With interest rates up sharply in 2022 and poised to rise more, parking short-term assets in US Treasury bills may pose a challenge. These positions are key to meeting liquidity needs, but they’re at risk of being outyielded as rates climb, and selling them could incur losses if their prices have fallen.

Fortunately, there’s another alternative for investors’ liquidity positions: a short-duration-bond exchange-traded fund (ETF) with the flexibility to navigate a rising-rate environment while providing ample liquidity.

Here are five reasons to consider a short-duration-bond ETF over US T-bills.

One: It May Help Tackle the T-Bill Yield/Price Challenge

Selling T-bill holdings to meet liquidity needs could hurt investors through price losses. And as rates continue to climb, the yield on existing holdings will fall short of newly issued T-bill yields, leading to price declines. A short-duration ETF that’s actively managed is able to adapt to changing conditions, which could help reduce price pressure in a rising-rate market.

Two: A More Efficient Approach to Managing Short-Term Bonds

Laddering T-bill exposures can be an inefficient, time-consuming process that can increase operational and trading costs. Financial advisors must research the correct maturities, manually trade bonds, monitor them, and trade them at maturity to roll into another security in order to keep clients invested. A short-duration-bond ETF offers a way to outsource this work and can be scaled across multiple clients.

Three: ETFs Are Among the More Tax-Efficient Vehicles

Because ETFs trade in the secondary market, they’re largely insulated from individual investors’ trading activities. Only a small percentage of trades impact the ETF itself, which can reduce the potential for capital-gains distributions. Also, while selling activity on an exchange does result in a redemption from the fund, it usually doesn’t impose tax exposure on remaining investors.

Four: Active Management Can Help Navigate Markets

Some bond ETFs are actively managed, which enables them to rebalance as interest-rate hikes take effect and anticipated hikes are reflected by markets. YEAR, AB’s Ultra Short Income ETF, rebalances actively and contains 15% floating rate notes that reset overnight. This flexibility may offer insulation during rising-rate cycles, which could reduce the impact of price fluctuations and potentially enhance returns. YEAR also provides a gross yield that’s 0.5% higher than that of one-year US Treasury bills (as of October 18, 2022).

