Stock market volatility is unusually low these days. Does that mean investors are complacent? We don’t think so. In fact, some risk indicators suggest market participants may be less relaxed than they seem.

There are plenty of things to worry about today, including stretched asset valuations, rising interest rates and political uncertainty. But investors don’t seem to be sweating any of them.

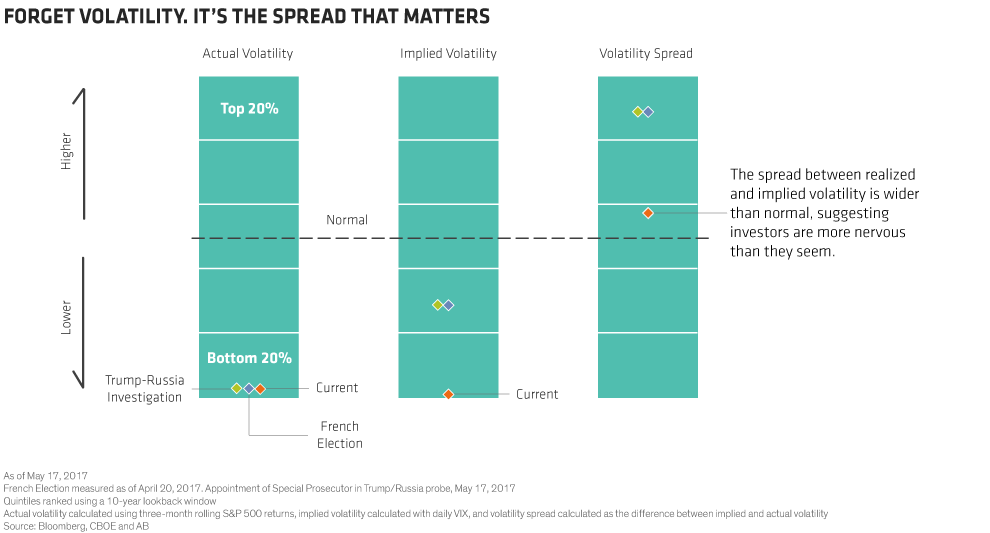

Actual US equity volatility is extremely low, judging from three-month rolling returns that measure how volatile S&P 500 stocks are. In fact, there have been just nine other three-month periods over the past quarter-century when actual volatility was lower than it is now.

Investors don’t seem to be expecting much volatility ahead in US stocks, either. The VIX, an index that captures the expected volatility priced into S&P 500 options, is also near all-time lows. Global stock market volatility—both actual and expected—has fallen too, though not as much.

A CHANGING MARKET REALITY

What gives? Are market participants denying reality?

The short answer is no. We’re actually seeing a changing reality for markets. Global economic conditions and policies are changing—and so are the issues investors focus on. US equities are a case in point.

For years after the global financial crisis, equity investors fixated on a few big macroeconomic and geopolitical issues. Would central banks keep loosening monetary policy to fight off deflation? Would they unwittingly stoke higher prices instead? Would the euro survive? The prevailing answer on a given day determined whether investors bought or sold, causing most S&P 500 stocks to rise or fall together.

Things are different now. The world economy is in better shape, the euro appears to be sticking around and markets are moving away from relying solely on central bank policy. Individual investors have shifted their focus to individual company fundamentals and stock-specific drivers. The result: lower correlation among individual stocks, and less volatility.

WHEN VOLATILITY SPIKES

Despite the stronger focus on fundamentals, the market isn’t asleep at the switch when it comes to potential roadblocks.

When investors have sensed danger, they’ve reacted swiftly. The VIX spiked before the first round of France’s presidential election. But when pro–European Union candidate Emmanuel Macron won the presidency in the second round, calm was restored (Display).

Last week, the VIX had its biggest one-day rise since September after the US Department of Justice appointed a special counsel to investigate the Trump campaign’s ties to Russia. Investors worried that the probe might derail Trump’s economic agenda. The result: the focus shifted briefly to the sort of broad market risk that prevailed in the postcrisis years.

THE MARKET’S MORE ANXIOUS THAN YOU THINK

So how do you invest in this environment without being whipsawed when the market shifts back and forth between emotion and fundamentals?

We think the best way is to look at multiple market signals—because not all volatility metrics tell the same story. In the display above, the difference between actual and implied volatility is above its average over the last 10 years. This volatility spread indicates that plenty of investors are willing to pay for protection against market downturns. It also signals that the market isn’t as complacent as the VIX alone suggests it is.

Changes in this volatility spread can also be a useful contrarian signal. Why? Simply because a widening spread indicates that investors are more nervous. Many then overreact—and overpay for protection. This can be a signal of potential opportunity in the stock markets—a time to take on more risk by increasing exposure to equities.

A narrow spread, on the other hand, can be a warning sign—and a reason to reduce exposure. As we pointed out in an earlier blog, market tranquility isn’t necessarily a reason to load up on risk.

LOOKING BEYOND RISK

Of course, looking at volatility alone isn’t enough. Other signals, such as equity momentum or credit conditions, can give investors a more holistic view of market risk.

The outlook for returns is important, too, and it’s been trending lower lately. This is partly because stocks are expensive—particularly in the US—and inflation pressures are building. As a result, investors might want to shift their focus to UK and European stocks.

Managing volatility and building a risk-aware portfolio are complex challenges. In our view, expanding their view of risk—and looking beyond risk alone—gives investors their best chance of success.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.