Unlocking Opportunities

"In the middle of every difficulty lies opportunity." Albert Einstein

Do Sustainable Companies Operate with a Competitive Advantage?

We think there are nine key areas where sustainable companies are operating with competitive advantage.

Unlocking Opportunity

The world faces critical challenges, from climate change to access to global health systems, to financial empowerment and financial security. The private sector is going to play an enormously important role in addressing those challenges. And that creates opportunities for innovative and well-run companies - as well as investors. Aligning with the United Nation’s Sustainable Development Goals helps AB to find those opportunities to invest.

The financial and human cost of climate change is unprecedented but addressing these challenges creates investment opportunities.

- Cleaner energy

- Resource efficiency

- Sanitation and Recycling

- Sustainable transportation

As the population continues to grow and the burden of disease becomes more complex, many companies are looking for innovative solutions.

- Access to quality care

- Food security and clean water

- Medical innovation

- Well-being

An important element of sustainability is ensuring people are economically and socially prosperous.

- Education and employment services

- Financial security and inclusion

- Information and communication technologies

- Sustainable infrastructure

Sustainable Themes Offer Differentiated Opportunities for Secular Growth

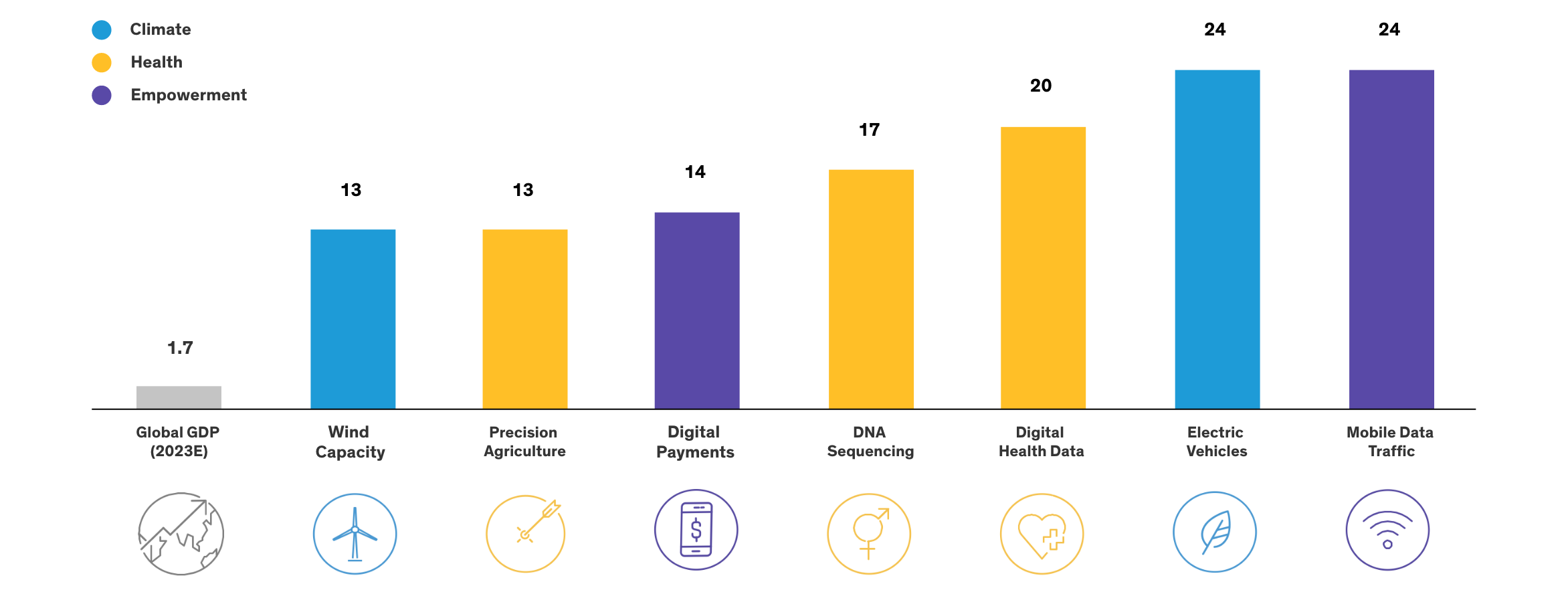

Diverse sectors - from precision agriculture to mobile data - are well placed to benefit from sustainable themes and are already growing at rates well ahead of global GDP.

Representative Secular Tailwinds

Compounded annual growth rates (percent)

Current forecasts do not guarantee future results. The charts and images shown are for illustration purposes only and may not be an exact representation of any financial product offered by AllianceBernstein.

Global GDP estimate is ex Russia, from AB economists as of 30 September 2023; wind capacity 2020–2030; precision agriculture market size 2022–2030; global digital payments 2022–2030; global DNA sequencing 2022–2030; digital health data 2018–2025; electric vehicle units 2022–2025; global mobile data traffic 2022–2028.

As of 30 September 2023

Source: BCC Research, BloombergNEF, Ericsson, Flex, Global Wind Energy Council, Morgan Stanley, SkyQuest Technology Consulting, Statista, Strategic Market Research and AB

Subscribe

Join Our Insights Program

Related Insights

Looking for More Fund Information?

AllianceBernstein Investment Management Australia Limited (ABN 58 007 212 606, AFSL 230 683) (“ABIMAL”) is the responsible entity of the AB Sustainable Global Thematic Equities Fund (ARSN 659 443 320) (“Fund”) and is the issuer of units in the Fund. ABIMAL has appointed AllianceBernstein Australia Limited (ABN 53 095 022 718, AFSL 230 698) (“ABAL”) as the investment manager of the Fund. ABAL in turn has delegated a portion of the investment manager function to AllianceBernstein L.P. The Fund’s Product Disclosure Statement (“PDS”) is available online or by contacting the client services team at ABAL at (02) 9255 1299. Investors should consider the PDS in deciding to acquire, or continue to hold, units in the Fund.

This information is for exclusive use of the wholesale person to whom it is provided and is not to be relied upon by any other person. It is not intended for retail or public use and may not be further distributed without the prior written consent of ABAL.

A Target Market Determination (“TMD”) for the Fund is available from our website. The TMD sets out the class of persons who comprise the target market for the Fund and the distribution conditions that are applicable, together with a number of other matters which should be considered by retail investors and their advisers.

Information, forecasts and opinions ("Information") set out on this website are not personal advice and have not been prepared for any recipient’s specific investment objectives, financial situation or particular needs. Neither the website nor the Information contained in it is intended to take the place of professional advice. Please note that past performance is not indicative of future performance, and projections, although based on current Information, may not be realised. Information can change without notice, and neither ABIMAL or ABAL guarantees the accuracy of the Information at any particular time. Although care has been exercised in compiling the Information contained on this website, neither ABIMAL or ABAL warrants that this document is free from errors, inaccuracies or omissions.

This document is released by ABAL.

The videos sourced information from the following sites.

• United Nations Sustainable Development Goals: https://sdgs.un.org/goals

• zerotracker.net

• iea.org/reports/net-zero-by-2050

• World Health Organisation: https://files.aho.afro.who.int/afahobckpcontainer/production/files/2_Global_expenditure_on_health_Public_spending_on_the_rise.pdf

• World Health Organisation: https://www.who.int/news/item/18-06-2019-1-in-3-people-globally-do-not-have-access-to-safe-drinking-water-unicef-who

• OCHA: https://reliefweb.int/report/world/global-food-crisis-what-you-need-know-2023

• United Nations https://www.un.org/en/desa/world-population-projected-reach-98-billion-2050-and-112-billion-2100