From nuclear tensions with North Korea to turmoil on the streets of Charlottesville, political risks have been hovering over equity markets again. We think investors should be on alert for a potential resurgence of volatility.

Volatility can’t stay low forever. Over the past year, US and global equity market volatility has fallen to the lowest levels in the past decade. Many investors have been concerned that such extremely low volatility might indicate that a potential reversal could be dramatic.

Complacency Breeds Imbalances

These are reasonable concerns. Low volatility often induces complacency, which can create market imbalances that snap back violently. For example, when volatility is extremely low, investors may think that risky assets are less risky than they really are. This perception fuels an inflation of prices that may result in a sharp correction.

Of course, there are plenty of good reasons for low volatility today. Global economic growth is continuing at a moderate pace. Inflation is generally benign. And even concerns about rising rates may be a bit overdone, given that the US Federal Reserve is likely to raise rates gradually.

However, it’s been a very long time since equity markets have experienced a major downturn. We haven’t seen the S&P 500 fall by more than 10% in 79 weeks. On average, the US market has fallen by that much every 33 weeks since 1928.

It’s Nearly Impossible to Time the Markets

None of this means that a significant downturn is definitely on the horizon. Volatility levels, like valuations, can’t tell you when a correction will occur. And even skillful investors who closely monitor macroeconomic signals, market risks and political hazards rarely predict the trigger for a change in sentiment and an inflection point in the market.

That’s why investors need to prepare now. We believe that lower-volatility equity portfolios can play an important role in cushioning the downside. But there’s a catch: the recent low volatility has coincided with a period of extremely low interest rates. When rates rise, many lower-beta stocks, which often behave like bond proxies, are likely to underperform (Display).

Passive Preferences Amplify Rate Risks

Interest-rate risks are being magnified by technological changes in markets. There’s a lot of money in quantitative strategies that systematically react to shifts in volatility, which could accentuate volatility when it surfaces. And the proliferation of exchange-traded funds (ETFs) has led to an uneven distribution of different types of stocks, as people buy passive vehicles to gain exposure to certain types of stocks.

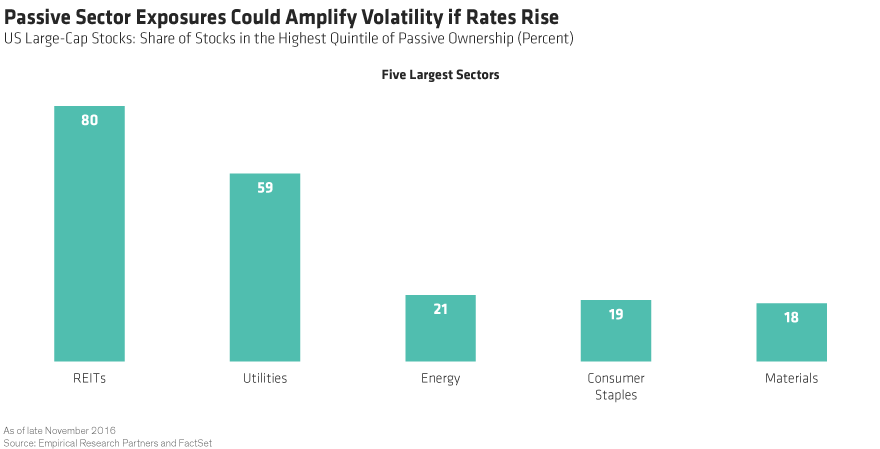

In the US, real estate investment trusts (REITs) and utility stocks are more likely to be owned in passive investment vehicles than are stocks in other sectors (Display). That’s because REITs and utilities are lower-risk stocks, and passive portfolios are often designed to provide investors with prepackaged exposure to lower volatility. Yet these stocks are typically also highly sensitive to interest rates. So if rates rise, causing these stocks suddenly to go out of favor and there’s a rush to the exits, volatility could be amplified—especially given the prominence of algorithmic trading today in which computerized prompts could generate mass selling. Indeed, after President Trump’s election last November, utility stocks and REITs fell sharply as interest rates rose.

Prepare With Care for Potential Volatility

These conditions warrant selectivity. In our view, investors should target companies that combine stable, low-beta characteristics with attractive valuations and strong cash flows. Stocks of companies with these characteristics are capable of supporting portfolio returns even if falling markets coincide with rising interest rates. Our research has found that adding a “stability bucket” to an investor’s overall portfolio can provide the downside defenses investors need in the long term, while still capturing equity upside potential in rising markets.

Don’t wait for a clear signal to indicate when to reduce risk. Recent events around the world serve as a reminder that volatility can spike at any time. Getting out of the market at the wrong time can be just as damaging to long-term returns as not being in the market when a rebound materializes. Deploying a thoughtful low-volatility equity strategy can help investors stay in the market through turbulence, reduce the damage in a downturn and deliver stronger gains during a rebound.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.