A recent Wall Street Journal article implied that some US executives have manipulated 10b5-1 programs to boost gains or reduce losses when trading company stock. Even if these abuses did occur, we think they shouldn’t obscure the value of 10b5-1 programs implemented in good faith.

The US Securities and Exchange Commission introduced Rule 10b5-1(c) in 2000 so corporate leaders could buy and sell company stock with less fear of facing insider trading allegations. Under the rule, companies can allow executives to create programs that automatically direct future transactions, even during blackout periods when insiders are normally forbidden to trade.

The Journal article questioned whether executives should be allowed to trade shortly after they’ve launched a 10b5-1 plan and to cancel their plans when in possession of nonpublic information. Responsible companies are already taking preventive measures in this area. Some companies now forbid sales for 30—or even 60—days after a program begins, and some don’t let executives modify or cancel their 10b5-1 plans during blackout periods.

Comparing Alternative Strategies

Rule 10b5-1 is flexible enough to accommodate various selling strategies, so a properly designed plan should meet an executive’s needs with a high degree of probability.

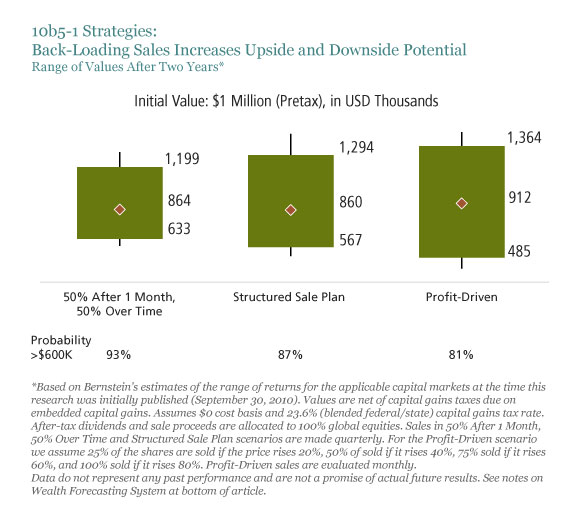

We used our Wealth Forecasting SystemSM to compare the effectiveness of three possible approaches:

-

Front-loaded: Sell 50% after 30 days, then sell equal amounts quarterly over the next two years;

-

Structured: Sell equal amounts quarterly over the next two years;

-

Profit-driven: Sell only after the stock price rises according to this schedule: sell 25% of the shares if the price rises 20%; 50% of the shares if it rises 40%; 75% of the shares if it rises 60%; and 100% of the shares if it rises 80%. If any shares remain after two years, sell them regardless of price.

In each case, we assumed that the sale proceeds are invested in a portfolio of global stocks.

The display below shows the expected range of outcomes when starting with $1 million and applying the selling strategies over two years. Selling sooner clearly reduces risk but also limits the potential upside. The successive strategies increase the dispersion of possible results. Although the median results are not dramatically different, the range of returns becomes quite large after two years.

Another way to look at this display is to consider the probability of reaching the executive’s goals. The bottom row of numbers shows the probability of receiving more than $600,000 after two years. Note that while the profit-driven strategy has a slightly higher median result, it is actually less likely to meet the seller’s goals than the plain-vanilla strategy of selling equal amounts at regular intervals.

Another way to look at this display is to consider the probability of reaching the executive’s goals. The bottom row of numbers shows the probability of receiving more than $600,000 after two years. Note that while the profit-driven strategy has a slightly higher median result, it is actually less likely to meet the seller’s goals than the plain-vanilla strategy of selling equal amounts at regular intervals.

Single stocks are more volatile than a diversified portfolio, and any staged-selling plan runs the risk that the stock could drop sharply before the selling is done. So executives need to think about whether they could tolerate a large drop in the value of their holdings.

Clearly, 10b5-1 trading plans can be designed to suit executives with different circumstances and appetites for risk. There is no one best way to divest a concentrated position—except to understand the potential rewards and risks of holding versus selling.

The Bernstein Wealth Forecasting System

SM

uses a Monte Carlo model that simulates 10,000 plausible paths of return for each asset class and inflation and produces a probability distribution of outcomes. The model does not draw randomly from a set of historical returns to produce estimates for the future. Instead, the forecasts (1) are based on the building blocks of asset returns, such as inflation, yields, yield spreads, stock earnings and price multiples; (2) incorporate the linkages that exist among the returns of various asset classes; (3) take into account current market conditions at the beginning of the analysis; and (4) factor in a reasonable degree of randomness and unpredictability.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.