Municipal bonds have rallied in 2014, but low yields, memories of last year’s sell-off and the potential for higher rates ahead have many investors wondering how to maneuver. We have a couple of ideas.

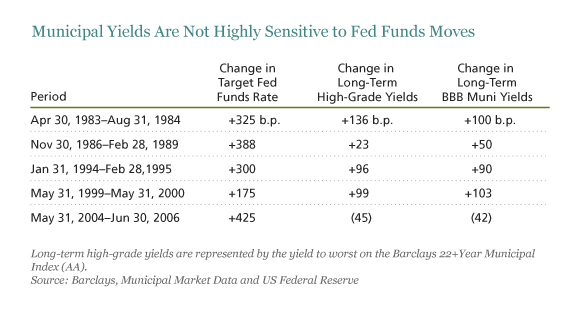

Bonds still play a key role in most investors’ portfolios, so let’s look at some facts: First, the sell-off wasn’t driven by poor fundamentals, but by outflows related to miscommunication by the US Federal Reserve about when the bond tapering would begin. And second, muni bond yields—particularly long-term muni bond yields—have historically risen by much less than the fed funds rate. As a result, they’ve done fairly well in periods when the fed funds rate has risen (Display 1).

But with rates low and likely to rise, how can investors enhance their returns? Those looking for higher income should consider investing in muni high-yield bonds. For more conservative investors, we think that reducing interest-rate risk in a high-quality bond portfolio makes sense.

But with rates low and likely to rise, how can investors enhance their returns? Those looking for higher income should consider investing in muni high-yield bonds. For more conservative investors, we think that reducing interest-rate risk in a high-quality bond portfolio makes sense.

Add Higher-Yielding Municipals

Longer-maturity bonds have historically been fairly insensitive to changes in the fed funds rate, but they also have the greatest interest-rate exposure. Within long-maturity bonds, one sector stands out: high-yield municipal bonds, which offer a 3.3% higher yield today than AAA-rated bonds of the same maturity. The average yield advantage of high-yield muni bonds over the last 18 years has been just 2.4%.

High-yield bonds offer more income today than usual, and we expect high-yield issuers’ credit quality to generally improve in a strengthening economy.

But what about credit risk? Last year, concerns about Detroit and Puerto Rico helped create a sell-off that caused long-term, high-yield bonds to underperform. The underperformance wasn’t due to fundamental problems, though. In fact, the credit quality of most states and local governments has improved along with the economy, as we expected it would. Municipalities have seen 16 straight quarters of year-over-year tax revenue growth, and tax collections are very high. This upswing—and the dissipation of concern over headline events—should spur even more demand for municipals.

For these reasons, we see long-maturity, high-yield bonds as a good opportunity for investors who want to be defensive but are looking to boost their income today.

Find the Sweet Spot in Intermediate-Term, High-Quality Bonds

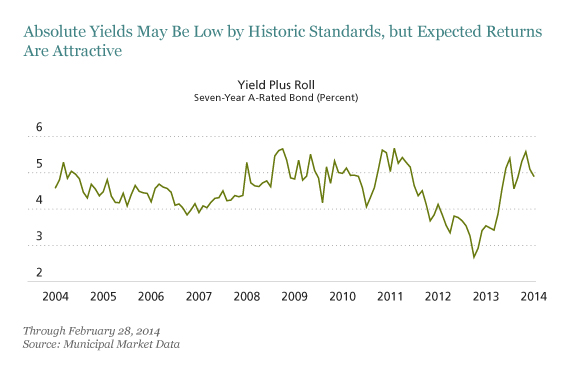

For more conservative investors, we think that it makes sense to reduce interest-rate risk by selling long bonds and using the advantages of intermediate-term municipals to enhance returns. What makes this proposition difficult for most investors is the reduction in yield that this repositioning implies. But, a lower yield doesn’t necessarily mean that you end up with a lower return.

A key piece of the puzzle is roll, the natural price gain a bond experiences as it moves closer to maturity. Today’s very low short-term rates mean that the intermediate part of the yield curve is steep, particularly for bonds with five- to eight-year maturities. The steeper the yield curve, the more powerful roll can be. If we combine the return potential from both income and roll, the expected returns of intermediate-term and long-term bonds are similar. In fact, while absolute yields may be low, expected returns from roll plus yield for intermediate-term bonds are attractive (Display 2). Of course, there are many other factors that impact muni bond returns.

So, while municipal yields may be lower today, investors can still build bond portfolios that offer good potential returns without taking too much interest-rate risk.

So, while municipal yields may be lower today, investors can still build bond portfolios that offer good potential returns without taking too much interest-rate risk.

The views expressed herein do not constitute research, tax advice, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams. Past performance of the asset classes discussed in this article does not guarantee future results.