A surprising number of plan sponsors lack a default investment—or choose a default investment for their plan that isn’t a qualified default investment alternative (QDIA). Is confusion part of the problem?

The Have-Nots

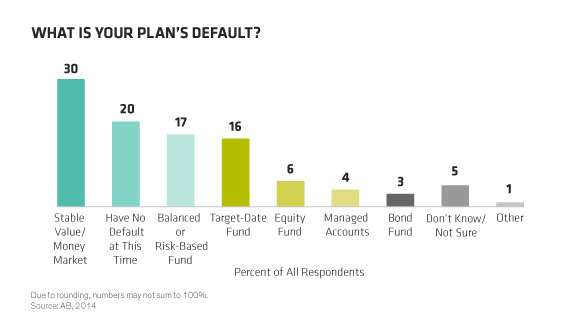

The trend toward greater adoption of target-date funds and other QDIAs continues, but some plan sponsors still haven’t embraced the changes ushered in by the Pension Protection Act of 2006 (PPA) and subsequent clarifying regulations. According to our survey of over 1,000 plan sponsors (a balanced representation from across the full universe of DC plan sizes), one-fifth of plan sponsors lack a default investment altogether—more so among the smallest plans (37%) than the largest (13%). Along with that, our survey indicates that another 30% of plans still use a stable value or money market fund as their default investment (Display).

Our results differ from other industry surveys that focus primarily on larger plans or are based on a single recordkeeper’s data. And while it’s surprising that roughly half our survey population doesn’t take advantage of QDIA safe harbor protections, the large size and balanced demographic representation of our study make this finding hard to dismiss. Many sponsors appear to be confused or misinformed even though respondents were screened to be sure they are fiduciaries. And this information gap seems to parallel our finding that over one-third of plan sponsors don’t actually know that they are fiduciaries.

Philosophical Divide in Plan Approach

The lack of a default shows some correlation to the philosophical divide between the “paternal” and “hands-off” plan perspectives. Plan sponsors with a default are more likely to select critical measures of plan success such as “improving participation” (39% vs. 30% for those without a default option) and “improving salary deferral amounts” (22% vs. 15%). They are also far more likely to rate “increasing plan participation” as a highly important goal (60% vs. 47%).

Respondents whose DC plans don’t have a default are less likely to offer automatic escalation (21% vs. 36% for those with a default), and they’re more likely to believe that participants want to make their own participation and investment decisions. They’re also less likely to have an investment policy statement providing guidelines for fiduciaries on making investment decisions (41% vs. 53%).

Why Non-QDIA Defaults?

Maybe plan sponsors don’t fully comprehend the benefits of the Department of Labor’s “carrot” of safe harbor for QDIAs. Or they may fear legal action from participants, although the safe harbor protects them from investment-return liability.

But one insight from our study suggests that the use of non-QDIA defaults has more to do with plan sponsors not fully recognizing their fiduciary status or responsibilities. When the default isn’t also the plan’s designated QDIA, plan sponsors are less likely to consider themselves plan fiduciaries (48% vs. 70% for those whose default is also their designated QDIA). They tend to rate fiduciary matters as lower in importance (only 33% “very important” vs. 56%). In addition, among plan sponsors whose default does not qualify as a QDIA, very few (15%) say they plan to change their default to a QDIA in the next two years.

Another barrier may be a lack of familiarity with QDIAs. One in five respondents didn’t know if their plan’s default was qualified, and half of the small number of plan sponsors who said an equity fund was their default (in itself hard to believe) mistakenly thought that equity fund was a QDIA. Two-thirds of those with stable value or money funds as a default said it's their QDIA, even though stable value or money funds are only valid as QDIAs for the first 120 days after participant enrollment.

Training Helps

How can companies turn faulty defaults into pluses for their plans and their participants? Education and training for all plan fiduciaries can go a long way toward instigating beneficial changes for DC plans, regardless of size. Companies that provide training for plan sponsors show increased awareness of fiduciary duties by a significant 10 percentage points. And DC plans that work with consultants or financial advisors would do well to ask them for increased plan sponsor education.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

“Target date” in a fund’s name refers to the approximate year when a plan participant expects to retire and begin withdrawing from his or her account. Target-date funds gradually adjust their asset allocation, lowering risk as a participant nears retirement. Investments in target-date funds are not guaranteed against loss of principal at any time, and account values can be more or less than the original amount invested—including at the time of the fund’s target date. Also, investing in target-date funds does not guarantee sufficient income in retirement.