Style Shift: Short-Term or Sustainable?

What can explain the sudden appeal of value in September? The rotation could have been triggered by many things, including relative valuations and technical factors. But macroeconomic expectations certainly played a big part, in our view. Bearish sentiment appeared to peak in August and gave way to small doses of good economic news. Global manufacturing showed signs of life, as the PMI for August increased after 15 straight months of decline.

Bond yields reflected some of this optimism. The 10-year US Treasury yield bottomed out at 1.43% in early September, then clawed its way back to 1.90% by mid-month, before falling back to 1.68% at quarter-end. US and global economic surprise indicators improved. The possibility that growth expectations may have become too pessimistic helped fuel returns for stocks that are more sensitive to the economic cycle, which are typically among the most attractively valued cohort in the market.

Economic Outlook: Which Way Is Up?

Still, it’s tough to draw a conclusion from such a short-term move, and the global economic outlook faces many challenges. Uncertainty driven by the US-China trade war remains a big obstacle to sustainable growth, especially in regions that are driven by manufacturing, such as Europe and Japan. Consumer and capital spending have held up so far, but could be vulnerable if manufacturing weakness persists. Volatile oil prices and Brexit disarray add more confusion to the outlook.

This tug-of-war for investor sentiment will probably continue, in our view. Since expectations for the global economy are so low, any nugget of good economic news could spark a risk rally. Major central banks are widely expected to keep monetary policy loose for the near future. At the same time, since multiple geopolitical and macroeconomic risks remain unresolved, investors are quickly spooked and easily revert to defensive postures.

Equity Valuations Look More Reasonable

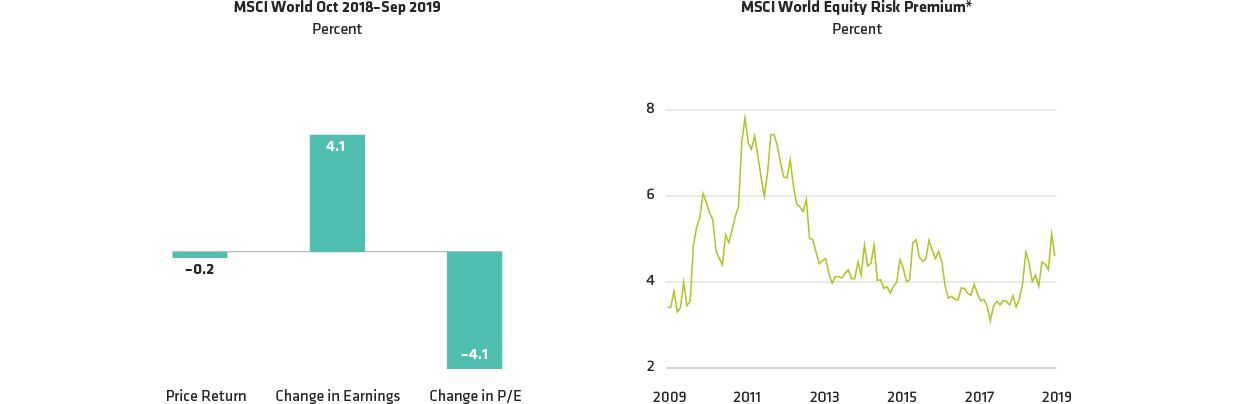

Where does this complicated situation leave equity markets? After all the ups and downs, global stocks haven’t really budged much over the last year. At the same time, earnings have risen by more than 4%. As a result, price/earnings ratios for global stocks have slipped by about 4% over the last 12 months, making them more reasonably priced than a year earlier (Display, left).

Meanwhile, the 10-year US Treasury rate fell by about 140 basis points over the same period. As a result, the equity risk premium—or the excess return investors can expect from investing in stocks over the risk-free rate of government bonds—increased to its highest level in three years (Display, right). If interest rates rise substantially over a sustained period, this premium would be threatened. But in current conditions, we believe that the potential reward for owning equities is attractive.