As the US economy continues to reopen, economic growth is accelerating in line with our above-consensus forecasts. This rebound has caused some investors to start dimensioning possible downside risks to the outlook. One area drawing more attention lately is looming change to corporate tax policy.

The Biden administration’s proposed infrastructure improvement plan, The American Jobs Plan, calls for rolling back some parts of the 2017 corporate tax rate cuts passed as part of the Tax Cuts and Jobs Act, along with enacting other measures to revise the corporate tax regime.

The initial proposal would raise the corporate tax rate from 21% to 28%. Of course, that’s subject to Congressional negotiation, which seems all but certain to produce a rate that remains well below the 35% rate in effect before the 2017 cuts. Some investors are worried that higher corporate tax rates would ultimately be a drag on economic growth.

We think it’s more likely that the tax hike will impact financial markets rather than the real economy.

2017 Tax Cuts Produced No Upswing in Business Investment

One sensible way to gauge the potential impact of a corporate tax hike is to take a look back at the impact of the 2017 tax cut, which dropped the rate from 35% to 21%.

The key variable is business investment: in theory, that tax-rate reduction should have boosted business investment, in turn putting extra muscle behind the US economy. If that theory proved true, it would stand to reason that raising the corporate tax rate should curtail business investment and slow growth.

However, the data seem to indicate that the 2017 corporate tax cut didn’t boost business investment much. Investment did expand in the ensuing quarters, but only gradually—and largely in line with its pre-tax-cut trajectory. Because there was no visible upswing in the trend, we expect that a partial unwinding of the 2017 tax cut won’t substantially slow business investment.

Indeed, given our expectation of surging demand and robust growth, we expect business investment to increase even if tax hikes go through. Investment decisions are more about forward economic growth expectations than the tax code, after all.

Tax Hikes Could Curtail Share Buybacks

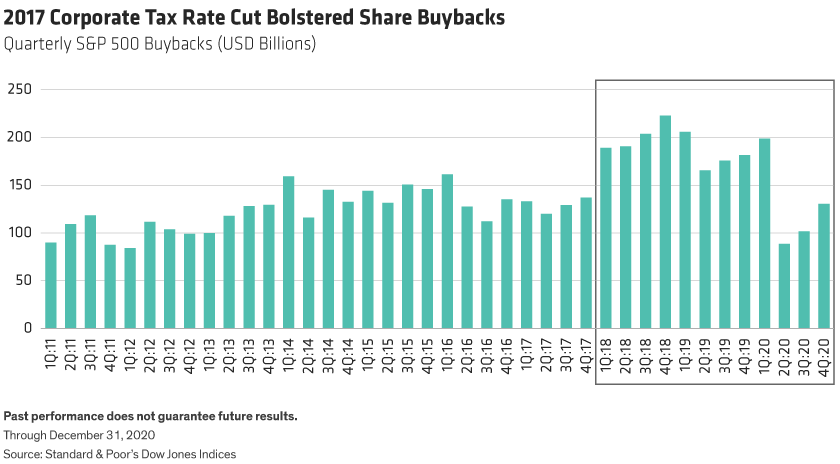

While we don’t expect potential changes to the tax code to disrupt business investment, higher tax rates could pose a headwind to financial markets. In the wake of the 2017 tax cuts, share buybacks surged to record highs for the next several quarters (Display), undoubtedly contributing to strong equity market returns the past few years.

With taxes going up, businesses are less likely to return money to shareholders. Does that mean stock markets will collapse? Not likely. We still believe that, over time, the stock market will broadly reflect the performance of the US economy.

So, lower buybacks might pose a headwind, but we don’t expect them to trigger a significant sell-off. However, given their role in driving returns in recent years, it’s a factor for investors to keep an eye on.

Eric Winograd is a Senior Economist at AllianceBernstein (AB).

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.