Corporate executives often passively wait to exercise stock options until right before they expire. But is this the best approach? Our research uncovered a purely quantitative method for deciding when to exercise them.

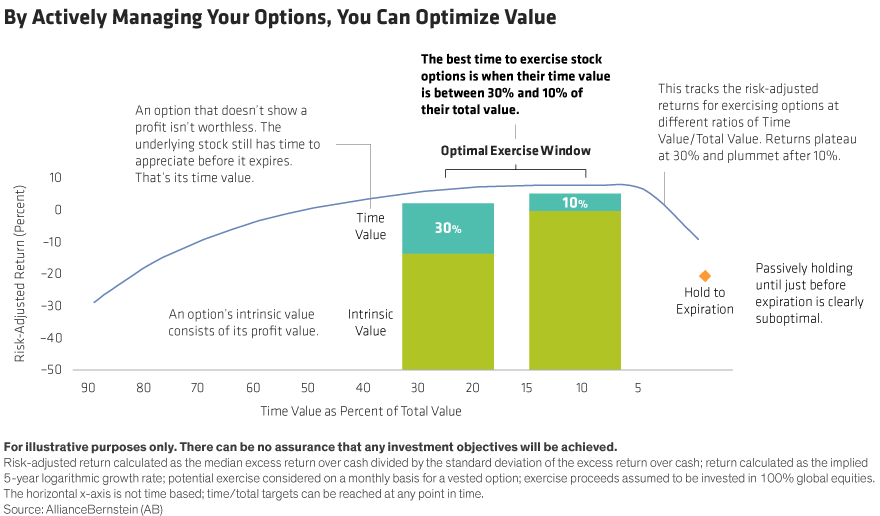

We used our proprietary forecasting model to analyze a variety of stocks—dividend paying, non-dividend paying, highly volatile, and stable. We found that the optimal time to exercise stock options is when their time value is between 30% and 10% of their total value.

Why? In the display, the blue line tracks the risk-adjusted returns of exercising an option at different ratios of time value to total value. Notice how returns begin to plateau around 30% and plummet after 10%. We pinpoint the 10% level as the inflection point where waiting for an extra dollar of profit is not worth the risk of the stock’s price falling—and potentially forgoing some or all the profit you have earned until then.

Can we be more precise? In general, risk-sensitive investors who are still building and securing their core capital (the amount needed to support lifetime spending) should consider exercising when time value reaches 30% of total value. Those who have already secured their core capital and whose options represent surplus capital (capital available for large optional purchases like a second home or for gifting to family or charity), might hold on until time value falls to just 10% of total value to maximize returns.

Note that these ratios of time to total value could be reached at any point during the life of an option and are constantly changing with stock price movement. That’s why executives should actively and continuously monitor the value of their grants—or allow their advisor to do so and notify them when the options appear ripe for exercise.

The views expressed herein do not constitute and should not be considered to be legal or tax advice. The tax rules are complicated, and their impact on a particular individual may differ depending on the individual’s specific circumstances. Please consult with your legal or tax advisor regarding your specific situation.