Less volatile, defensive stocks have been so popular lately that many investors are now asking whether the low-volatility opportunity has come and gone. The question highlights why we think a multifaceted, actively managed approach is the way to go when investing in this space. These strategies have more levers to pull to avoid near-term risks and, thus, to extend the long-term return potential of low-volatility stocks.

Safety Looks Pricey

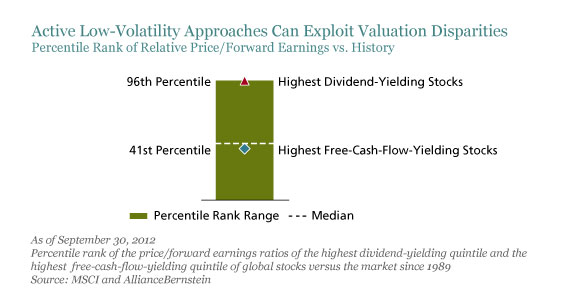

We see why investors may be uneasy. Valuations in some corners of the low-volatility realm appear lofty, bid up by the massive postcrisis flight to safety. For example, the forward-earnings multiple of the highest dividend-yielding quintile of global stocks is among the highest it’s been since 1989. Some traditional safe-haven sectors such as utilities, consumer staples and telecom currently trade at premiums between 9% and 22% versus their 10-year averages, based on 12-month-forward earnings estimates.

Passive Is Passive About Valuation

Approaches that passively invest in less volatile stocks are inherently vulnerable to the risks that arise from being overly concentrated in overpriced subsets of stocks. Most passive strategies screen strictly for low beta, with no consideration of valuation. Those that passively track capitalization-weighted low-beta indices will be heavily influenced by the largest, most expensive stocks. That’s especially risky these days.

Active Can Maneuver

It’s a very different story for actively managed low-volatility portfolios. These strategies can steer clear of overpriced names and lean more heavily on other factors to manage risk and increase return potential. Our research has found that combining low volatility with traits of high fundamental quality—such as high return on assets, strong cash generation, and disciplined balance-sheet management—can produce better risk-adjusted returns than focusing on low volatility alone.

An active low-volatility approach allows for more flexibility on valuation. For example, our research is finding attractive opportunities among stocks with high free-cash-flow yields, which are still selling below their long-term valuations (Display). Active strategies can also take advantage of valuation disparities among traditionally less volatile sectors. For example, healthcare and transportation sell at 5% to 15% price/earnings discounts to their 10-year averages. And these approaches can scout for opportunities among the steadier stocks in riskier—yet still relatively attractively valued—sectors. These would include technology and retail companies with dominant, defensible market shares or secular growth prospects.

In these uncertain times, low-volatility strategies have been getting a lot of attention because of their potential for generating market-like-or-higher returns over time with significantly less risk. By adjusting exposures to circumvent risks and exploit opportunities along the way, an actively managed low-volatility approach increases the odds of success without getting trampled by the crowd.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.