Sweden has become the poster child for European property-market volatility. The country’s residential property market has experienced one of Europe’s biggest booms and sharpest reversals in recent years. And Swedish commercial real estate (CRE) markets are facing oversupply, high vacancy rates and rising financing costs.

As a result, the bonds of leading Swedish real estate companies have faced successive credit rating downgrades, sparking fears that CRE troubles will extend to banks and property companies across Europe. We disagree. In our analysis, Sweden’s banks and property companies are mostly well placed to ride out the property-market downturn, and we see fears of a domino effect as overly pessimistic.

Sweden’s Property Market Is Atypical

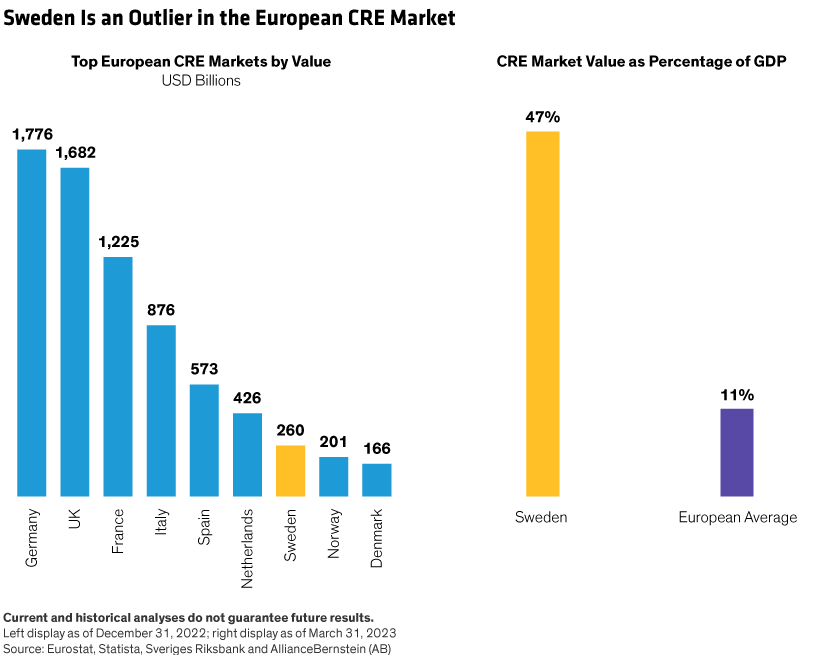

Investors should take care not to extrapolate Sweden’s property woes across Europe, because Sweden’s financial stability is far more sensitive to CRE than the European average. For example, Sweden’s CRE is one of Europe’s smaller markets, accounting for about 2.8% of the total. But Sweden’s CRE market represents 47% of Swedish GDP, compared with a European average of about 11%.

Sweden’s CRE market is also closely entwined with the Swedish financial system: 47% of CRE bank lending originates from Swedish banks, and a similar proportion of CRE companies’ bonds are owned by Swedish financial institutions and investors. This makes Swedish banks highly sensitive to CRE market developments, given their above-average exposures to the property market (Display).

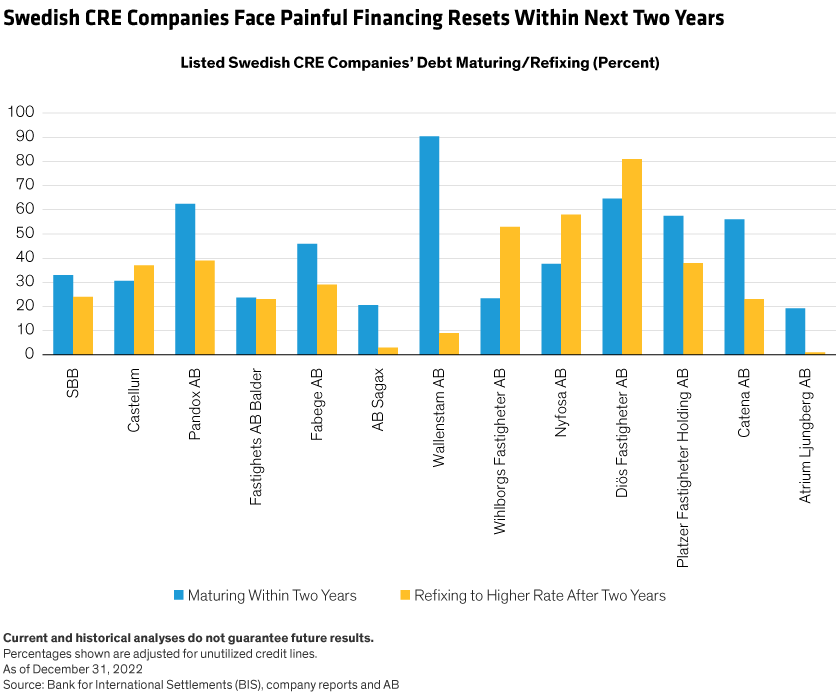

Rising interest rates are weighing heavily on the share prices of Sweden’s CRE companies, which have increased their leverage substantially over the last 10 years. Many face much higher debt-service costs (Display), damaging investor confidence.

