US stocks continue to pose big questions for investors. After nine years of strong gains, concerns about market conditions are rife. But we think US stocks are more attractive than perceived for three main reasons.

The skepticism is understandable. From April 2009 through June 2018, the S&P 500 Index rose by an annualized 16.6%, the longest bull run in postwar history. Equities have been powered by steady earnings growth and the US Federal Reserve’s quantitative easing policies, which have kept rates down and propped up valuations. Perhaps the good times are about to end.

But in fact, US stocks look resilient from three perspectives: Market fundamentals are solid. Technical forces are supportive. And even stock valuations—a lingering concern—are relatively attractive today.

1. Fundamentals: Economic Growth and Strong Earnings

Equity market performance is always tied to macroeconomic growth. In 2017, stocks performed well globally amid strong, synchronized GDP gains around the world. But developed economies diverged in 2018. In the six largest economies outside the US, GDP growth has decelerated, whereas in the US, the growth rate is expected to rise, from 2.3% last year to over 3% in 2018. In the second quarter, US real growth surged by 4%, firing on almost all cylinders and fueled by the December 2017 tax reform, which helped boost corporate profits and is triggering positive second- and third-order effects. As a result, the ISM index, a leading US growth indicator, continues to point to further economic momentum.

The robust economy is supporting revenues and earnings for US companies. Earnings are expected to advance by 23% year over year in 2018, according to consensus estimates. Many analysts estimate that tax reform is responsible for about a third of earnings growth as well as much of the upward earnings revisions early in the year. Yet since April, earnings revisions have been driven more by strong business fundamentals. Indeed, aggregate year-over-year revenue growth reached 9% in the second quarter of 2018. That’s the highest since the global financial crisis, and suggests that business is booming for US firms.

Will the “Sugar Rush” End?

Earnings growth is a consistent signal for strong equity returns. Since 1990, when earnings growth for S&P 500 companies exceeded 10%, the index has returned 16% on average, and has never been negative.

But what happens after the “sugar rush” growth from tax reform fades? In our view, US equities can still deliver positive returns after quarterly profit growth peaks. In the past, stock returns decelerated sharply—but remained positive—long after earnings growth peaked (Display, left). Today, consensus estimates still expect earnings to exceed 10% in 2019, which signaled strong stock returns in the past (Display, right).

2. Technical Support: The Buyback Boost

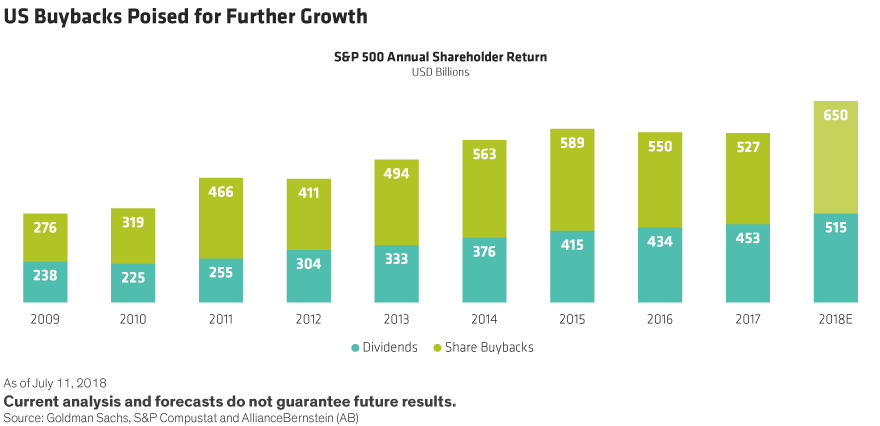

Equity returns should also enjoy support from the flood of corporate share buybacks. US companies have been incentivized to reward investors with buybacks, which are more tax efficient than dividends. Over the last decade, net share repurchases by US companies have nearly tripled, to an expected US$650 billion in 2018 (Display). In the past, companies typically bought back shares to support their stock when management thought it was too cheap. Today, buybacks are a routine method of increasing shareholder value.

Corporate buybacks are like a private sector QE program that doesn’t need to be unwound. Buybacks translate into expected net inflows of $500—$600 billion, which should more than offset any selling by mutual funds or institutional investors. Buyback authorizations have already risen sharply as US multinationals, led by technology and healthcare firms, take advantage of the tax benefits to repatriate cash from overseas. Banks are also returning more capital after good results in stress tests have freed some of their capital up.

3. Valuations: Concerns Have Eased

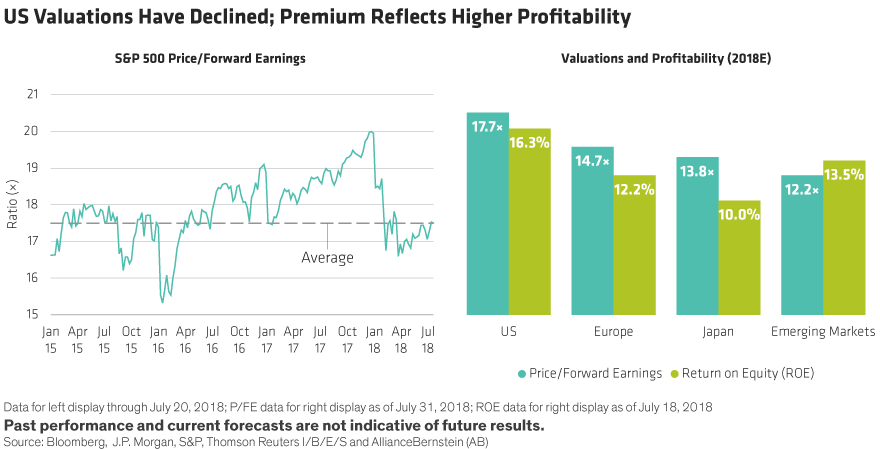

These benefits have long been overshadowed by concerns about US equity valuations. But now, the S&P 500’s price to forward earnings has fallen back to its 20-year median. The market correction in the first quarter of 2018 compressed the P/E from 19x to 16.7x in the second quarter—the most attractive level in three years (Display, left).

While US stock valuations are still higher than most other global markets, we believe the premium is justified (Display, right). US equities have delivered the best risk-adjusted returns compared with any other market since the global financial crisis. What’s more, American companies are focused on shareholder returns and balance-sheet efficiency, and as a group often offer higher quality and profitability than their peers in other regions.

Of course, there are plenty of risks today, from trade wars to rising rates. That’s why it’s important to take a highly selective approach. Investors in US equities should be wary of the most expensive pockets of the market, including defensive sectors such as consumer staples and utilities. The best way to capture the opportunity, in our view, is through focused portfolios that target individual stocks of companies with high-quality businesses and exposure to long-term growth trends. While markets may be volatile, we think US stocks have enough staying power to defy the skeptics and deliver solid returns for investors with a long-term horizon.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time.