Donors often seek advice on the best ways to support their favorite charities. Many resort to giving cash, but often that’s not the most optimal gift. There are other assets that may provide a higher tax benefit. Donors over the age of 70½ have even more options—they can make a direct gift of either cash or another asset, or roll over a charitable IRA.* While both are relatively straightforward to implement, there are several factors that may make one of them more tax beneficial.

Cash Isn’t Always King

The simplest way to give to a qualified charity is to make a direct gift of cash—it’s easy, scalable, and flexible. From year to year, cash donors can give more or less, or stop giving altogether if financial situations change or sights are set on supporting a new cause. Assuming the donor can itemize deductions, a personal income-tax deduction can be taken for the amount given. But there might be a better way to boost the tax benefit of charitable donations—giving appreciated securities, rather than cash.

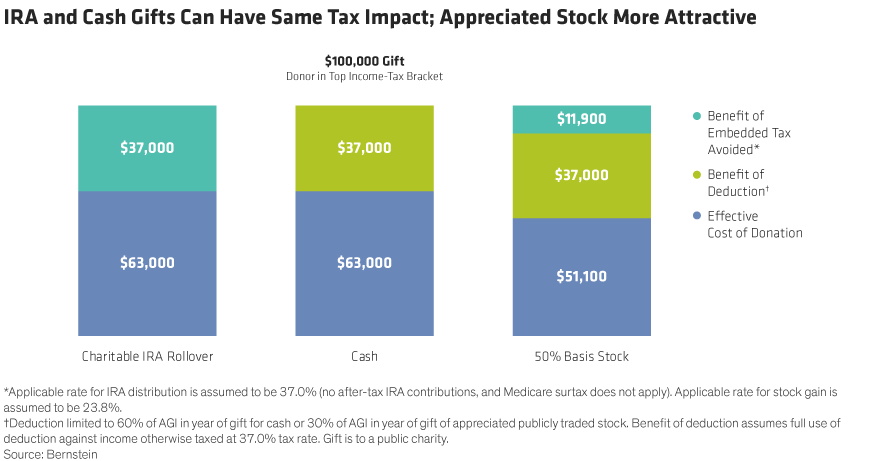

For a donor in the top federal tax bracket (37%), deducting the value of a $100,000 cash gift to a qualified charity reduces the federal income tax owed by $37,000, thereby cutting the effective cost of the gift (the value of the gift minus the tax benefit) to $63,000 (Display). For those who pay state and local income tax, the effective cost may be even lower.

By contrast, gifts of appreciated publicly traded stock or other assets can also reduce or eliminate tax on capital gains, as well as reduce tax on ordinary income. If the same taxpayer donated $100,000 in publicly traded stock bought for $50,000, the 23.8% tax on the stock’s $50,000 gain would be avoided. The extra tax savings cut the effective cost of the donation to $51,100. If $100,000 in publicly traded stock acquired at no cost was donated, the 23.8% tax on the stock’s $100,000 gain is eliminated. The extra tax savings would cut the effective cost of the $100,000 gift to $39,200.

Regardless of whether the donor can itemize, the effective cost will always be lower when giving highly appreciated stock. The reason is simple: Gifting appreciated stock allows the donor to avoid taxes on the gain in the stock.

What About an IRA?

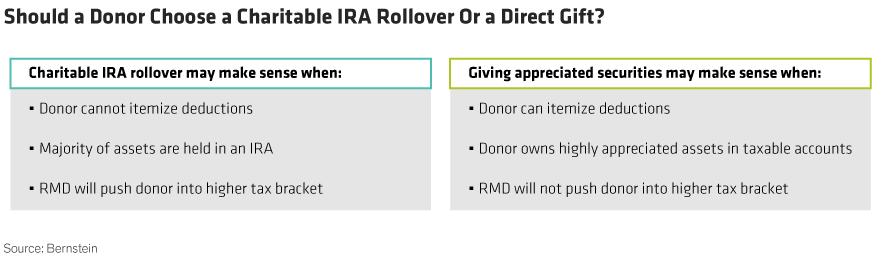

There’s another option for donors over the age of 70½. If they don’t need the required minimum distribution (RMD) from an individual retirement account (IRA) to fund living expenses and want to avoid paying income tax on the distribution, a charitable IRA rollover may make sense. Donors who have exceeded the annual income limitations on charitable income-tax deductions or who do not itemize deductions generally benefit most.

Giving opportunities are limited from IRA accounts, but there’s an exception for people who must take required distributions. The Protecting Americans from Tax Hikes (PATH) Act of 2015 allows IRA owners who are at least 70½ years old to donate up to $100,000 each year directly from their IRA to a qualified public charity.**

At first glance, the tax avoidance benefit from a charitable IRA rollover may appear extremely advantageous. But it may not always deliver the most optimal outcome. In some cases, giving highly appreciated assets might be the right choice (Display).

For a donor in the top federal income-tax bracket, a $100,000 gift from an IRA to a charity will avoid $37,000 in embedded tax (Display). That is, it would reduce the effective cost of the gift to just $63,000. Note that a cash gift would result in the same economic benefit—if the donor itemizes his or her tax return and could take full advantage of the charitable income-tax deduction in the current year. But if donors face deduction limits, or take the standard deduction, a qualified charitable IRA distribution may be a better strategy. However, if highly appreciated stock is given instead, the combined benefit of avoiding the capital-gains tax and creating a charitable income-tax deduction may be greater than a charitable IRA rollover.

Your Giving Plan

Crafting a philanthropic plan entails more than selecting a charity or deciding how much to give. It also means choosing the right asset and defining an appropriate strategy and structure. Because maximizing the benefit to your selected charity is just as important as making the most of the benefit to you.

*Charitable IRA rollovers are otherwise known as qualified charitable distributions.

**The law allows donations to a qualified public charity, but not to donor-advised funds, supporting organizations, or private foundations.

Blog was adapted from Akron Community Foundation, The Signal, Fall 2019.

The views expressed herein do not constitute and should not be considered to be legal or tax advice. The tax rules are complicated, and their impact on a particular individual may differ depending on the individual’s specific circumstances. Please consult with your legal or tax advisor regarding your specific situation.