Conviction Through Deep and Detailed Analysis

Volatility is a fact of life in equity markets and can provide opportunities for skilled, long-term investors. Diversification is often seen as a key technique to managing risk, because it reduces exposure to a particular asset by entering into multiple investments. But think again. Jim Tierney, fund manager and CIO—Concentrated US Growth, explains that a selective portfolio of a small number of stocks can provide surprising risk-management benefits.

"Many investors take the view that concentrated equity portfolios are by default more vulnerable to a market correction than a diversified portfolio," says Tierney. "This is because they worry that by focusing on a small number of stocks, a portfolio may be more vulnerable when volatility strikes. We disagree."

"Based on our experience—and academic studies—we believe that concentrated portfolios can actually cushion the damage in a market correction because beyond a limit of 20 to 30 stocks, the diversification benefits tend to diminish. Since concentrated managers have much more to lose if a single stock underperforms, they tend to be much more focused on the earnings risk of individual holdings and of the portfolio."

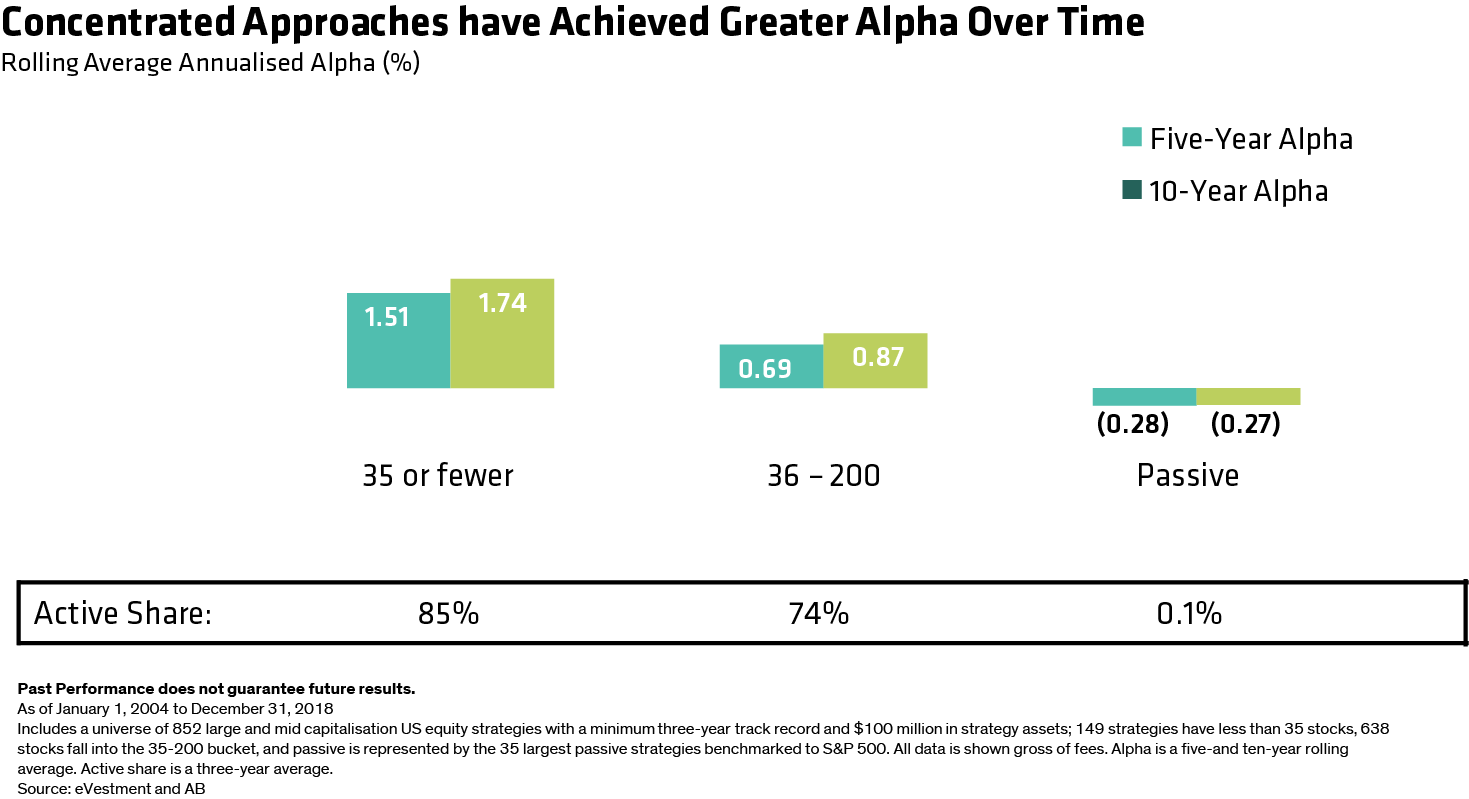

Our research on US equity strategies supports this notion. We followed up on the famous study by Cremers and Petajisto* and found that the median concentrated US equity manager, with 35 or fewer stocks in a portfolio, encountered less severe losses than diversified portfolios in down markets. And the results speak for themselves: over the 10-year period of the study, concentrated strategies posted stronger three-year returns than either traditional active or passive strategies.

As markets become more volatile, portfolios with fewer stocks are often seen as more vulnerable to market surprises. However, just because a stock is in an index, it doesn't mean it is a good investment, as benchmarks give investors exposure to volatile sectors, especially in down markets.

"Portfolios with small numbers of stocks by definition have a high active share and diverge from the benchmark substantially," says Jim. "It's important to own what we believe are great businesses rather than holding something simply because it's in the index. By concentrating only on those businesses with high upside potential, with predictable and sustainable earnings growth, we can cushion the portfolio from surprises which rattle the market."

For example, both the energy and financials sectors are notoriously unstable. Banks, in particular, are too risky for a concentrated portfolio in our opinion because it's simply too difficult to forecast earnings that are tied to the uncertainties of the future rate and credit cycles. As a result, constructing a portfolio that is less exposed to those cyclical sectors would tend to protect against vulnerability in those markets.

