Bond investors get anxious when rates rise suddenly, as Treasury yields have recently. But if your investment horizon is longer than a few months, rising rates are nothing to be afraid of.

Bonds are sensitive to interest-rate movements, and investors can initially suffer negative returns when yields rise. But if your investment horizon is longer than a few months, short-term losses probably don’t matter that much.

That’s because when it comes to your bond portfolio, time heals most wounds. As bonds mature, their prices drift back toward par. That means investors who sit tight will be able to reinvest the principal and coupon income that their portfolios pay in newer—and higher-yielding—bonds. This can offset short-term losses, and often increases total return.

Consider the recent spike in US Treasury yields. The 0.3% rise in January alone was abrupt and disorienting, even for many seasoned traders and professional money managers, and it will suppress near-term returns. But moves of that magnitude are rare—they’ve happened only 11% of the time since 1993. And history shows that when rates rise, the longer you hold your bonds, the better you do.

As Conditions Change, Flexibility Is Critical

Knowing which bonds to own—and how much—can be daunting. Today’s global bond market is complex, and not all bonds are alike. High-yielding, return-seeking assets such as high-yield corporate bonds are more closely correlated with global growth and equities than other risk-mitigating bonds like US Treasuries or German Bunds, which are more sensitive to interest-rate changes.

The good news, as we’ve seen, is that the power of time applies to all of them. Even so, investors should resist the urge to simply invest in everything and then put their fixed-income portfolios on autopilot. The multiyear run of rising asset prices and low interest rates may be winding down. Managing a portfolio today requires keeping track of changing conditions and valuations and recalibrating exposures as necessary.

For example, it was fear that the US economy would grow too quickly—and possibly overheat—that provoked the recent market volatility. Investors worried that wage increases of the scope seen in January along with a jolt of fiscal stimulus in the form of tax cuts could push up inflation and force the Federal Reserve to hike rates more aggressively. They responded by demanding higher yields on Treasuries.

In this atmosphere, it can be tempting to favor credit assets, which usually outperform when growth is strong. But many of these securities, including US and European high yield, have had a big run-up in value already thanks to low interest rates and easy central bank policies. As conditions change and borrowing costs rise, investors may want to think twice about taking on too much credit risk.

Balance: A Bond Investor’s Best Friend

There is still value in high-yield bonds and other credit assets, so income-oriented investors certainly shouldn’t avoid them entirely. A better option, in our view, would be to pair return-seeking credit assets with risk-reducing assets such as government bonds in a single strategy and continually adjust the balance between the two, altering portfolio weightings as valuations and conditions change.

Why would you want to own government Treasuries when rates are rising? Again, it comes back to the power of time. Over the medium term, more than 90% of US Treasury returns come from the yield. That means rising rates can dramatically boost income for investors who are not primarily focused on short-term Treasury price fluctuations.

Treasury exposure also provides diversification to credit exposure, as the return streams of the two types of bonds are usually negatively correlated. In other words, strong returns on one side can outweigh weakness on the other.

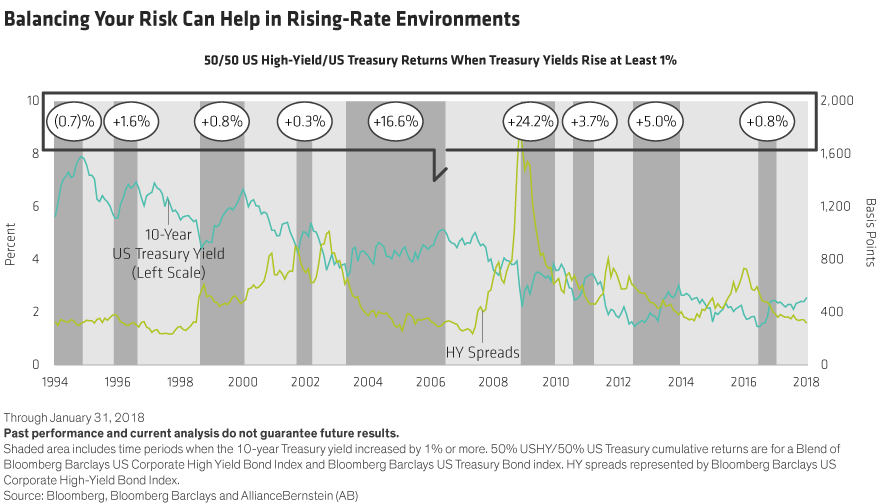

That balancing effect can be valuable when rates rise. The following Display illustrates how a hypothetical strategy split evenly between US Treasuries and US high yield would have performed during periods when Treasury yields spiked by at least 1%. The strategy would have done particularly well—returning 16.6%—between 2003 and 2006. That’s notable, because that period overlapped with the Fed’s mid-2000s rate-hiking cycle, a campaign that closely approximates the one we are experiencing now.

Don’t Limit Your Options

It’s also important to remember that there are many different sectors and securities that can make up the credit side of a barbell strategy. To keep things simple, we used US Treasuries and US high yield as proxies for interest-rate and credit risk in the hypothetical portfolio above. And high-yield corporates are certainly a critical component of any income-oriented strategy.

But over time, the most effective income-generating strategies reach beyond high-yield corporates. That should be the case in bull and bear markets alike. At this late stage in the US credit cycle, we think it makes sense to diversify credit exposure to other promising sectors.

Among them, we see value in credit risk–transfer (CRT) securities—nonguaranteed mortgage-backed bonds issued by US government–sponsored housing agencies. Yields are attractive—they currently range from 2.5% to 6%—and those rates float.

Another option: emerging-market debt, which has demonstrated an ability to deliver positive returns even when US bond yields rise.

All these securities should provide a steady stream of income and carry attractive return potential. That makes them an important part of any bond strategy. The key to success, in our view, is balancing your exposures—and being ready to rebalance them when conditions change.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.