As Spain slips back into recession, the Spanish government has begun talks on ring-fencing the country’s bad property loans in one or more separate entities. While this may help, we doubt whether the move will be enough on its own to solve Spain’s problems, as our European banking analyst, Victoria Norman, discusses below.

Attempting to Isolate Toxic Loans

The Spanish authorities' move to create a modified “bad bank”—in the same spirit as Ireland’s National Asset Management Agency, but not as radical—is an attempt to isolate the toxic loans that have been poisoning Spain’s banking system. For the smaller banks in particular, such a plan could be advantageous, as management might be less distracted by having to deal with problem assets. But at this stage details are scarce and, in particular, questions remain about how the entity would be funded and who would be responsible for any residual losses, should the assets be run off at a loss.

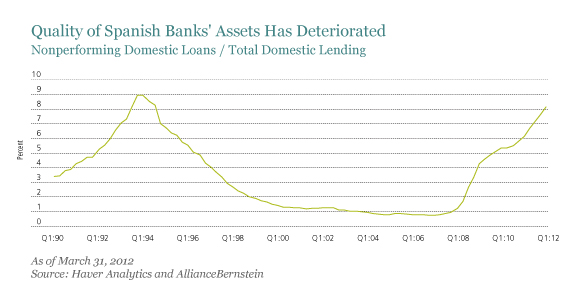

The “bad bank” talks are the latest stage in the government’s attempts to reform the country’s banking system in the wake of the crisis. After the banks had been prompted to identify their bad assets, a law (Royal Decree 2/12) was passed in February requiring them to set an additional €54 billion of provisions and “capital buffers” against their €175 billion of problematic property exposures (doubtful loans have risen alarmingly, as shown in the display). According to our estimates, these provisions will go some, but not all the way to recognizing the losses the sector is facing. They also fail to address potential losses outside the banks’ real estate books.

The jury is still out on the success of the February reform. We hope that increasing the provision coverage of nonperforming loans might ease the sale of assets. The large banks are indeed now starting to address their problems by selling property assets privately. As for the rest of the industry, it’s a little early to say as they don’t have to set up their provisions until the end of the year.

Whether or not all these measures succeed, we think that Spanish banks will continue to face deteriorating asset quality and higher-than-normal funding costs this year and into 2013. Market estimates are that the remaining total bank funding requirement for this year will be about €100 billion. We think the banks should be able to cover that with the help of funds from the European Central Bank’s long-term refinancing operations—which make cheap, long-term loans available to commercial banks. But we also think they will have difficulty funding themselves in the wholesale markets as long as confidence in the Spanish government and economy remains shaky. Earlier this week, S&P downgraded Spain’s credit rating, resulting in the subsequent downgrade of 11 of Spain’s largest banks. Moody's is expected to follow suit imminently, as the results of its reviews of the European banking systems are also due this month. One effect of the S&P downgrades was that the two largest institutions lost their coveted A-1 short-term credit rating, which may put them in a weaker position in the wholesale funding market.

Against this backdrop, as corporate bond investors we remain cautious about the Spanish banks for the time being.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.