Thanks to recent changes in the tax code, founders, employees, or investors who receive stock in small businesses may be eligible for significant tax savings under the Qualified Small Business Stock (“QSBS”) exclusion—if certain requirements are met. However, eligibility partly hinges on when the stock was issued—otherwise known as the “Original Issuance” requirement—and how it intersects with the choice of a business entity.

The Complexities of the “Original Issuance” Test

To qualify for the QSBS exclusion at the time of a stock sale, a taxpayer must hold “original issue” C corporation stock for more than five years, and the business must be “active” for “substantially all” of the taxpayer’s holding period.

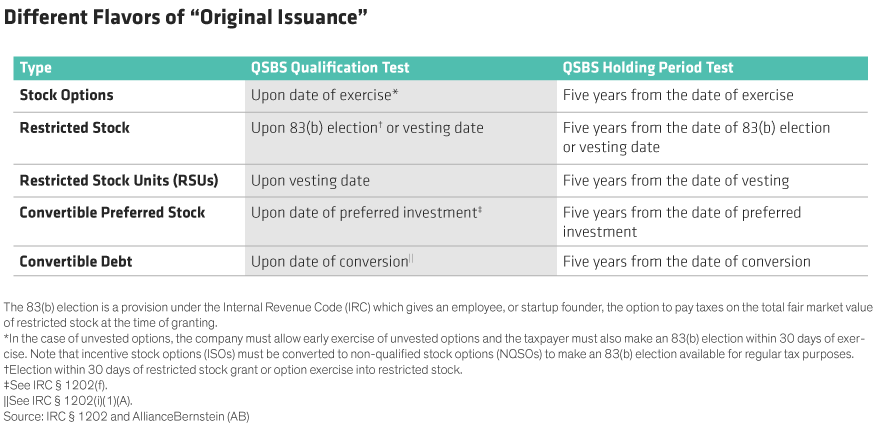

When does issuance occur? The answer is straightforward—when a C corporation issues shares directly to a founder or an investor. However, determining issuance gets more complicated if:

- the corporation grants stock options, restricted stock, or restricted stock units

- the investment capital is structured as a convertible note or as a simplified agreement for future equity (“SAFE”)

In these less straightforward cases, determining when the five-year-holding period begins varies (Display).

For those who qualify, the amount of gain eligible for tax exclusion—whether it’s 0%, 50%, 75%, or 100%—depends on the date of issuance, as discussed in an earlier post. But timing matters in other ways, especially when it comes to the choice of business entity.

The Impact of Business Entity Choice

Clearly, the potential back-end income tax benefits afforded under Section 1202 should not be the sole driver of whether a business is structured as a C corporation, S corporation, or LLC. But given the power of the incentive, it’s worth factoring into the analysis. As a business owner, there are various benefits to launching as an S corporation or LLC. For instance, many founders like the single layer of taxation provided through an S corporation, while others prefer the flexibility of the LLC structure. However, only the original issuance of C corporation stock is eligible for QSBS treatment.

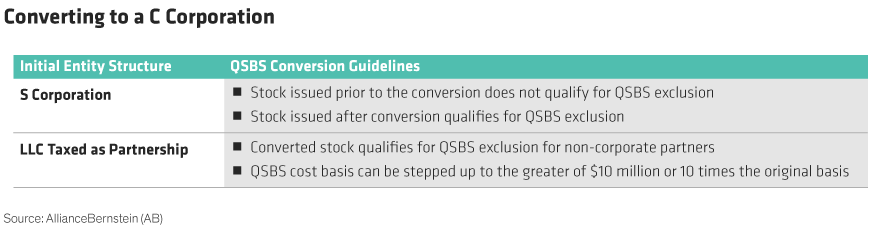

What if a business starts out as S corporation or an LLC and then converts to a C corporation?

In the case of an S corporation, stock issued prior to the conversion would not qualify for the QSBS exclusion. However, stock issued after the conversion would—assuming other QSBS requirements are met.

In contrast, LLCs taxed as partnerships are treated differently. Conversion to a C corporation could allow non-corporate partners to qualify for the QSBS gain exclusion (on post-conversion appreciation). A less obvious potential benefit for LLC conversions? They use the fair market value of the LLC interests at the time of conversion when calculating the potential QSBS gain exclusion. In this instance, the basis is determined by the greater of $10 million or 10 times the original basis.

For example, if a partner’s LLC interest is valued at $3 million at the time of conversion, then the maximum QSBS gain exclusion amount for that partner jumps to $30 million. Keep in mind that the five-year holding period requirement begins upon conversion, so a business owner will need to wait at least that long prior to an exit to reap the QSBS tax benefit from the conversion.

Determining QSBS eligibility demands careful consideration of the “Original Issuance” requirement, the type of entity structure initially chosen, and whether the entity is subsequently converted into a C corporation. The tax law changes that went into effect at the end of 2017 significantly reduced the top tax rate of C corporations to 21%, and therefore, lowered the tax penalty of C corporations relative to pass-through entities. For those looking to take advantage of a potential QSBS exclusion, the formation of and conversion to a C corporation is likely to become more popular.

Business owners deserve a partner who will support them right from the start. For more thought leadership for entrepreneurs and business owners, check out the related blogs here.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.