With markets so calm, it’s easy to become complacent about the corrosive effects that volatility can have on long-term investment success. If you don’t need the money for a long time, you can ride out the inevitable market squalls. But if you’re close to or already drawing from those funds, volatility can be costly.

We are all prone to performance chasing, leading many of us to make the classic mistake of buying high when markets boom and bailing out too quickly when they bust (and forfeiting the chance to participate in subsequent recoveries). It’s harder to resist these impulses during volatile periods, which can erupt with little notice.

Even if you have the stomach to ride these upheavals without changing your allocation, volatility can still hurt. It’s a function of the cruel math that governs the difference between average returns and compounded returns: if a stock falls by 50%, it needs to rebound by 100% to restore lost ground. The steeper the fall, the harder it is to climb back. Compounded over time, big price swings can be a significant drag on long-term performance.

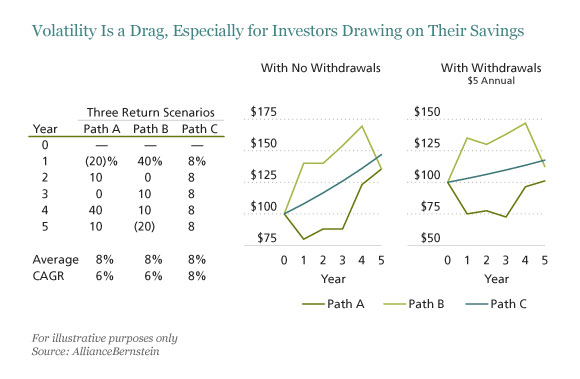

We see this “risk drag” at work in the middle line chart of the display below, which compares the performance of an initial $100 investment under three different patterns of returns, all of which average 8% per year over a five-year span. While the end result for both of the more volatile paths is the same, the consistent return path’s final destination is better.

The stakes are much higher for investors in the post-accumulation stages—whether they are retirees living off their savings or plan sponsors paying claims from their pension funds. Risk drag reduces both the expected value of those funds and the chances that there will be enough money to meet future needs.

In the most basic sense, the problem arises because of the differences between the steady timing of withdrawals and the unpredictable swings in the fund’s investment value. High volatility increases the chances that you’ll be taking money out when the portfolio is suffering, thereby locking in losses.

The impact can be particularly pernicious if the downdraft occurs early in the withdrawal period. As the right-hand line chart of the display above shows, when taking out $5 a year, the $100 investment fares much worse under Path A, which suffers a 20% drop in the first year, than under Path B, which sees the 20% drop in the last year. And both do worse than the steadier Path C. Clearly, the path matters—and the smoother the ride, the better.

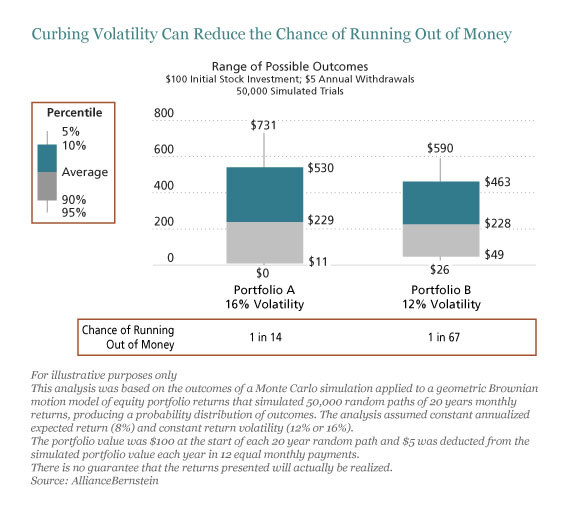

Taming volatility can also help ease this investor’s biggest fear: running out of money. To calculate the probability of such an event, we ran two equity portfolios through a random Monte Carlo analysis for a 20-year period. For both portfolios, we assumed a $100 initial investment and withdrawals of $5 a year. To isolate the risk drag associated with withdrawals, we also factored in a compound annual return of 8% for both portfolios, though annual volatility was set at 16% for Portfolio A and at 12% (a 25% reduction) for Portfolio B.

As the display below illustrates, both portfolios ended the 20 years with about the same average balance. However, the range of probable outcomes was far narrower for the less volatile portfolio, and its downside potential was dramatically lower. In 90% of scenarios, Portfolio B ended up with a balance of $49 or more, nearly five times higher than that of Portfolio A. As important, the probability of running out of money was one in 67 of the possible scenarios for the lower-risk portfolio, versus one in 14 for the riskier portfolio.

More volatility is not always bad. We could get lucky and end up with more money, as we see in the simplified example above. But we could also end up with less money—or worse, outliving our funds. In the absence of a crystal ball, we believe that investors in the post-accumulation stages are better off with a plan that will temper the impact of market ups and downs. They will then be more likely to stay the course, in turn allowing them to catch opportunities in upswings, help preserve more of those gains in downturns and significantly reduce the chances of ending up with the worst-case scenario.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AllianceBernstein portfolio-management teams.