Emerging markets have faced a significant economic slowdown in recent years. But there are still many industries and companies that are continuing to grow. We believe these are the places that investors should focus on to capture attractive return potential in developing-world equities.

Many investors have been disappointed by emerging markets. Economic growth is slowing in many countries. Equity returns have lagged behind those in developed markets. And earnings growth of companies in the MSCI Emerging Markets Index has declined from a peak of about 18.8% in 2010 to 12% today.

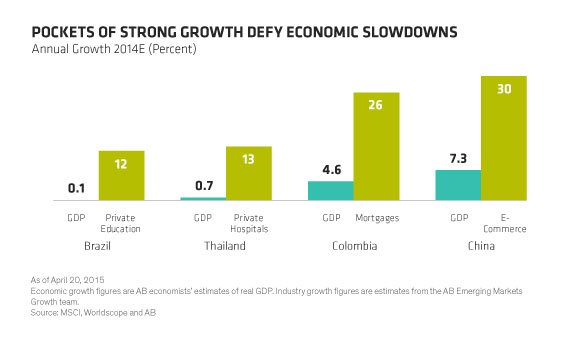

Some investors have given up. We think that’s a mistake. Economic growth and political risk may grab headlines, but there are plenty of pockets of powerful growth in emerging markets that are being overlooked (Display). The trick is to search for companies that don’t depend on economic growth to succeed, and to focus on industries benefiting from structural change, driven by increasing penetration of a product or service from very low levels.

Going Deeper in Financials

Financial services are a great place to start. In many emerging markets, transactions are migrating from cash to plastic at a rapid pace. What’s more, in countries like China, India and Indonesia, wages are still advancing by an annual pace of about 10%, despite economic headwinds.

These trends trigger a process that we call financial deepening. With more discretionary income, households have more money to funnel toward financial services. Mortgages, consumer debt, insurance and other savings products haven’t penetrated mass markets at anywhere near their rates in developed countries. For example, in India, only about 10% of households have mortgages. In Peru, insurance penetration is just 3%—among the lowest in all emerging markets.

Wealthier People Are Getting More Healthcare

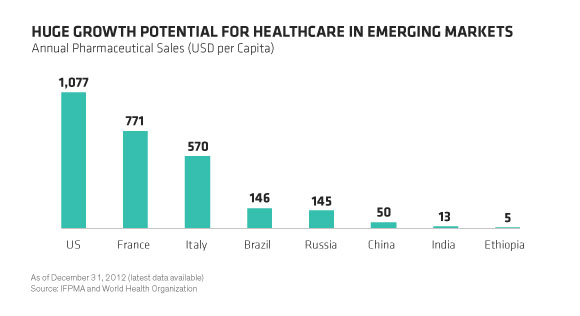

Healthcare is another source of growth that isn’t really influenced by macroeconomic growth. In many emerging markets, structural growth over the past two decades has created big changes in diets and health consciousness. As protein-based diets become more common—and junk food becomes more popular—diabetes and heart disease are becoming endemic.

Yet healthcare still has a long way to go. Healthcare spending across emerging markets is growing at an annual rate of around 8%, according to the World Bank. That’s more than double the rate in developed markets and well above the rate of economic growth in the developing world, estimated at about 4%. Many drugs have much lower penetration rates than in the developed world, owing to low per-capita spending on pharmaceutical products (Display). Hospital care is also much less common. Companies that can fill these gaps have a good chance of delivering strong earnings growth—and equity returns—to astute investors.

Private Education Is Booming

Private education is also worth studying. In Brazil, the government has a target of increasing post-secondary education among the 18- to 24-year-old population from 15% to 33% through 2020. Under the plan, the number of students in postsecondary education will jump from 7.3 million in 2014 to 12 million in 2020. The government is relying on the private sector to get the job done, and growth is being fueled by subsidized student loans.

Similar trends are unfolding in China. From preschool through university, the private education industry is expected to be worth $102 billion in 2015, according to Deloitte estimates. And it’s been growing at an explosive rate of about 20% a year from 2008 to 2013, says BDA, a Beijing-based advisory group. In China, the industry is driven by a cultural focus on education as well as the one-child policy, which prompts parents and grandparents to spend generously on their kids.

Structural Change Drives Growth

These disparate trends share some common threads. First, they’re all being driven by multiyear changes and socioeconomic shifts on a grand scale. Second, since each theme transcends short-term economic issues, they’re capable of delivering results when GDP growth is muted. And third, emerging-market benchmarks really can’t capture the power of these big trends, because an index will also be exposed to many highly cyclical companies, low-quality names and firms that are hampered by poor corporate governance.

So don’t be fooled by the gloomy flow of news from the developing world. Even in a more challenging macro and political environment, emerging markets can still be a fruitful source of growth for investors who are willing to hunt off the beaten path.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.