China is rapidly becoming a trendsetter in many digitally driven industries. This is turning conventional research methodology on its head. Investors should look to China to discover where technology and retail markets around the world are headed.

For decades, investors studied developed-world trends to forecast the future in emerging markets. That approach now looks obsolete. In industries ranging from e-commerce to advertising, China has leapfrogged its developed-market peers. Companies and investors in the West should pay close attention.

E-commerce vs. Brick and Mortar

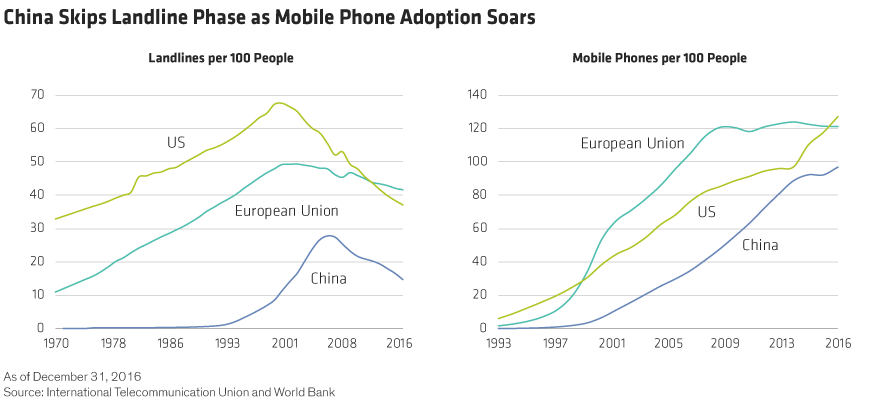

Mobile trends are at the heart of the new world order. China’s landline telephony infrastructure never developed as much as that in the US or Europe (Display, left). Yet mobile phone penetration in China has almost caught up with that in the West (Display, right). Meanwhile, brick-and-mortar retail is very underdeveloped in China. This difference in infrastructure is the source of China’s edge.

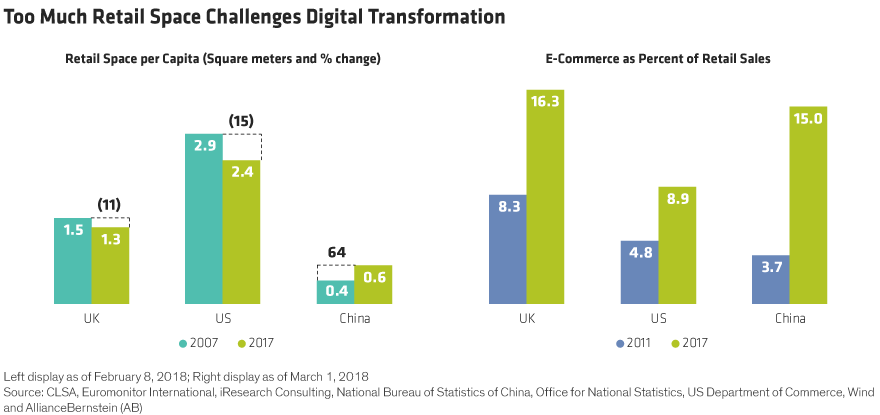

For developed countries, the shift to e-commerce is often painful. It requires the retail sector to unwind huge networks of stores and strike the right balance between physical and digital sales. For China, it’s much easier, since companies don’t have to dismantle nearly as much physical store space to take the digital leap (Display below, left). For example, the Alibaba Group has been building out its Hema supermarket chain, in which the stores are optimized for online delivery. In contrast, Amazon recently purchased Whole Foods and will likely need to retrofit the stores meaningfully.

What’s really going on here? Instead of reconfiguring brick-and-mortar infrastructures, Chinese companies can directly build efficient e-commerce platforms designed for a digital world. As a result, Chinese e-commerce now accounts for about 15% of retail sales, versus 8.9% in the US (Display above, right).

Mobile Payments

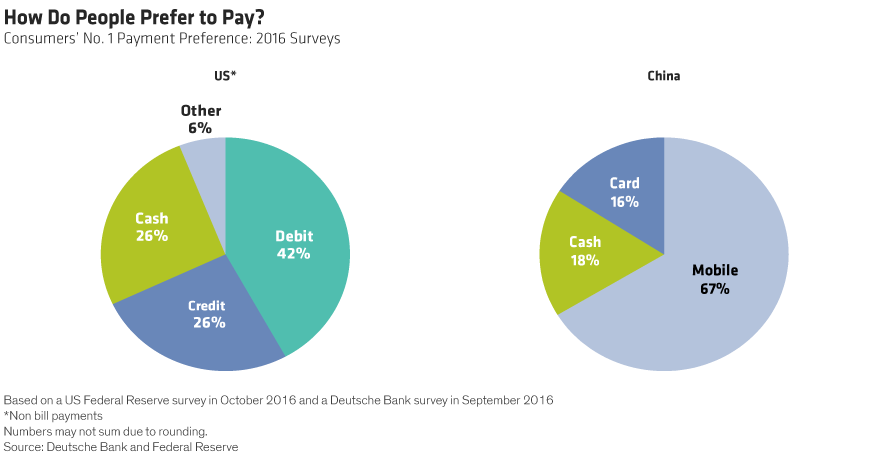

The Chinese e-commerce boom is fueled in part by a payment revolution. Chinese consumers overwhelmingly prefer to pay via mobile devices (Display). Here, too, Chinese consumers and companies have leapfrogged their US peers. And again, it’s all about infrastructures.

China has 16.3 bank branches per 100,000 adults, compared with more than 32 in the US and almost 24 in Europe. Similarly, credit cards never made it into as many Chinese wallets. This explains why Chinese consumers have embraced mobile payments for everything from clothing to fast food.

KFC is a case in point. By the end of 2017, 53% of its sales in China were made with mobile payments. In fact, one premium KFC store in Hangzhou allows customers to pay using facial recognition.

Media and Advertising

Similar trends are evolving in media consumption. In China, the rapid shift toward mobile has powered a digital advertising boom. About two-thirds of all advertising spend in China is dedicated to digital platforms, compared with 40% in the US. By 2020, that’s expected to exceed 70%, according to our research, based on data from eMarketer.

Televisions are no longer the centerpiece of media consumption. Today, smartphones provide advertisers with mountains of data about consumers. Returns on advertising investments can be measured more directly. And new players, equipped with more accurate data, are disrupting the way advertisers reach consumers. Through its lead in digital advertising, China is at the forefront of using consumer data as a new currency.

Artificial Intelligence and Face Recognition

Some Chinese companies are testing new technologies in bold ways. TAL Education uses distance learning to teach some of its students and is experimenting with artificial intelligence (AI) technology to help teach students. Results suggest that these programs can keep kids more focused than real teachers. The company is also developing facial-recognition technologies to gauge the level of concentration of the students. If a student isn’t focused, parents will be automatically notified.

Megvii Technology, a Chinese facial-recognition technology company, is applying its technology in areas ranging from retail to security. Facial recognition is used to identify a VIP when he or she enters the store. Police applications include security cameras in shopping malls to catch criminals on the run. China is quickly turning science fiction into reality.

Research Lessons

In many areas, China is several years ahead of the developed world in embracing new technologies. Studying how China adopts technology is like looking into a crystal ball that provides a glimpse at what might happen in the US, Europe and Japan in the future. Investors who understand the Chinese landscape can gain a double advantage: the ability to identify companies with strong return potential in China and to find developed-market stocks that are ahead of the curve.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.