-

The views expressed herein do not constitute research, investment advice or trade recommendations and do not necessarily represent the views of all AB portfolio-management teams.

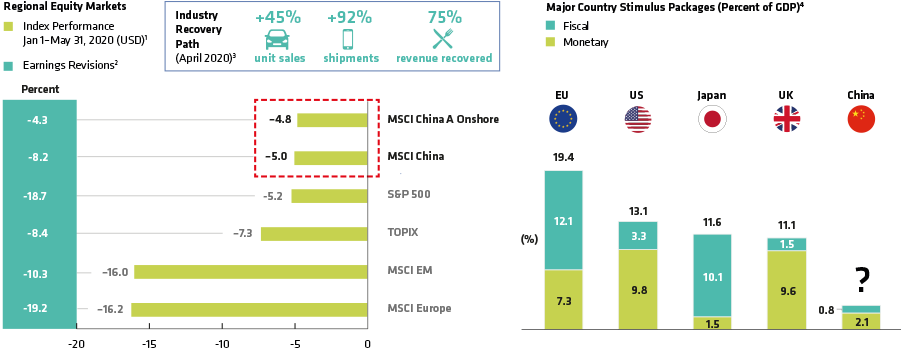

Why Have Chinese Stocks Held Up So Well?

Historical analysis does not guarantee future results.

1 All indices are net total returns in USD.

2 Earnings revisions are 12-month forward consensus earnings revisions as of May 5, 2020.

3 Autos show recovery in number of passenger vehicles sold in April 2020 vs. March 2020. Smartphones show recovery of total shipments in April 2020 vs. March 2020. Restaurants show average April 2020 revenue as a percentage of pre-pandemic level based on reports from four major companies: Haidilao, Taier, Xiabu Xiabu and Yum China.

4 Country stimulus packages shown are as of March 31, 2020.

Source: Bank of England, Banks of Japan, Bloomberg, Bureau of Economic Analysis, China Association of Automobile Manufacturers, CAICT, CLSA, CNBC, Us Department of Commerce, European Central Bank, Refinitiv, Haidilao, China Ministry of Finance, Morgan Stanley, MSCI, People’s Bank of China, Thomson Reuters, RIMES Technologies, Tai’Er, Xiabu Xiabu, Yum China and AllianceBernstein (AB)

-

First Out, First Back

-

Industry Recoveries Curb Earnings Hit

-

More Stimulus Potential

-

MSCI makes no express or implied warranties or representations, and shall have no liability whatsoever with respect to any MSCI data contained herein.

The MSCI data may not be further redistributed or used as a basis for other indices or any securities or financial products. This report is not approved, reviewed or produced by MSCI.