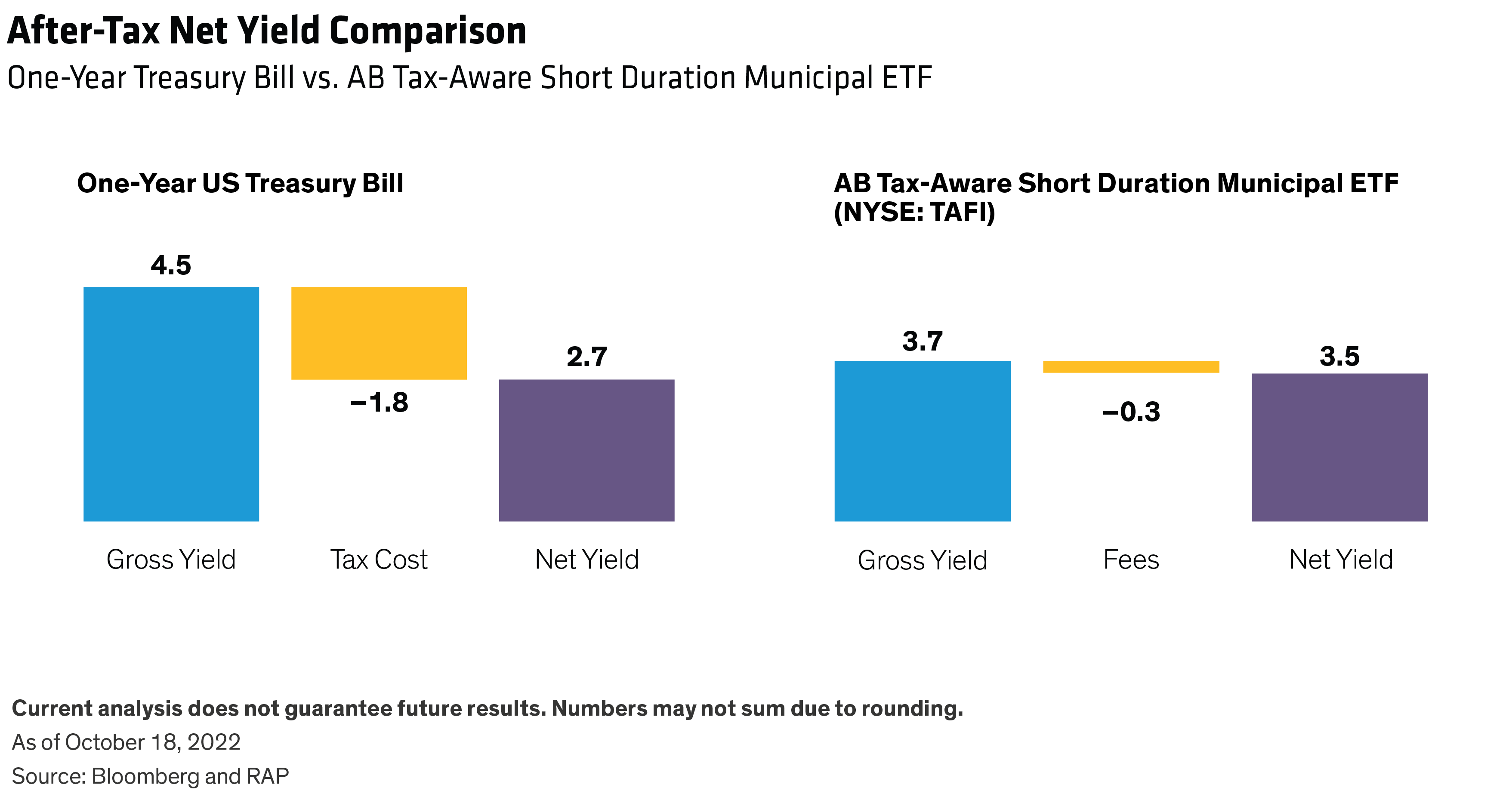

Five: Opportunity to Improve After-Tax Return Potential

Some fixed-income ETFs are designed with after-tax returns in mind. TAFI, AB’s Tax-Aware Short Duration Municipal ETF, invests primarily in municipal bonds—with income that’s exempt from federal taxes and potentially from state taxes. On an after-tax basis, TAFI provides almost 0.8% more net yield than one-year T-bills (Display). US Treasuries are treated as income for tax purposes.

Implementation Ideas

For taxable client accounts, consider an actively managed strategy that helps limit duration risk with a focus on after-tax return and income, such as AB Tax-Aware Short Duration Municipal ETF (TAFI).

For qualified accounts, consider an actively managed strategy that is optimized for yield, capital preservation and liquidity, such as AB Ultra Short Income ETF (YEAR).

For more information on AB’s ETFs, visit www.ABFunds.com/go/ETFs.

Investing in ETFs involves risks, including loss of principal.

Investors should consider the investment objectives, risks, charges and expenses of the Fund/Portfolio carefully before investing. For copies of our prospectus or summary prospectus, which contain this and other information, visit us online at abfunds.com or contact your AB representative. Please read the prospectus and/or summary prospectus carefully before investing.

TAFI—Bond Risk: The Fund is subject to the same risks as the underlying bonds in the portfolio, such as credit, prepayment, call and interest-rate risk. As interest rates rise, the value of bond prices will decline. Below-Investment-Grade Securities Risk: Investments in fixed-income securities with lower ratings (aka “junk bonds”) are subject to a higher probability that an issuer will default or fail to meet its payment obligations. These securities may be subject to greater price volatility due to such factors as specific municipal or corporate developments and negative performance of the junk bond market generally, and may be more difficult to trade than other types of securities. Municipal Market Risk: Economic conditions, political or legislative changes, public health crises, uncertainties related to the tax status of municipal securities or the rights of investors in these securities may negatively impact the yield or value of a municipal security. Tax Risk: The US government and Congress may periodically consider changes in federal tax law that could limit or eliminate the federal tax exemption for municipal bond income, which would in effect reduce the income shareholders receive from the Fund by increasing taxes on that income. Derivatives Risk: Derivatives may be more sensitive to changes in market conditions and may amplify risks. New Fund Risk: The Fund is recently organized, giving prospective investors a limited track record on which to base their investment decision.

YEAR—Investment Securities Risk: To the extent the Fund invests in other funds, shareholders will bear to layers of asset-based expenses, which could reduce returns.

Market Risk: The market values of the portfolio’s holdings rise and fall from day to day, so investments may lose value. Interest-Rate Risk: As interest rates rise, bond prices fall and vice versa; long-term securities tend to rise and fall more than short-term securities.

Credit Risk: A bond’s credit rating reflects the issuer’s ability to make timely payments of interest or principal—the lower the rating, the higher the risk of default. If the issuer’s financial strength deteriorates, the issuer’s rating may be lowered, and the bond’s value may decline.

Inflation Risk: Prices for goods and services tend to rise over time, which may erode the purchasing power of investments.

Foreign (Non-US) Risk: Non-US securities may be more volatile because of political, regulatory, market and economic uncertainties associated with such securities. Fluctuations in currency exchange rates may negatively affect the value of the investment or reduce returns. These risks are magnified in emerging or developing markets.

Derivatives Risk: Investing in derivative instruments such as options, futures, forwards or swaps can be riskier than traditional investments, and may be more volatile, especially in a down market.

Below-Investment-Grade Securities Risk: Investments in fixed-income securities with lower ratings (commonly known as “junk bonds”) tend to have a higher probability that an issuer will default or fail to meet its payment obligations.

Leverage Risk: Trying to enhance investment returns by borrowing money or using other leverage transactions such as reverser purchase agreements—magnifies both gains and losses, resulting in greater volatility.

New Fund Risk: The Fund is recently organized, giving prospective investors a limited track record on which to base their investment decision.

AllianceBernstein ETFs are distributed by Foreside Fund Services, LLC, in the US only.

The [A/B] logo is a registered service mark of AllianceBernstein and AllianceBernstein® is a registered service mark used by permission of the owner, AllianceBernstein L.P.

© 2022 AllianceBernstein L.P., 501 Commerce Street, Nashville, TN 37203