Investors in value stocks have always been contrarian thinkers. But never as much as today, amid growing challenges to the investing style after a decade of underperformance and a painful 2020. To be a dedicated value investor in 2021 requires swimming against a wave of popularity for growth stocks and defying performance headwinds of historic proportions.

Critics of value investing have plenty of ammunition. Perhaps market conditions in the 21st century have created a permanent advantage for growth companies. Maybe investors’ behavioral biases, which trigger opportunities in companies facing controversy, no longer drive mispricing anomalies in misunderstood stocks. Some traditional value metrics don’t seem to work anymore. And with interest rates still near historic lows, the hurdles to a value winning streak look especially high.

But writing off value investing today is a mistake, in our view. This is not simply because return patterns shifted in value’s favor during the fourth quarter of 2020, providing a glimpse of the rebound potential. Rather, we believe that a continuation of the powerful forces that have driven the value-growth divide in recent years is untenable. In fact, COVID-19 has produced the ultimate value controversy, severely punishing many companies that are struggling with uncertain long-term recovery prospects.

By the end of 2020, value stocks were left trading at a historic discount compared to growth stocks. Based on price/forward earnings, the MSCI World Value Index was 53% cheaper than the MSCI World Growth Index. Near-record discounts persist in value stocks across a wide range of industries and regions. As a result, we believe that an unprecedented value opportunity now prevails across sectors, industries and regions.

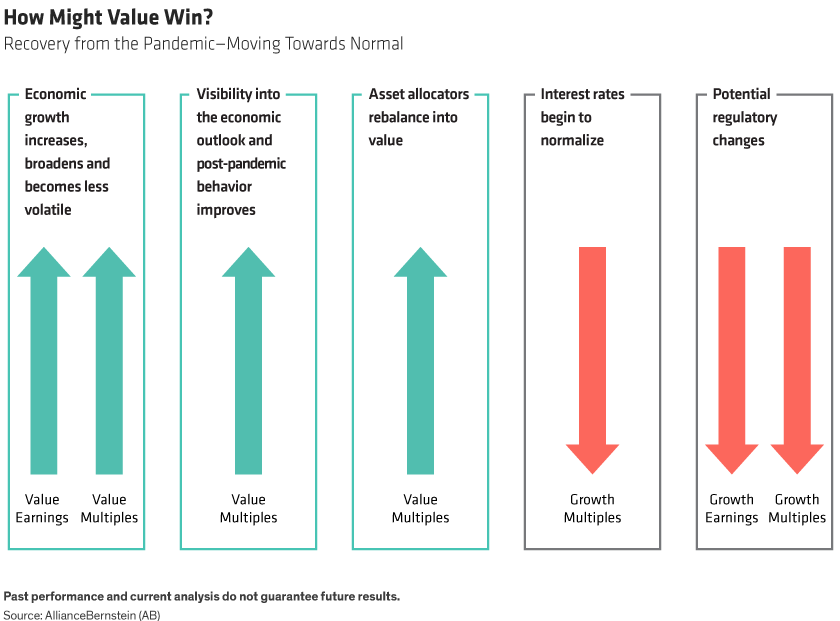

In our view, the dramatic effects of the pandemic may be a catalyst for change, as five key developments (

Display) could foster an unwinding of the extreme divergence of value and growth stock valuations in the coming years.

To gauge the opportunity, we will analyze the scale and causes of the extreme dislocation in equity valuations from several perspectives. By determining what it would take for value stocks to stage a sustainable comeback, we can then evaluate the potential payoff for investors who are willing to initiate, expand or rebalance allocations to value stocks today.

*Based on expected nominal US GDP growth of 4.0% in 2023 and a reversion of the value versus growth discount from 53% at the end of 2020 to 32% on December 31, 2022.