2018 started with the continuance of a 14-month market uptrend and extreme calm. Now with just a few days left in the year, we’ve seen a change: there’s been a resurgence in volatility and a market sell-off of almost 20% since the S&P 500 hit an all-time high in mid-September.* As we think ahead to 2019, we consider the factors that will influence the financial markets and answer questions on the minds of many investors.

Formulating our expectations

In forming our thoughts for next year, we gathered forecasts and perspectives from across our firm on the expected key market drivers for the next 12 months. Before we discuss these factors, it’s important to point out that our investment thesis does not change when we ring in a new year. Our expectations are continually formulated and adjusted based on a long-term time horizon; we do not invest nor do we base our strategic asset allocation on a one-year time frame. With that said, we do take into account short-term outlooks and may make tactical changes based on these beliefs.

Ringing in 2019

Our expectations for the global economy continue to be decelerating growth and more volatile financial markets. This viewpoint stems from continued, steady increases in inflation, modestly higher interest rates in the US, and further trade uncertainty. Let’s discuss each in turn.

Bracing for higher prices

When the economy is doing well, prices for finished goods, raw materials, and labor, among other things, tend to rise.

Concern about inflationary pressures has prompted the Federal Reserve to increase interest rates with the objective of staving off significant price inflation. This is a normal response to a strong economy. We forecast that US inflation will be around 2.25% by the end of 2019, which by itself is not worrisome, but likely will compel the Fed to continue to tighten somewhat.

Rate hikes forge ahead

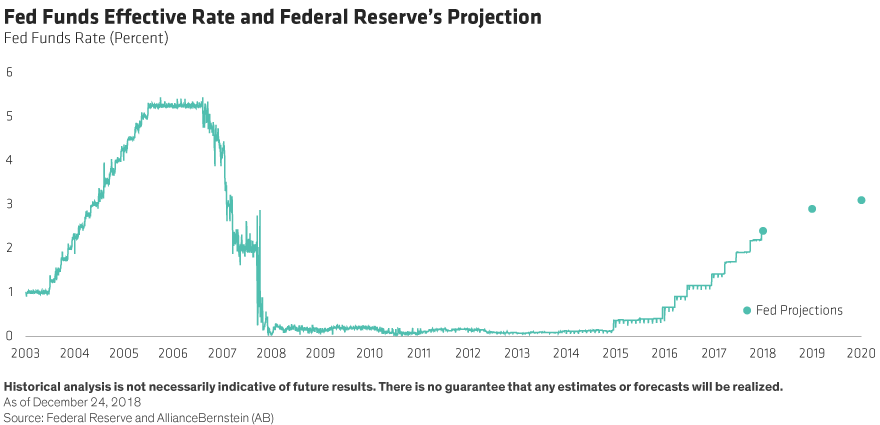

With inflation increasing at a moderate, yet steady rate, we expect that the Fed will stay on their rate hiking path (Display). We are forecasting two rate hikes in 2019, in line with the Fed’s comments from its December 19 meeting.

But this Fed action only targets short-term interest rates. We believe long-term rates will also rise next year. Today the 10-year Treasury is yielding around 2.8%* and we think it will move up to around 3.5% by the end of 2019.

These higher interest rates across the entire yield curve, in part, will tighten financial conditions in the US. While tighter financial conditions will hinder the ease with which transactions across businesses get done, we don’t believe they will be restrictive enough to push the US into recession— merely into slower growth. Our US GDP forecast for 2019 is 2%, down from the 2.5% that was expected in 2018.

Trade disputes persist

Despite the discussions at the G20 meeting that initially appeared fruitful, we believe investors should ready themselves for prolonged trade disruption. The uncertainty that accompanies this disruption will not ease any time soon, in our opinion. Why? In a word, populism.

Populism, as a political ideology, is gaining traction all over the world. This attitude should cause a turnabout from the globalization movement that characterized markets for the past few decades, as more and more countries restrict immigration, labor, and capital flows, while protecting key industries through trade and greater use of fiscal policy.

Corporations will no longer search for the cheapest or most efficient source of raw materials, labor, or transport worldwide. As a result, this loss of sourcing arbitrage will challenge profitability for many corporations.

Profit margins have expanded since the early 1990s, particularly for manufacturers—a big part of that was due to globalization and the ability to procure the lowest-cost provider of some good or service. With populism rising and the benefits of globalization past their peak, disruption to this framework should be diminishing profit margins.

So, what’s it all mean?

The confluence of higher inflation, rising rates, and trade tensions together with fading positive market drivers from this year will reduce earnings growth in the US next year from around 20% in 2018. There is a wide consensus on this point, with some expecting mid-single digits and others less optimistic.

Keep in mind, however, that the US economy and economies throughout the world are still solid and will continue to grow next year. While there are challenges, as there always are, the data do not suggest a recession on the horizon.

Returns for any short period, like 12 months, are impossible to forecast accurately with consistency, but the conditions we’ve laid out above lead us to conclude that financial markets should remain somewhat volatile. It’s in this environment that greater-than-normal diversification is warranted, patient investing is imperative, and thoughtful research is rewarded.

*Through 12/24/18

For more on trends in the economy, markets and asset allocation for long term investors, explore The Pulse, a Bernstein podcast series, and for additional thought leadership, check out the related blogs here.

The views expressed herein do not constitute research, investment advice, or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.