Official reform of the government’s role in housing finance isn’t likely this year. But de facto reform, led by the private sector, is already under way. That’s good for investors, borrowers and the housing market as a whole.

We were encouraged by a US Senate bill last year that outlined a plan to take taxpayers off the hook for mortgage losses by reducing the government’s involvement in financing mortgage credit. Final legislation is probably years away. But that hasn’t stopped private capital from taking on a bigger role in the market.

One way investors are getting involved is through risk-sharing transactions issued by the two government sponsored enterprises (GSEs), Fannie Mae and Freddie Mac. These act like credit-linked notes, providing investors with regular payments based on the performance of the underlying loans. But unlike traditional agency securities issued by Fannie and Freddie, they carry no government guarantee; private investors, not taxpayers, absorb the losses if a large number of loans default.

The Birth of a New Market

The GSEs began using these securities in 2013 to offload some of their credit risk to private investors. The market has endured a few growing pains in the early going, but demand has steadily increased over the last year, and we expect volatility to decline as the investor base grows. In 2014, the risk-sharing market grew to some $14 billion, and it appears on track to nearly double in size by the end of this year.

Why is this good news for investors?

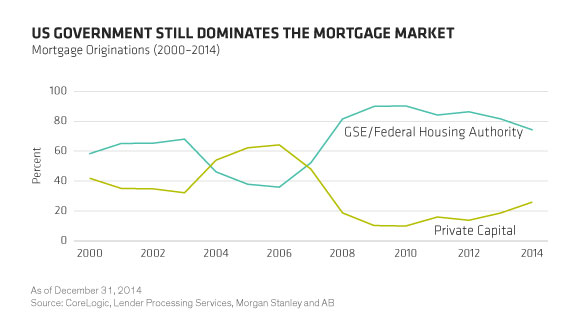

For starters, it’s a great opportunity to get access to newly originated loans in the $10.5 trillion US mortgage market. Because structural problems have not been fixed in the non-agency residential mortgage-backed securities that were exposed by the financial crisis, there’s been little new issuance. That’s left the government as the dominant player in the mortgage market (Display).

Now, investors in search of higher returns than traditional agency debt typically offers can turn to these new deals, which have higher yields to compensate investors for assuming more credit risk.

No Time Like the Present

Some prospective investors may worry about taking on that credit risk. But here’s something to consider: Because we’re still in the early stages of the housing recovery, mortgage lending standards are extremely tight, and the loans being made tend to be high-quality ones to worthy borrowers. Several credit metrics, including average FICO score and borrower debt-to-income ratio, are at or near their best levels since 2006. That has kept defaults low.

In other words, if there was ever a time to take on mortgage credit risk, it’s now. That might explain why investors were lining up at Freddie’s recent sale of new risk-sharing bonds, which were structured to transfer even more credit risk to bondholders. Freddie ended up increasing the size of the issue to meet investor demand.

Buttressing and Broadening the Market

We think new types of transactions like these that tinker with how losses get absorbed will broaden interest in this market. And as investor demand increases, so will credit for those looking to buy a new home or refinance an existing loan. In recent years, many borrowers who historically would have qualified for a mortgage haven’t been able to get one.

Even more importantly, these new transactions provide a road map for the future. We can imagine a situation in which banks, mortgage insurers and even the Federal Housing Authority use the template Fannie and Freddie created to issue their own version of risk-sharing transactions.

Eventually, Congress will get around to voting on genuine housing market reform. But if these new risk-sharing transactions keep growing as we expect they will, private capital markets may beat it to the punch.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.