Most Swedish CRE Companies Still Look Robust

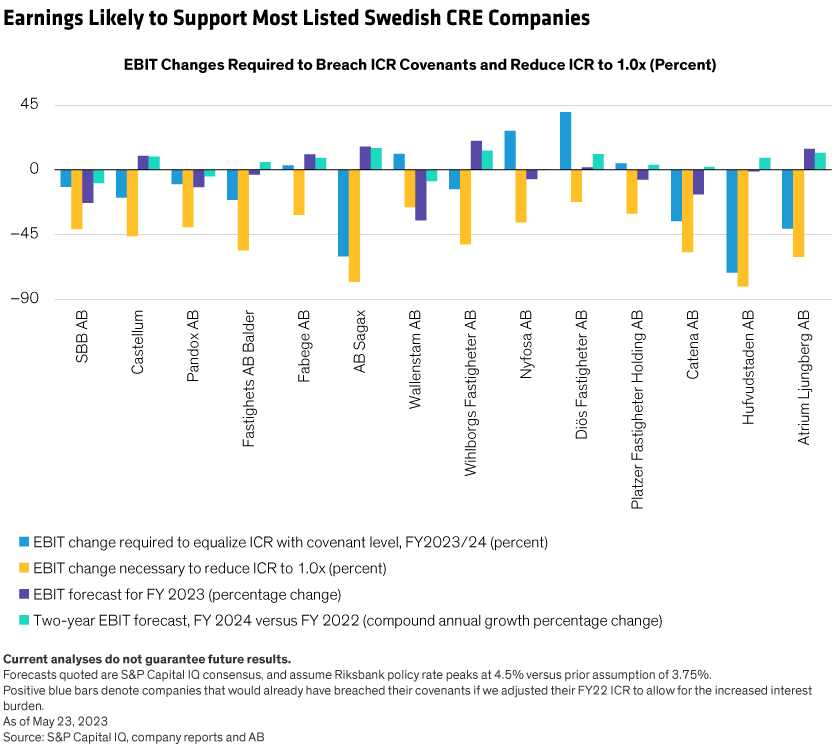

Allowing for the sharp increase in financing costs, our analysis suggests that the largest Swedish CRE companies’ earnings before interest and taxes (EBIT) will mostly remain positive over the next two years. This means that only a few would breach their interest-cover ratio (ICR) covenants, and only one would fail to keep its ICR above 1.0× (Display).

Overall, recent developments don’t point to a drastic CRE scenario. We expect only modest asset-quality deterioration and increased performing loan provisioning at Swedish banks.

Consequently, we think Swedish banks will weather the storm. Crucially, they still have capacity to provide further support to real estate borrowers by taking on more property exposure. Their non-performing loans (NPLs) are low, and loan to value (LTV) ratios are still healthy. Meanwhile, their profitability is strong after successive rate rises helped to widen their net interest margins.

Warding Off Worst-Case Scenarios

Faced with worst-case scenarios, CRE companies could implement an array of measures to mitigate the situation, while banks would likely also offer renegotiated terms and conditions for those companies at risk of breaching their covenants (whether LTV or ICR).

For Swedish banks, even if the estimated value of their collateral were to fall below the loan value, they would still have the option to retain the asset and divest it later once market stresses have eased. This tactic was used successfully in previous crises, and at higher LTV ratios than today.

Bank assets such as higher-yielding property portfolios with inflation-linked rents and leases that oblige tenants to meet buildings’ tax, insurance and maintenance expenses—typical of Nordic light industry, logistics and warehousing—would likely bounce back faster. By contrast, lower-yielding portfolios with no indexation or cost pass-through—typical for Swedish residential—would be much slower to recover and more likely to suffer write-downs.

European Banks Are in Good Shape

Meanwhile, across Europe, we think the risk of contagion from Swedish CRE lending is low. We find that most European banks’ property exposures are manageable, their LTV ratios (averaging about 50%) give them a significant cushion against property losses, and their NPLs are yet to increase.

With a handful of exceptions, European banks’ exposure to US CRE is also modest, representing only a small fraction of their overall US loan books. The majority of European banks also perform well in our financial stress tests based on scenarios such as the GFC and previous banking crises. In the UK, the Bank of England’s recently published Financial Stability Report shows that here too, banks are relatively resilient to a severe stress-test scenario.

Across Europe’s residential property markets, it’s also rare to find the characteristics that have made Sweden’s so volatile: a majority of interest-only loans on variable or short-term fixed-rate deals; no requirement for most households to pay down their debt below 50% of property values; and a relatively low level of fiscal support for householders.

Overall, we think the problems facing Sweden’s banks will impact their profits but not their solvency, and we expect relatively moderate hits to their capital buffers. For Swedish CRE companies, we think the real estate downturn will in most cases be survivable. And for property markets across Europe, we see Sweden as an outlier rather than a sign of things to come.

Additional Contributors: Ravi Dasari | Analyst - European Banks Credit Research

Vivek Bommi, CFA is Head of European Fixed Income and Director of European and Global Credit, Steve Hussey is a Senior Vice President and Head of Developed-Market Global Banks Research and Ali Bendarkawi is a Vice President and Senior European Corporate Credit Analyst, all at AB.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams. Views are subject to change over time.