However, by only focusing on a few companies, does that mean a concentrated portfolio will miss out on a big sector recovery?

Jim says this shouldn't be a concern for long-term investors. "Over the short term it's true that volatile sectors can lead the market at times," he says. "But over the long term, we believe it's better to focus on a few select holdings that provide alternative ways to gain selective exposure to a sector recovery. For us, secular growth trumps cyclical growth in the long term. For example, some financial exchanges or asset management firms have much lower capital intensity than pure banks—and offer better return potential driven by secular trends in their industries."

Focusing on stocks that have shown consistency of earnings through good and bad periods is a prudent path to generating long-term returns, rather than taking big sector overweight's, which may be prone to instability. This offers a strong case for investing in a few quality stocks, as opposed to a larger quantity of holdings, to provide the potential to produce substantial alpha through security selection over the long term.

As markets become more unpredictable, often moving from 'favoured' to 'at risk' due to a tweet or policy decision, are concentrated portfolios more at risk in todays' markets?

"Mitigating risk is difficult in any portfolio", says Jim. "For us, ensuring diversification of exposures and investing in companies with visible growth drivers is tantamount to minimising risk. On this front, we operate on the premise that the best defence is a good offence."

"In a concentrated portfolio we can focus our time on fewer businesses and get to know them better through deep fundamental analysis of their business model and active engagement to identify their governance capabilities," he adds. "This high conviction approach can act like a sieve to sift out companies with weak ESG profiles, enabling us to identify only those businesses we believe will grow consistently, and not fade over time or at the whim of the market. Companies that tend to flourish through almost any environment should produce faster growth compared to those that need a strong economic cycle; that, we believe is how you balance risk—and where you find the outperformance."

*Cremers, K.J. Martijn and Petajisto, Antti. "How Active Is Your Fund Manager? A New Measure That Predicts Performance," March 31, 2009.

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams and are subject to revision over time. AllianceBernstein Limited is authorised and regulated by the Financial Conduct Authority in the United Kingdom.