|

Concentrated Global Growth: Concentrating on Quality Businesses

|

|

Global Core: Preparing for Unknown Unknowns

|

|

CRTs Price Dislocation: 2020 isn't 2008

April 27, 2020

CRTs have been a big headline so far this year. Mike Canter and Peter Cornax explain why 2020’s market turbulence isn’t a repeat of what we saw in 2008—and why we believe CRTs continue to possess solid fundamentals at attractive valuations.

|

|

Italian Sovereign Debt: How to Avoid Being Junked

April 30, 2020

Italy’s credit rating is under pressure. In an unscheduled downgrade on April 28, Fitch lowered the country’s sovereign rating to BBB-minus, just a notch above junk.

|

|

Corporate Debt: Defaults, Downgrades and Fallen Angels

April 30, 2020

Coronavirus-led economic uncertainty is forcing downgrades, defaults and fallen angels. Could this spell opportunity for credit investors?

|

|

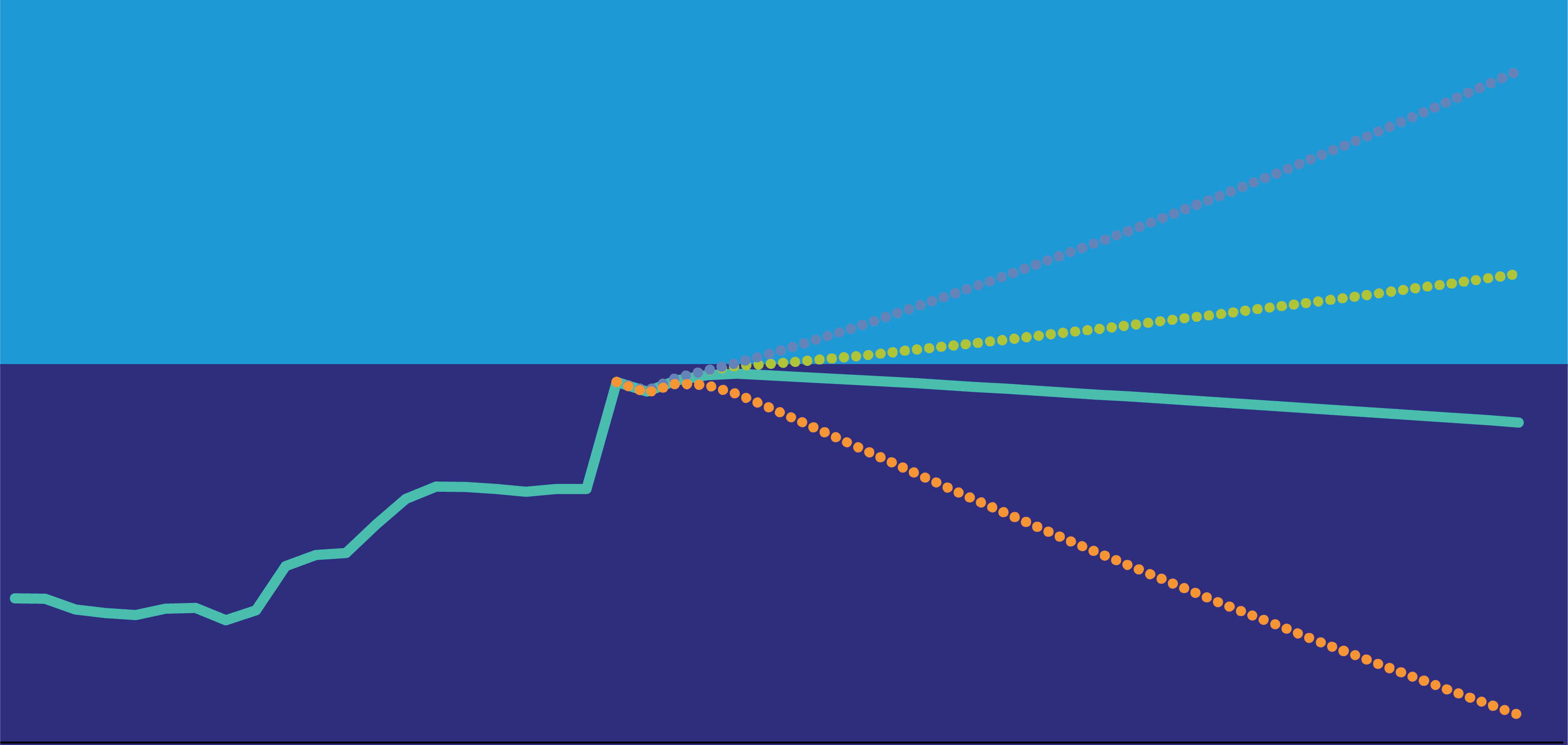

Managing Risk Models in the Coronavirus Crisis

April 27, 2020

The spread of the COVID-19 virus has blindsided conventional risk models. By understanding what went wrong, investors can develop a more forward-looking approach to risk management that considers multiple scenarios for a highly uncertain market environment.

|

|

Introduction to Asia Credit

April 20, 2020

Arnaud Mounier, Head of Fixed Income Business Development—APAC, and Jenny Zeng, Co-Head of Asia-Pacific Fixed Income, examine how Asia credit’s characteristics and fundamentals could make it a more resilient, lower-beta credit play for insurers. That may be a compelling proposition in an environment where being selective is the best course of action.

|

|

Flexibility Needed with Fallen Angels

April 13, 2020

AB’s analysis suggests that 8.5% of investment-grade issuers are now, based on their fundamentals, at risk of migration to high yield. According to Peter Cornax, Senior Insurance Investment Strategist & Portfolio Manager, that means insurers should consider being more flexible in holding fallen angels in their credit allocations to avoid being forced sellers.

|

|

Economic Perspectives

|

|

Credit Is Attractive, Though Risk Remains

April 6, 2020

Market dislocations created by the turmoil have made investment-grade credit substantially more attractive, Peter Cornax, Senior Insurance Investment Strategist & Portfolio Manager, explains. Investors still need to navigate risks, but selectively providing liquidity to markets creates opportunities to take advantage of higher yield spreads.

|

|

Policy Progress Reinforces Economy, Markets

March 30, 2020

Peter Cornax, Senior Insurance Investment Strategist & Portfolio Manager, talks through the policy actions taken to support liquidity and make markets more likely to be driven by fundamentals than technical factors. He also looks at the implications for high-yield exposure.

|

|

Insurance Update: The Incoming Challenge

March 23, 2020

It was another wild week for investors, and policymakers stepped in to provide support to both economies and markets. These measures included a massive $2 trillion fiscal stimulus bill finalized by the US Congress on Friday. Our experts put the latest news in context. Eric Winograd, AB’s US economist, gives his perspective on how the CARES Act advances progress in the fiscal channel—and how it demonstrates policymakers’ willingness to act. He also updates last weeks’ developments in the public-health and monetary-policy channels. Peter Cornax, Senior Insurance Investment Strategist & Portfolio Manager, talks through the policy actions taken to support liquidity and make markets more likely to be driven by fundamentals. He also looks at the implications for high-yield exposure.

|