like to be in control of their investment strategy, and feel that target-date funds take that control away (39%). And second, they think they can do a better job building their wealth than a target-date fund (40%). Also, if automatically enrolled, this group is far more likely to opt out.

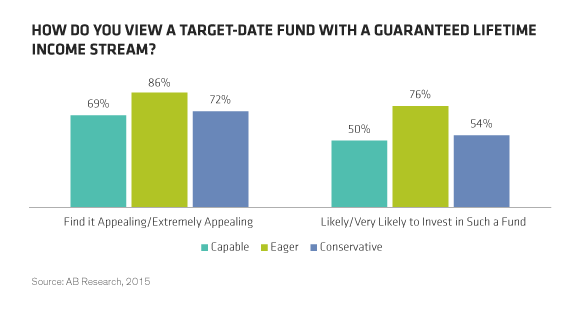

With their better planning, saving and confidence levels, it makes sense that these independent investors show a slightly lower interest in target-date funds with a guaranteed lifetime income component (Display 2).

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

"Target date" in a fund's name refers to the approximate year when a plan participant expects to retire and begin withdrawing from his or her account. Target-date funds gradually adjust their asset allocation, lowering risk as a participant nears retirement. Investments in target-date funds are not guaranteed against loss of principal at any time, and account values can be more or less than the original amount invested—including at the time of the fund's target date. Also, investing in target-date funds does not guarantee sufficient income in retirement.