In the hunt for growth in today’s low-growth world, up-and-coming small- and mid-sized companies are a good place to start. But you need to look everywhere, from Indiana to Indonesia.

SMID-cap stocks unite the typically robust growth of small companies with the higher quality of more established mid-cap firms. Smaller companies tend to grow faster than larger ones because they are often nimbler and more niche-focused, or pure plays on an exciting new growth theme.

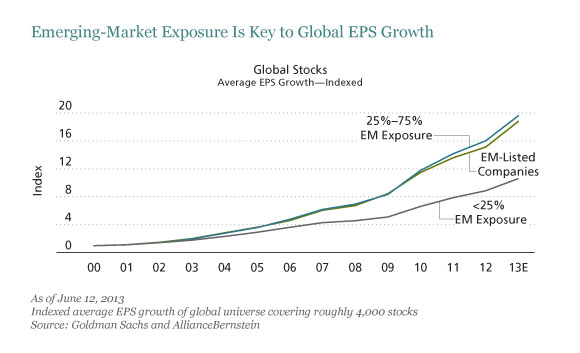

These days, a major driver of higher SMID-cap growth is exposure to emerging markets—not just the BRIC heavyweights but also the smaller yet comparably vigorous economies in Latin America, Southeast Asia and Africa. Earnings for locally based emerging-market companies and rich-world firms with significant emerging-market businesses have grown many times faster than they have for companies with little or no presence in the developing world (Display). Given shifting global consumption trends, we don’t see this growth gap closing any time soon.

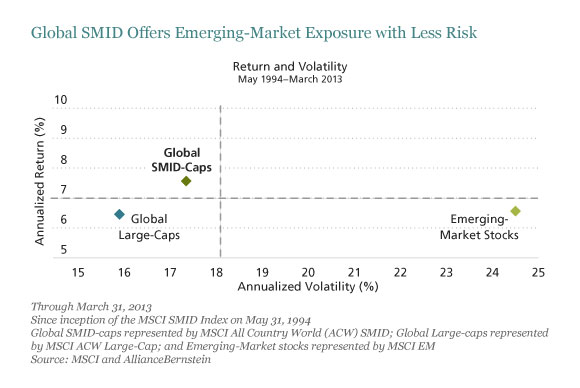

SMID-cap investing is a great way to harness this growth potential. Roughly half of global SMID-cap stocks are listed in emerging markets, and another 7% get more than 30% of sales from those countries. Global large-cap stocks just aren’t as well situated: only 38% have significant stakes in the developing world. Partly reflecting this emerging-market tilt, global SMID-caps have outperformed global large-caps over the long term, with only a slight increase in risk (Display).

So why not just go with a pure emerging-market allocation? Because, by going global, investors also gain access to the many idiosyncratic, domestically driven growth opportunities in smaller developed-market companies—and the diversification benefits that come with them. As the display above also shows, global SMID-caps have outperformed emerging-market stocks, with much less risk.

Adding to their appeal, global SMID-caps are also great sources of alpha potential. Smaller companies everywhere get far less research coverage than large-caps, and next to none in smaller emerging markets. This neglect can make small stocks more volatile, but it also gives active managers more chances to add value, especially if they have the research resources to develop insights on company fundamentals that others are overlooking. Though we focus on earnings growth, we don’t buy growth in a vacuum. Given the risks involved, we pay strict attention to returns on invested capital and other signs of managements’ effectiveness and capital stewardship. We also stay well diversified.

Today, we’re finding SMID growth opportunities across a wide swath of industries:

- European luxury-goods manufacturers gaining popularity among increasingly affluent emerging-market customers

- Innovative US technology companies grabbing share from less focused conglomerate rivals in the rapidly growing global LED market

- Pharmaceuticals, medical technology and healthcare-services firms profiting from surging demand for higher-quality, preventive medical care and the expansion of private and public healthcare programs across the developing world

- Financial-services companies in Southeast Asia as they increase domestic credit penetration from very low levels and expand into new services and geographic markets

- Thai and Indonesian consumer-oriented stocks benefiting from these nations’ continued rapid urbanization, young and growing workforces and recent government efforts to lift minimum wages

Tracking down the best growth ideas today requires casting a wide net over the small- and mid-cap opportunity. For us, that means going global.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.