Should companies encourage retiring employees to keep their assets in the DC plan? With regulators increasingly scrutinizing IRA sales, it’s a good time for firms to develop an organizational policy on this issue.

As baby boomers march into retirement, many workers are changing their minds on when to retire. The average retirement age in the US right now is roughly 63—workers who were teenagers when Beatlemania was in full swing.

But employees are increasingly working longer: retirement savings for most workers are low, more defined benefit (DB) plans are being frozen or eliminated, and full Social Security benefits don’t kick in until age 66—or age 67 for workers born after 1960.

In our latest survey of defined contribution (DC) plan sponsors, more than half of respondents (56%) say the average retirement age at their company has risen over the past five years. They also expect nearly one-fourth of employees (23%) to hold off on retiring until after age 67.

Help!

These trends are putting more pressure on DC plans to get sponsors more involved in participants’ DC account decisions when they retire.

When plan sponsors are asked about their organization’s philosophy on terminated or retired participants’ plan balances, the most common response (37%) is that participants should roll their assets over into an individual retirement account (IRA) or other qualified plan.

The next most-cited response from plan sponsors (28%) is that their company has no philosophy. But 18% of respondents feel participants should keep their money in the plan. Only 7% see taking a lump-sum distribution (cash-out) as the answer, while another 7% feel participants should buy an annuity.

Money (That’s What I Want)

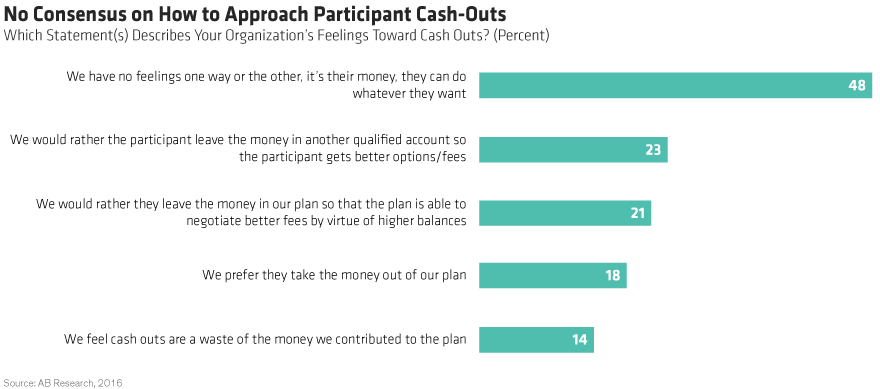

Most plan sponsors don’t think a cash-out is a good idea, but there’s no consensus on how to approach the issue with employees. Only half of our respondents’ organizations even track the percentage of participants who cash out. And nearly half (48%) feel that cash-outs are none of their business—the money belongs to the employees, and they can do whatever they want with it (Display).

But we’re seeing a growing level of concern on the part of plan sponsors: 23% say they’d prefer that participants put the assets in another qualified account. Nearly as many (21%) would rather have participants leave the money in the plan, because the plan can negotiate better fees since it has higher asset balances.

Interestingly, 14% of plan sponsors feel cash-outs are “a waste of the money we contributed to the plan.” That’s a bit harsh, considering that company match contributions are competitive table stakes for hiring and retaining employees—not simply a generous addition.

There are pros and cons to whether or not sponsors should encourage employees to keep assets in the plan. After all, plan sponsors face continued fiduciary liability and administration for those assets. But by keeping assets, plans may have more power to improve pricing.

This approach isn’t simply selfishness on the part of plan sponsors! A paternalistic attitude could save employees from paying higher fees they may get charged in other investing vehicles. Also, lump-sum cash distributions turn too many people into kids in a candy store.

In My Life

Given the growing interest in keeping assets of retiring participants in the plan, sponsors should revisit their default investment option to make sure it’s a strong solution both to and through retirement. They could take this opportunity to upgrade their target-date offering—exploring more diversified or customized glide paths, improving manager diversification with nonproprietary solutions, and potentially lowering fees by using collective investment trusts (CITs) as underlying investment vehicles.

Another in-plan variable could improve results: target-date funds that incorporate a guaranteed income stream for a participant’s life.

We asked sponsors of plans with $10 million or more in assets about these funds: 68% say they’re appealing or extremely appealing. But the funds are relatively new: almost one-third of sponsors who appreciate them say they haven’t added them as an option because they haven’t seen them before.

Another 26% feel that costs will be a hurdle, and some see the potential for fiduciary concerns or legal risks—they want regulatory and safe-harbor clarity from the US Department of Labor (DOL) first. The DOL has made some movements lately in favor of using these options in plans, and we’re hoping to see more specific guidance soon.

Getting Better

Some respondents in our plan sponsor survey worried that participants won’t want this type of target-date fund with a guaranteed lifetime income component. But participants seem to feel differently. In our recent participant survey, 84% of current target-date fund users find such a fund to be appealing or extremely appealing, and even 65% of nonusers agree. Also, 62% of nonparticipants say they’d be interested in such a guaranteed-income target-date fund—and that it would enhance their desire to participate in the DC plan.

DC plans hold the key to solving the retirement readiness dilemma for American workers. The good news is that DC plan sponsors are increasingly recognizing the need to take a more comprehensive approach in preparing today’s workers for tomorrow’s financial well-being. The less-good news is that we still have a long way to go.

"Target date" in a fund's name refers to the approximate year when a plan participant expects to retire and begin withdrawing from his or her account. Target-date funds gradually adjust their asset allocation, lowering risk as a participant nears retirement. Investments in target-date funds are not guaranteed against loss of principal at any time, and account values can be more or less than the original amount invested—including at the time of the fund's target date. Also, investing in target-date funds does not guarantee sufficient income in retirement.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.