Corporate executives and other investors with very large holdings of a single stock can choose among several strategies to diversify their risk and defer or reduce taxes. The first question to ask is, What’s your goal?

If your company stock has outperformed during the bull market that began in 2009, your net worth may be concentrated in the stock of your current or recent employer. Since even the best stocks can sink, often for reasons no one anticipates, we think holders of company stock are well advised to protect their gains.

Here’s a brief review of the choices to consider, listed by the objective they can help you achieve. Your company may prohibit you from engaging in some of these strategies, so you’ll have to check on company rules, as well as consult your tax and financial advisors, before implementing them.

Want to sell now, but worry that the price will keep rising?

The simplest solution is to sell the position immediately and reinvest the proceeds in a diversified portfolio of stocks. Many investors hesitate, because they worry they’ll miss out on future gains. Various strategies for staged selling reduce the risk of selling too soon—or too late. In general, the upside and downside potential increases as the selling period is extended. Proceeds of both immediate and staged sales are subject to capital gains tax.

Want to diversify risk and defer taxes over the long term?

Consider an exchange fund. In this strategy, you contribute your concentrated stock position to the fund and receive exchange fund units in a portfolio that is typically 80% diversified equities and 20% illiquid real estate. The exchange is tax-free, but the contributed stock’s original cost basis is transferred to the exchange fund units. The fund is managed to an equity benchmark in a tax-sensitive manner, and may offer daily liquidity. Early withdrawal penalties may apply during the first several years, but people with income needs can often avoid these penalties by signing up for a systematic redemption plan.

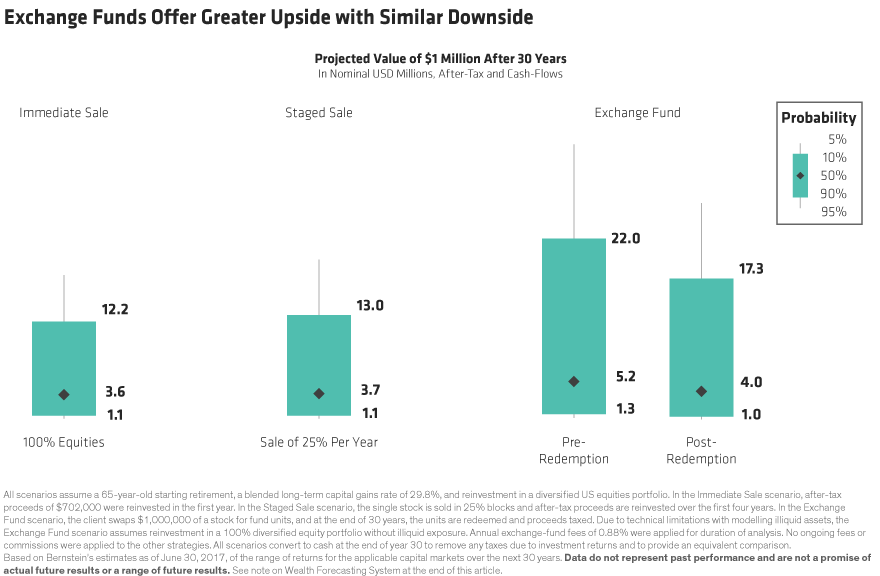

The Display shows our estimate of the range of potential outcomes for an exchange fund, compared to an immediate sale or a staged sale over four years, with the proceeds reinvested into a diversified stock portfolio. On an after-tax and post-redemption basis, the exchange fund provides higher wealth appreciation potential than either of the other strategies, and similar downside (Display). Why? Deferring taxes lets you invest more during the life of the fund, creating the greater upside potential, while the fund’s diversification limits downside.

Want to maximize your tax savings?

If you donate your appreciated shares to a charitable remainder trust that benefits a qualified charity, you’ll eliminate capital gains tax on the shares and get a valuable tax deduction. The charitable tax deduction is equal to the value of the stock donated, up to 30% of your adjusted gross income. If the value of the stock far exceeds your adjusted gross income, you could make annual contributions equal to the deductible limit.

Want to sell shares now but defer paying capital gains tax until next year, when you might have losses or deductions to offset them—or tax rates might be lower?

Prepaid variable forward contracts allow you to sell shares to a bank at a discount (e.g., 15%) of their current value for future delivery; the exact number of shares you ultimately deliver will depend on the stock price at settlement (hence the variable part of the name). Taxes are deferred until delivery, but still due.

Need to protect yourself for a short period, perhaps because the future of your company stock hinges on the success of a new product?

Hedge with options. Purchasing put options gives you the right, but not the obligation, to sell the stock at a specified exercise price before or when the options expire; this effectively places a floor on the stock price.

If you don’t like paying cash for the put purchase, you can use a collar: Selling calls with a higher exercise price to partly or fully fund the purchase of puts with a lower exercise price. A collar places a cap as well as a floor on the stock price. In effect, you give up some potential gains to protect yourself from potential losses.

Both approaches are useful, but they are typically expensive (in outright cash paid, or potential gains foregone), especially if they are implemented over longer periods of time. Option strategies also often require diligent monitoring to ensure that they remain effective.

Certain companies may prohibit corporate executives and other employees from engaging in some of the strategies mentioned in this article. The views expressed herein do not constitute, and should not be considered to be, legal or tax advice. The tax rules are complicated, and their impact on a particular individual may differ depending on the individual’s specific circumstances. Please consult with your legal or tax advisor regarding your specific situation.

The Bernstein Wealth Forecasting System seeks to help investors make prudent decisions by estimating the long-term results of potential strategies. It uses the Bernstein Capital Markets Engine to simulate 10,000 plausible paths of return for various combinations of portfolios, and for taxable accounts, it takes the investor’s tax rate into consideration.