While many investors appreciate that alternative investments can enhance returns and lower the risk of a portfolio, determining which alternative is best suited and how much, can be difficult. Traditional asset allocation approaches focus on risk/return trade-offs found in outdated, one-dimensional models. Unfortunately, as they stand today, these models are incapable of capturing the unique attributes of alternative investments—illiquidity, leverage, lack of relevant index comparison, difficulty in rebalancing, tail risk, and other factors—that have no relevant public market equivalent.

To effectively allocate to alternative investments, new risk factors must be developed and incorporated into portfolio construction. Exclusively using age-old standards for asset allocation exposes investors to dangerous outcomes.

Alternatives burst onto the scene

To construct an effective asset allocation, the types of alternatives—such as real estate, private equity and debt, hedge funds, and real assets, like timberland and commodities—and their benefits and drawbacks, need to be understood. Alternative strategies can invest in private markets, have unique drivers of return, carry diverse return relationships with the market (betas), use differing amounts of leverage, and take on distinctive levels of risk. They can also be illiquid, forcing investors to have a long-term bias due to their lock-up requirements.

Even within the same alternative category, assets can have very different characteristics. However, there are commonalities among some alternative investments that allow for more precise classification that’s helpful in building an asset allocation. For example, certain assets can exhibit similar drivers of return, betas, leverage, and risk. They may also display comparable levels of correlation to other assets in a portfolio.

Is it really uncorrelated?

For many years, investors looked to correlations as the primary driver of asset allocation. This practice may be acceptable in liquid markets where daily price information is available and markets are transparent and well understood, but how should investments without the luxury of transparency and liquidity be treated? If an investment is only valued once a month, it will likely exhibit a low correlation to liquid, public markets. But is that correlation a function of the underlying investments or the fact that it is illiquid and infrequently valued?

In most conventional asset allocation models, regardless of how easily a funds’ holdings can be valued, investments are assigned the same degree of low correlation to traditional stocks and bonds simply due to their illiquid nature. Yet in practice, there are differences; a hedge fund that is investing in publicly traded securities, but in an illiquid structure, will likely exhibit a higher correlation to global equities and have more pricing liquidity than a commercial real estate venture that buys apartment buildings. As such, the commercial real estate should be viewed as more illiquid, and more lowly correlated to public securities than the hedge fund. This failure to accurately capture the correlation between asset classes is one of the flaws of conventional models.

The Next-Gen Model

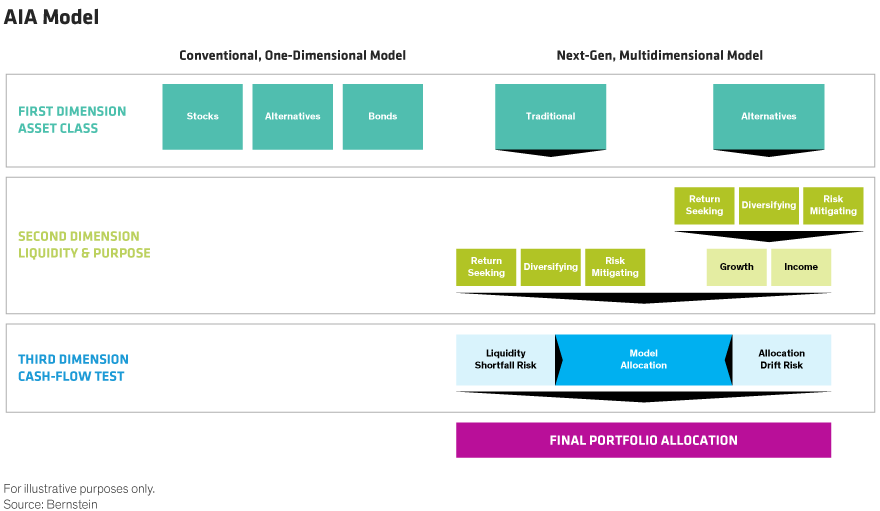

The traditional, or conventional model considers only one dimension—the type of asset—to establish an asset allocation framework. It assesses the risk and return profile of the investor to determine the appropriate percent of stocks, alternatives, or bonds. For years, this model was effective, before a proliferation of products widened the investment choice, and advanced technology allowed for more precise models. Today, there’s a better way.

The next-generation model is multi-dimensional (Display). Like the conventional model, it starts with traditional (stocks and bonds) and alternative assets. The next dimension analyzes liquidity needs and investment purpose, to categorize investments into three buckets—return seeking, diversifying, and risk mitigating. Alternative assets are further segmented as to whether they provide income or growth. The amount allocated to these buckets is determined by the investor’s return expectations and risk tolerance, taking into account ongoing liquidity or cash needs, goals, and other factors, like portfolio tail risk, leverage, and potential for intermittent or consistent cash flow generation. Especially when investing in alternative strategies, evaluating potential tail risks is important because the conditions that create difficult equity markets can be magnified in an illiquid strategy.

The final dimension focuses on spending. Two specific risks affect spending—liquidity shortfall and allocation drift. For anyone spending from a portfolio, any allocation that has more than a small probability of running out of liquidity should be avoided. In other words, no allocation should put the investor at tangible risk of running out of money. This is especially true when investors allocate heavily to illiquid assets.

Allocation drift risk is harder to avoid. This risk is the degree to which an allocation may drift over time. Drift will likely occur in any portfolio with illiquid investments; as the illiquid investment appreciates or depreciates in value, it will make up an increasing or decreasing percentage of the overall portfolio. But because these investments cannot be sold at will, this drift cannot easily be recalibrated. Additionally, this difference in return patterns could be exacerbated by portfolios with high spending rates where the liquid portion would be rapidly depleted. Establishing acceptable bands of drift is an important component to alternative asset allocation.

Allocation along several dimensions

Today’s allocation models need to improve upon the one-dimensional comparison of expected return versus expected risk, especially when illiquid investments are added into the mix. Incorporating alternative investments requires an understanding of other important factors that affect investor outcomes. Rather than relying solely on correlation as a driver of allocation risk, the impact from illiquidity on other components of the investment profile, from spending to access to capital, needs to be considered. Anything less is falling back on the outdated models that have driven asset allocation decisions for years.

For more on allocating to private equity and other alternatives, read our recent blogs, “Enhancing Your Investment Portfolio with Private Equity,” and “Sizing an Alternatives Allocation Starts with Spending.”

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.