SMID-cap stocks, which bridge small- and mid-cap indices, have performed almost as powerfully as small-caps historically, but haven’t been as erratic. The “mid” in SMID is largely why.

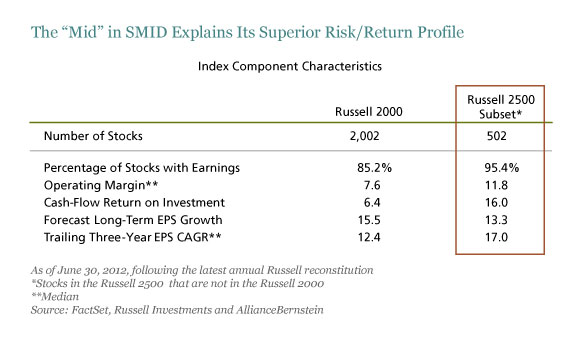

The 500 mid-cap companies in the Russell 2500 Index (the most commonly used proxy for the SMID category) make up only 20% of the index’s stocks but 56% of its capitalization. As the display below shows, this subset brings significant improvement in profitability versus the small-cap Russell 2000 Index, while maintaining an earnings growth profile that is only slightly less robust. This fundamentally more resilient and less volatile collection of stocks not only improves the index’s liquidity significantly, but also drives a lot of its performance attractiveness.

Think of these subset companies as the more life-tested members of the small-cap world. They are often as entrepreneurial and niche market–focused as smaller companies, but they are more established and benefit from greater economies of scale. Thus, this cohort is more profitable than its smaller-cap counterparts and, as our research found, enjoys considerably higher returns on investment across most sectors of the economy. Although long-term earnings growth forecasts for the Russell 2500 subset trail those of their smaller peers, they have done a far better job of living up to expectations, as evidenced by their higher reported earnings growth.

Yet these subset companies can have very different backstories. They can be early-stage, high-growth stars that have graduated from the crowded ranks of small- and micro-cap businesses. Others may be just starting to harvest the profits from their earlier business investments. Or they may be larger-cap firms that have been demoted to mid-cap status because of a controversy that has raised doubts about their earnings power.

Regardless of where they sit on the style spectrum, smaller-cap companies are under-followed and overlooked generally, creating ample alpha opportunities, especially for investors who take the time to know and understand them. And because SMID-caps are more liquid and less volatile than small-caps, trading in a SMID portfolio is more efficient and less costly, so less performance is lost to portfolio implementation. We’ll share more of our research on this topic in more detail in our next blog post on the SMID alpha potential.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio- management teams.